Substance – are your transfer pricing actually happening on the ground?

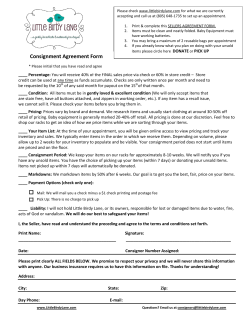

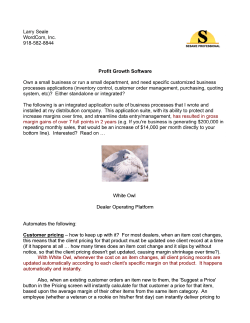

Substance – are your transfer pricing arrangements still reflective of what is actually happening on the ground? In a nutshell Since the June 2012 G20 leadership meeting, which focused on the question of base erosion and profit shifting, the spotlight has been on transfer pricing arrangements and the underlying substance of multinationals’ activities, particularly those in favourable tax jurisdictions. As there is not one commonly shared definition of substance (see Diagram 1 for various definition of substance) or one substance based profit allocation methodology, uncertainty is increasing in respect of what it means to have sufficient substance in order to minimise a risk of double taxation and associated transfer pricing penalties for non- compliance. Under the OECD Base Erosion and Profit Shifting project, the question of ‘recognition of contractual arrangements versus substance’ has been raised in various contexts including intellectual property planning, financing planning and centralised operating models. Why it matters Residence •Central management and control (common law) •Place of management (civil law) Permanent establishment •Place of management •Foreign principal ‘economically’ bound •Attribution of profit / significant people functions (SPFs) Beneficial ownership •Recipient has ‘full right to use and enjoy income unconstrained by a contractual or legal obligation’ Operating structures and transfer pricing Controlled foreign companies Economic employer •Re-characterisation /contractual arrangements •Control over functions and risks •Entitlement to IP related returns •Capacity to bear risks •Exempt activities tests / substance requirements •Significant people functions •Authority to instruct individual, bears responsibility for the results of their work, and conducts performance/pay review Diagram 1 – Definition of substance is key for many areas of international taxation We can help Despite a lack of a commonly shared definition on substance, there are similarities in approaches that the tax authorities take in terms 0f substance expected in Entrepreneurs/ Intellectual property companies. If the level of substance in the Entrepreneur company is insufficient, tax implications can vary from transfer pricing adjustments, to an imputed permanent establishment to a change in residence of the Entrepreneur How confident are you that what company – Diagram 2 overleaf gives an actually happens on the ground overview of the implications. in day to day business activities is still consistent with what was An unexpected tax authority enquiry understood when transfer may result in an increased overall tax pricing policies were put in cost or double taxation or, as a place? minimum, a lengthy dispute. Given the current environment it seems that question is not whether the substance of intragroup transactions will be tested by the tax authorities but when and with what degree of rigour. Given our experience in the implementation of various commercial operating models around the world, and the agreement of appropriate pricing policies with relevant tax authorities , we can work with you to carry out a proactive review of your group’s operating model in relation to the level of genuine substance and associated evidence required to support the economic position of the model. Where business activities may have changed, we can also help with reassessing the value drivers and the impact on pricing. Where a tax enquiry has already started, we can provide advice on an appropriate approach to the resolution of the dispute. Centralised operating models assume a certain degree of substance in the Entrepreneur and its service providers. The transfer pricing methodologies and level of reward for each party are set based on their respective functional and risk profiles. If the functional and risk profiles of the parties change, the pricing arrangements need to be amended to reflect the changes. If the transfer pricing arrangements do not reflect the changes made, the legal entities will be open to a successful challenge by the tax authorities from the transfer pricing or wider corporate tax perspective (in case of impact on the corporate residence of the entities) , which may result in additional tax, late payment interest and potential penalties being payable. Diagram 2 outlines several different scenarios from ‘sufficient level of substance’ to ‘little or no substance in the Entrepreneur’ and the likely tax impact. Worst case Scenario All substance outside the Entrepreneur Likely focus of tax authority challenge Residence challenge Potential outcome All Entrepreneur’s profit taxed in local entities Best case Most substance outside the Entrepreneur Some substance outside the Entrepreneur All substance In Entrepreneur PE place of management, CFC and TP PEs, CFC, TP TP Profit in Entrepreneur reduced to cost + and or CFC Some Entrepreneur profits taxed in PEs elsewhere/ and or CFC All Entrepreneur’s profit taxed in its jurisdiction Diagram 2 – degree of tax impact caused by ‘insufficient ‘ substance Contacts Ian Dykes, Partner Value Chain Transformation ian.dykes@uk.pwc.com +44 (0) 121 265 5968 Annie Devoy, Partner Transfer Pricing annie.e.devoy@uk.pwc.com +44 (0) 207 212 5572 Giovanni Bracco, Partner Tax Risk Assurance giovanni.bracco@uk.pwc.com +44 (0) 207 804 4059 Alenka Turnsek, Director Value Chain Transformation alenka.turnsek@uk.pwc.com +44 (0) 207 213 5045 Claire Blackburn, Partner Transfer Pricing claire.blackburn@uk.pwc.com +44(0) 207 212 3529 Simon Wilks, Partner Tax Dispute Resolution Network simon.wilks@uk.pwc.com +44(0) 207 804 1938

© Copyright 2025