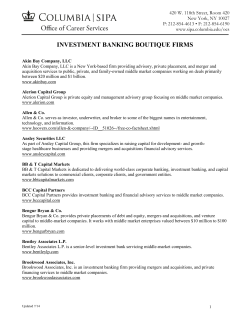

The to INVESTMENT BANKING UNOFFICIAL GUIDE Issued by