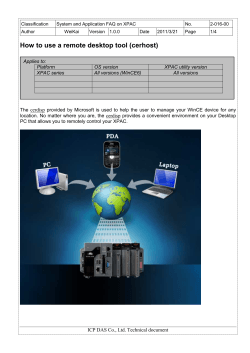

e we hy ar W ng