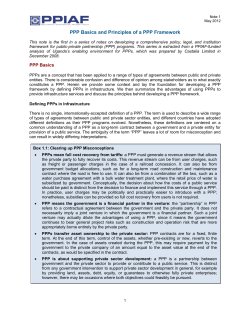

How to Engage with the Private Sector in Public-Private Partnerships in