NET LEASED INVESTMENT OFFERING FAMSA 4700 South Ashland Avenue Chicago, IL 60609

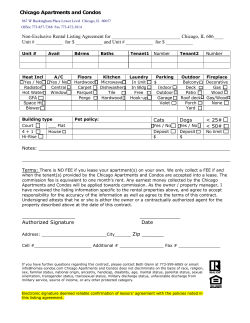

NET LEASED INVESTMENT OFFERING FAMSA 4700 South Ashland Avenue Chicago, IL 60609 www.bouldergroup.com TABLE OF CONTENTS NET LEASED INVESTMENT OFFERING TABLE OF CONTENTS 1) Confidentiality & Disclaimer 2) Executive Summary 3) Investment Highlights 4) Property Overview 5) Aerial 6) Site Plan 7) Maps 8) Tenant Profile 9) Demographic Comparison Report 10) Location Overview 11) Contact Information www.bouldergroup.com CONFIDENTITALITY & DISCLAIMER NET LEASED INVESTMENT OFFERING CONFIDENTIALITY & DISCLAIMER The information contained in the following Offering Memorandum is proprietary and strictly confidential. It is intended to be reviewed only by the party receiving it from The Boulder Group and should not be made available to any other person or entity without the written consent of The Boulder Group. This Offering Memorandum has been prepared to provide summary, unverified information to prospective purchasers, and to establish only a preliminary level of interest in the subject property. The information contained herein is not a substitute for a thorough due diligence investigation. The Boulder Group has not made any investigation, and makes no warranty or representation. The information contained in this Offering Memorandum has been obtained from sources we believe to be reliable; however, The Boulder Group has not verified, and will not verify, any of the information contained herein, nor has The Boulder Group conducted any investigation regarding these matters and makes no warranty or representation whatsoever regarding the accuracy or completeness of the information provided. All potential buyers must take appropriate measures to verify all of the information set forth herein. www.bouldergroup.com EXECUTIVE SUMMARY NET LEASED INVESTMENT OFFERING EXECUTIVE SUMMARY The Boulder Group is pleased to exclusively market for sale a single tenant net leased FAMSA property located in Chicago, Illinois. This 25,000 square foot property is located on the first floor of the historic Goldblatt building (City Landmark in Chicago) approximately five miles southwest of downtown Chicago. The property benefits from a dense infill location with population in excess of 343,000 within three miles. There are eleven years remaining on the primary term of FAMSA’s lease with rental escalations throughout both the initial term and renewal option periods. FAMSA is a chain of retail stores that sells household appliances, electronic products, furniture, clothing and other consumer products throughout its 420 locations in 78 Mexican cities and 37 cities in the United States. In 2012, FAMSA had annual revenue in excess of $1 billion. This is an ideal location for FAMSA as this strategic location targets their consumer profile. The property is located in a dense infill area of Chicago along West 47th Street between Ashland Avenue and Marshfield Avenue. FAMSA has frontage and excellent exposure along all three roadways and is positioned at the signalized intersection of 47th Street and Ashland Avenue. This intersection experiences traffic volumes in excess of 41,000 vehicles per day. FAMSA is located in the first floor of the historic Goldblatt building with entrances on Ashland Avenue and 47th Street. 47th Street is a primary retail thoroughfare featuring many national retailers including Wal-Mart Neighborhood Market, Marshalls and Aldi, which are located less than one-half mile from the property. Other retailers in the immediate area include Home Depot, Burlington Coat Factory and Food 4 Less (Kroger). As of May 2013, the Goldblatt building was approved as a designated City Landmark in Chicago. Landmark sites are selected after meeting a combination of criteria, including historical, economic, architectural, artistic, cultural, and social values. The Chicago Landmarks Ordinance requires that any alterations beyond routine maintenance, up to and including demolition, must have their permit reviewed by the Landmarks Commission. Additionally, Goldblatt’s Senior Living has plans to occupy floors two through five of the property. Goldblatt’s Senior Living is an assisted living facility that will contain 101 residential units and is scheduled to open June 2014. The original lease commenced in December 2009 with a primary term of 15 years with three 5-year renewal options. The lease features $2 per square foot rental escalations every five years throughout the primary term and in the renewal option periods. FAMSA is a publicly traded company on the Mexican Stock Exchange (GFAMSAA) with annual revenue in excess of $1 billion. FAMSA operates over 420 locations throughout 78 Mexican cities and 37 cities in the United States. www.bouldergroup.com INVESTMENT HIGHLIGHTS NET LEASED INVESTMENT OFFERING INVESTMENT HIGHLIGHTS •Located within a dense infill area of Chicago •Long term lease with eleven years remaining •FAMSA is a publicly traded company with annual revenue in excess of $1 billion •$2 per square foot rental escalations every five years throughout the primary term and renewal option periods •Population in excess of 343,000 within three miles of the property •Positioned on a hard corner of a signalized intersection with frontage along three roadways •Traffic volumes in excess of 41,000 vehicles per day at signalized intersection of 47th Street and Ashland Avenue •Nearby retailers include Wal-Mart Neighborhood Market, Home Depot, Burlington Coat Factory, Marshalls, Aldi and Food 4 Less (Kroger) •Located within the historic Goldblatt building, a designated City Landmark in Chicago •Goldblatt’s Senior Living facility is scheduled to open on floors two through five of the Goldblatt building in June 2014 www.bouldergroup.com PROPERTY OVERVIEW NET LEASED INVESTMENT OFFERING PROPERTY OVERVIEW Price: $5,711,141 Cap Rate: 8.50% Rent Schedule: NOI Escalation Date $490,5471 $540,547 $590,547 $640,547 $690,547 $740,547 12/1/2014 12/1/2019 12/1/2024 (Option 1) 12/1/2029 (Option 2) 12/1/2034 (Option 3) Renewal Options: Three 5-Year Lease Commencement Date: December 1, 2009 Lease Expiration Date: November 30, 20242 Tenant: FAMSA Credit Rating: B (Standard & Poor’s) Lease Type: Double Net Rentable Square Feet: 25,000 (1) FAMSA pays a fixed annual rent of $500,000 to landlord. Additionally, landlord is responsible for a tax base year expense of $6,453 and a CAM base year expense of $3,000. (2) FAMSA has the right to terminate the lease beginning December 1, 2016 by providing no less than one hundred and eighty days written notice. If tenant exercises termination right, tenant shall pay a penalty dependent upon when the lease is cancelled. If lease is cancelled December 2016, tenant shall pay a penalty of $544,821. www.bouldergroup.com AERIAL NET LEASED INVESTMENT OFFERING AERIAL WEST 47th STREET 20,000 VPD SOUTH ASHLAND AVENUE 21,000 VPD N N www.bouldergroup.com SITE PLAN NET LEASED INVESTMENT OFFERING SITE PLAN N S. ASHLAND AVE. S. MARSHFIELD AVE. W. 47TH STREET www.bouldergroup.com MAPS NET LEASED INVESTMENT OFFERING MAPS CHICAGO www.bouldergroup.com TENANT PROFILE NET LEASED INVESTMENT OFFERING TENANT PROFILE FAMSA (BMV: GFAMSAA) is a retail company engaged in the purchase and sale of household appliances, electronic products, furniture, clothing and other consumer products. FAMSA is a Mexico based company, headquartered in Monterrey, Mexico, and is publicly traded on the Mexican Stock exchange under the symbol GFAMSAA. FAMSA operates over 420 retail stores and 8 distribution centers in 78 Mexican cities and 37 cities in the United States. Additionally, FAMSA manufactures furniture and provides banking and credit services, including personal car financing through its own bank (Banco Ahorro Famsa). Website: Number of Locations: Number of Employees: Stock Symbol: Revenue: www.famsa.com 420+ 18,000 GFAMSAA (BMV) $1.15 billion www.bouldergroup.com DEMOGRAPHIC COMPARISON REPORT NET LEASED INVESTMENT OFFERING DEMOGRAPHIC COMPARISON REPORT Population Total Population Total Households 1-mi 3-mi 5-mi 35,912 9,638 343,702 103,040 877,946 297,031 $23,268 $36,566 $28,809 $42,936 $32,235 $49,439 Income Median Household Income Average Household Income www.bouldergroup.com LOCATION OVERVIEW NET LEASED INVESTMENT OFFERING LOCATION OVERVIEW Chicago is the most populous city in the Midwestern United States and the third most populous city in the United States with 2,700,000 residents. Chicago is the county seat of Cook County, the second largest county in the United States. The Chicago MSA is the third most populated metropolitan area in the United States with 9,580,567 residents. The MSA covers over 1,300 square miles and six counties. The Chicago metropolitan area is home to the corporate headquarters of 57 Fortune 1000 companies, including Boeing, McDonald’s, Motorola, Discover Financial Services and United Airlines. Chicago is a major hub for industry, telecommunications and infrastructure and O’Hare International Airport is the second busiest airport in the world in terms of traffic movement. The metro is also a major financial center in North America, and is home to the largest futures exchange in the United States, the CME Group. Chicago is third in the world on the Global Financial Centers Index which ranks the competitiveness of financial centers based on people, business environment, market access, infrastructure and general competitiveness. www.cityofchicago.org www.bouldergroup.com CONTACT INFORMATION NET LEASED INVESTMENT OFFERING CONTACT INFORMATION 666 Dundee Road, Suite 1801 Northbrook, IL 60062 Randy Blankstein President 847.562.0003 rblank@bouldergroup.com Jimmy Goodman Partner 847.562.8500 jimmy@bouldergroup.com www.bouldergroup.com

© Copyright 2025

![This article was downloaded by: [HEAL-Link Consortium] On: 17 April 2010](http://cdn1.abcdocz.com/store/data/000032199_2-977d41ab82857e251c482ccb2fd60fdc-250x500.png)