J W F E I N A N D

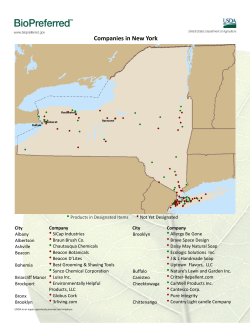

FJW EINAND AND ASSOCIATES F. James Weinand & Associates Certified Public Accountants, PS 6322 Lake Grove St. S.W. Lakewood, WA 98499 Telephone: (253) 584-7966 Fax: (253) 584-0330 AFWA Regional Conference May 17 and 18, 2013 Presenter Shawn Gagnon, CPA shawn@weinandandassociates.com This publication is designed to provide accurate and authoritative information regarding the subject matter covered as an aid to education in conjunction with a seminar presentation. It is not legal or taxation advice and may not be used for any other purpose. It is provided with the understanding that the author is not engaging in or rendering specific legal, accounting or other professional service, and is immediately outdated as a result of daily treaty, statute, ruling, regulation, litigation and other promulgation. No tax return or planning positions are recommended to any taxpayer or third-party recipient of tax services; nor is any written or oral communication specific enough to be tax advice to any individual taxpayer. It may not be relied upon to avoid any Federal, state or local penalties. The author, publisher, and distributor of this document assume no responsibility to any recipient of this document to correct or update its contents for any reason, including changes in any law or professional standard. If you are not the intended recipient of these materials, you are hereby notified that any viewing, copying, disclosure or distribution of this information is subject to legal restriction and may result in criminal and civil prosecution to the fullest extent granted by law. If tax or legal or other expert assistance is required, the services of a competent professional should be retained. Copyright © 2013. 1 How to Read an S Corporation Tax Return Like a Pro And Bonus: Mini Tutorial on Entity Structures 2 I. Mini Tutorial on Entity Structures (you get the Bonus stuff first) A. Entity Structure: Making the right choice can make all the difference in how a business is run, how it is taxed and how its profits are calculated. B. Before deciding on an entity structure for a business, we should look at the BIG picture! What’s the BIG picture? It’s obvious – “How to get money out of the Business and into the hands of the Owners!” Take a look at the pie chart and apply this to any business. Management Someone is making decisions and governing the entity START HERE: How to get $$$ out of the business and to the owners! Dividen ds, Interest, Royalties, Return On Capital, Return Of Capital, Fringe Benefits Compensation for Reasonable Services Performed Determine the character of the cash flow to the owner. 1 Courtesy of Tax Geek, LLC Copyright 2013 C. There are four basic forms of entity structure for operating a business. The right entity structure for a business can reduce or better manage the amount of tax burden and also the reporting burden. Some entities are much simpler and require less complex tax compliance than others. Each has its own pros and cons. D. 1. Sole Proprietorship (including Single Member LLC) 2. Partnership (GP, LP, LLP, LLLP) 3. Corporation (C or S) 4. Limited Liability Company (Single or Multi-member) The Sole Proprietorship (SP) 1. Believe it or not, there are a few advantages to being an SP. Simple tax reporting is one of them. The income and expenses from a SP are reported on Schedule C of the individual’s personal income tax return, Form 1040. 2. The SP is allowed the Home Office deduction if the office is used by the taxpayer to conduct administrative or management activities of a trade or business AND there is no other fixed location of the trade OR business where the taxpayer conducts substantial administrative or management activities. Normally nondeductible home expenses, such as insurance, utilities and repairs and maintenance are allowed based on an allocation of square footage. 3. The #1 biggest drawback to a SP is Unlimited Liability (unless the SP is a single member LLC). More on LLC’s later. 4. The #2 drawback is the Self Employment Tax. The net income of the SP is subject to Self Employment Tax at 15.3% on amounts up to the Social Security max (the amount changes annually) and then 2.9% on everything above that. 5. Other disadvantages to SP are the disallowance of some fringe benefits, such as group-term life insurance and cafeteria plans for owners. E. The Partnership 1. The Partnership is one of the oldest business formations. For income tax purposes, the Partnership is one of the most complex entity types; however, it can be one of the most flexible entity structures. Income and losses flow-through to partners at the individual level. Currently, we have the General Partnership, Limited Partnership, Limited Liability Partnership, Limited Liability Limited Partnership. 2 2. Overview: a) The LP and LLP are treated like a general partnership with respect to trade payables and notes (i.e. entity liable absent personal guarantees) but is treated as limited partnership for tort liabilities (i.e., entity assets at risk plus personal assets of responsible “wrongdoers”). b) Taxation of the LLP is automatically classified as a partnership for federal income tax purposes unless they make an election to be taxed as a corporation (by filing Form 8832). 3. Advantages of the Partnership (GP, LP, LLP, LLLP) a) Easy to organize. A written partnership agreement is recommended but not required. b) Lots of flexibility with Profit and Loss distributions and special allocations among partners. 4. c) Unlike the corporation, reasonable compensation is not an issue. d) It’s easy to get into a partnership. Disadvantages of the Partnership a) The net operating income of the Partnership is subject to SelfEmployment Tax. b) Guaranteed payments for services to Partners are subject to Self Employment Tax. c) Partnership net income is taxed to the partner whether or not it is actually distributed. d) A General Partner is personally liable for all the partnership debt (this is why we like the LLC and LLP). e) Fringe benefits are taxable to the partners. f) It can be expensive (AND difficult ) to get out of a Partnership. 3 F. The “C” Corporation 1. The “C” Corporation has been around for a very long time. The sheer number of corporations in the U.S. is testimony to the viability and usefulness of this entity type. With the advent of the industrial revolution and the need for significant concentrations of capital, the “C” Corporation has been a very popular tool. 2. Advantages of the “C” corporation: a) Limited liability. b) Flexible year-end schedule. c) Owner deductions for fringe benefits. d) Better planning and deduction for owner’s retirement plans and deferred compensation possibilities. e) The ability to split income between the corporation and the owner (through wages), thus having two taxpayers and better management of tax brackets. f) Easier access to capital markets for future expansion (no limit on the number of stockholders). g) Easier transferability of ownership. h) Different classes of stock (common and preferred) allowed. i) Generally, tax-free incorporation under Code Section 351. j) Ordinary loss treatment (up to $100,000) instead of capital loss treatment for stockholders in qualifying small corporations under Code Section 1244. k) 50% Capital gain exclusion for stockholders in qualifying small corporations under Code Section 1202 (the 2nd 50% is subject to 28% long term capital gain rates, like collectibles). 3. The Disadvantages of a “C” Corporation include: a) Double taxation on dividends and on sale of all corporate assets and liquidation to shareholders. b) Wages paid to shareholders subject to unreasonable compensation claims by the IRS. 4 c) Tax problem with Accumulated Earnings after $250,000 of accumulated Earnings & Profits ($150,000 for Personal Service Corporations). d) Alternative Minimum Tax! e) Losses do not flow through to shareholders. f) Operating a Personal Service Corporation as a C Corporation has been a great source of debate over the years. Personal Services Corporations at taxed at a whopping 35%! g) G. Personal Holding Company trap! The “S” Corporation 1. The “S” Corporation is the newer kid on the block. They have been around for almost 30 years. The Net Income or Loss of the “S” Corporation flows through to the shareholders of the corporation according to stock ownership. 2. Advantages of an “S” Corporation include: a) The net trade or business income is not subject to Self-Employment taxes. Howeve r, a recent publication from the Treasury Inspector General Office for Tax Administration and the Joint Committee on Taxation indicates that Congress is looking at changing this and making it subject to selfemployment tax. Currently, there is a House bill that suggests taxing S Corporation net profits for Self Employment Tax! Yikes!! Keep your eyes open for this issue in the very near future especially in light of current budget constraints and the need to find new revenue! b) Provides a method to shift income to others without giving up control of the entity. For example, one class of stock with Dad owning 1% and daughter owns 99%. c) Non-voting common stock can be used for Estate tax planning. d) The Accumulated Earnings Tax cannot be assessed against an “S” Corporation. e) Only one level of tax (at the individual level) if the S Corporation sells its assets. If the S Corporation liquidates, a Schedule D liquidating gain generally is not recognized to the shareholders. 3. The disadvantages of the “S” Corporation include: a) Built in gains tax problems for the first 10 years upon conversion from a “C” Corporation to “S”. 5 b) Fringe benefits must be included in wages for shareholders owning 2% or more. c) Only 100 (more like “100ish” with family attribution rules) shareholders allowed (individuals, estates and certain trusts). d) Unequal distributions are NOT allowed and could terminate the “S” election. e) Shareholders loans to an “S” Corporation could be considered a second class of stock (a debt instrument) thus terminating the “S” status. H. Limited Liability Company (single or multi-member) 1. This is the newest kid on the block. Wyoming was the first state in the U. S. to create this entity structure. It was based on a similar structure in Germany, where it has been used for over 100 years. Every state has since followed with its own LLC version. Washington got into the game October 1, 1994. The LLC format is very, very popular! 2. The #1 reason to like the LLC structure is……………..Limited Liability, of course! All members of the LLC have limited liability as if the entity were incorporated under state law. However, certain professional LLCs (called PLLC) provide limited liability for tort claims only for the members NOT guilty of the tort act. 3. SMLLC (Single Member LLC) – see Sole Proprietorship section for pros and cons, however, SMLLC’s get the same limited liability treatment. 4. Multi- member LLCs get Partnership treatment with flow-through of gains and losses to the individual level with the operational flexibility of a partnership. See previous section on Partnership pros and cons. 5. Flexible management! One or more members or non-member managers may manage the LLC. Keep in mind that the IRS trend is to look at Management for self-employment tax implication. Also consider passive and non-passive activity rules. The tax boxes checked on Form K-1 (excerpt shown below) can have a huge tax impact on members. 6 6. LLC’s can also make a federal election to be taxed not as the default Partnership (multi-member LLC) but as a corporation (Single member LLCs can do this too!). The state laws governing the LLC do not change. Only the tax treatment at the federal level would change to a corporate tax structure. From that election, the LLC could then elect to be treated like an “S” Corporation or remain as a “C” Corporation. Refer back to previous sections on the pros and cons of the “C” and “S” corporations . 7 II. How To Read an S Corporation Tax Return Like a Pro1 If you are working in the tax industry and have heard…………………..”Can you take a look at my S Corporation tax return and tell me if my Tax Professional did a good job?” or if you are in private industry or banking and looked at an S Corporation tax return and thought……….”What am I supposed to “see” here?”............ then you are in the right place today. A. B. We are going to learn how to spot lurking issues or irregularities and to analyze an S Corporation tax return at first glance. 1 C. So………..get out your red pen and let’s look at some hot issues. D. Let’s start with page 1 of Form 1120S: E. Name of Entity: Is there an Inc. or LLC in the name? F. Boxes A and E 1. Dates are important. 2. State incorporation issues apply. 3. S election dates. 4. Do you have an IRS acceptance letter? Title and outline courtesy of Tax Geek, LLC, Copyright 2013 8 G. Box G 1. When to use this and when not to use this. 2. When do you need a Revenue Procedure? H. Line 7 – Compensation of Officers I. Line 8 – Salaries and Wages J. Line 9 – Repairs and Maintenance K. Line 13 – Interest Expense L. Line 14 - Depreciation M. Lines 17 & 18 – Pension and Employee Benefits N. Lines 22 thru 27 O. Paid Preparer Use Only – Who’s work am I reviewing and how long have they been in practice? P. Turn to Page 2 and let’s look at Schedule B 1. Lines 1 through 4 2. Lines 5, 6 & 7 3. Line 8 – Prior C Corporation 9 Q. 4. Line 9 – Prior E&P 5. Line 10 – Schedule L 6. Line 11 – Non-Shareholder Debt and COD 7. Line 12 – A rare find! 8. Line 13 – 1099-MISC filing requirement Schedule K – The Flow-Through Items! 1. Line 1 – Income or Loss 2. Line 2 – Income or Loss 3. Lines 3 through 10 – Shareholder individual tax issues 4. Line 11 – Section 179 5. Line 12a – Contributions 10 6. Line 16c – Non-Deductibles 7. Line 16c – Non-Deductibles 8. Line 16d – Distributions……The Holy Grail of S Corporations 9. 10. a) Common sense rules b) Compensatio n issues Line 16e – Repayment of Shareholder Loans a) Promissory Notes b) Payment of Interest c) Basis issues Line 17c – Dividend Distributions Paid form Accumulated Earnings & Profits a) Prior C Corp b) 1099-DIV? c) Line 17d – Other stuff 11 R. S. Schedule L – The Balance Sheet 1. Circle Lines 7 and 19 – Loans to/from Shareholders 2. Scan beginning and ending balances Schedule M-1 – For the Accountant in all of us! 12 T. Schedule M-2, From right to left (just to be different!) 1. Column C - Previously Taxed Income (PTI) a) 2. Column B – Other Adjustments Account (OAA) a) 3. Any Pre 1982 S Corporation profits? Tax exempt income and expenses Column A – Accumulated Adjustments Account (AAA) a) Triple A (surprise…………it does not always=Retained Earnings) b) Line 7 – Distributions c) Line 8 - Can it go too low or negative? 13 14 15 16 17 18

© Copyright 2025