Document 324015

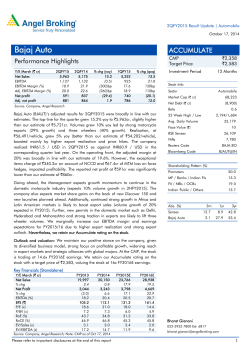

Company Update | Textile October 13, 2014 Siyaram Silk Mills BUY Earnings traction leads to re-rating CMP Target Price Siyaram Silk Mills (SSML) is a major player in the branded textile business with portfolio of strong and value-for-money brands like Siyaram’s, J Hampstead, Oxemberg and Mistair. With the enhanced capacity and increasing diversification in the revenue profile, the company would be able to sustain its growth momentum and improve its EBIDTA margin. Further, rise in outsourced manufacturing and repayment of debt will enable the company to post higher profits, going forward. Widening of Portfolio and foray into ladies wear segment to spur growth: Improvement in market conditions coupled with introduction of new brands and segments will help SSML to maintain its high growth trajectory. SSML has launched two new premium cotton brands – Zenesis and Moretti, and has penetrated further into new growth areas like cotton shirting, linen fabrics etc. The company has recently forayed into ladies wear (SKD) and ethnic women’s wear under the brand Siya which is a long term growth driver. This will enable the company to post a revenue CAGR of 17.8% over FY2014-16E to `1,810cr. Margins to improve on better product mix: SSML is aiming to increase the share of readymade garments segment in its product mix, which has higher margins, thus leading to an overall improvement in the EBITDA margins. The revenue share of readymade garments is expected to increase to 20% in FY2016E from 16.3% in FY2014 which will lead to higher EBIDTA margins of 11.4% in FY2016E. Higher Asset turnover and declining debt to boost profitability: The asset turnover (gross block) is expected to improve from 2.4x in FY2014 to 3.1x in FY2016E as the company has already incurred the required capex. We believe there would be minimum capex requirement going forward as the company would be outsourcing manufacturing, which will prove to be more profitable. In addition, with the cash flow coming in, the company will be able to reduce its debt, thereby easing interest expenses and improving profitability. Hence, we expect the profit to grow at a CAGR of 32.1% over FY2014-16E to `111cr. `718 `947 Investment Period 12 Months Stock Info Sector Market Cap (` cr) Net debt (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Textile 673 270 0.4 850 / 213 6,059 10 26,384 Nifty Reuters Code Bloomberg Code 7,884 SIYR.BO SIYA IN Shareholding Pattern (%) Promoters 67.1 MF / Banks / Indian Fls 6.6 FII / NRIs / OCBs 4.9 Indian Public / Others 21.4 Abs.(%) 3m 1yr 3yr Sensex 5.4 28.5 56.3 SSML 32.6 228.0 163.0 Valuation: SSML is trading at a PE of 6.1x on FY2016E earnings, which is attractive. We reiterate our Buy rating on the stock with an upgraded target price of `947, valuing the stock at a revised target PE of 8x FY2016E earnings. Key financials Y/E March (` cr) Net Sales % chg Adj. Net Profit % chg OPM (%) EPS (`) P/E (x) P/BV (x) RoE (%) RoCE (%) EV/Sales (x) EV/EBITDA (x) FY2012 916 6.5 57 (1.4) 12.7 60.5 11.9 2.5 23.3 18.5 1.0 7.6 FY2013 1,041 13.7 55 (3.0) 10.6 58.7 12.2 2.1 18.9 15.2 0.9 8.3 FY2014 1,303 25.2 64 15.6 10.7 67.8 10.6 1.8 18.6 16.4 0.7 6.7 Source: Company, Angel Research; Note: CMP as of October 13, 2014 Please refer to important disclosures at the end of this report FY2015E 1,536 17.8 80 25.9 10.9 85.4 8.4 1.5 19.8 17.5 0.6 5.2 FY2016E 1,810 17.9 111 38.6 11.4 118.4 6.1 1.3 22.7 20.8 0.5 4.0 Bhavin Patadia 022-39357800 Ext: 6862 bhavin.patadia@angelbroking.com 1 Siyaram Silk Mills | Company Update 1QFY2015 performance Y/E March (` cr) Net Sales Operating profit 1QFY15 1QFY14 % chg. (yoy) 4QFY14 % chg. (qoq) 302 251 20.3 406 (25.6) 32 26 24.4 43 (25.5) OPM (%) 10.6 10.3 35bp 10.6 1bp Adj. PAT 12 11 7.9 20 (42.6) Source: Company, Angel Research SSML reported a decent set of numbers for 1QFY2015. The company's top-line for the quarter grew by 20.3% yoy to `302cr, led by an improving product mix and aggressive marketing. The EBIDTA margin for the quarter improved by 35bp yoy to10.6%. The depreciation cost increased by 60.1% yoy (adhering to the new Companies Act 2013) and came in at `10.8cr. As a result, the net profit grew by a modest 7.9% yoy to `12cr. Exhibit 1: 1QFY2015 performance Y/E March (` cr) 1QFY15 1QFY14 % chg. (yoy) 4QFY14 % chg. (qoq) FY2014 FY2013 % chg Net Sales 302 251 20.3 406 (25.6) 1,303 1,041 25.2 Net raw material 147 124 18.8 222 (33.9) 671 532 26.2 (% of Sales) 48.6 49.3 (63) 54.8 (614) 51.5 51.1 Employee Cost 29 26 12.1 29 (0.3) 108 89 (% of Sales) 9.6 10.3 (70) 7.1 242 8.3 8.6 Other Expenses 21.0 94 76 24.2 111 (15.5) 384 310 (% of Sales) 31.2 30.2 98 27.5 371 29.5 29.7 Total Expenditure 270 225 19.8 363 (25.6) 1,163 931 24.9 Operating Profit OPM (%) Interest 24.0 32 26 24.4 43 (25.5) 140 110 27 10.6 10.3 35 10.6 1 10.7 10.6 16 8 7 20.7 8 0.5 29 25 14.2 Depreciation 11 7 60.1 8 41.8 29 22 33.6 Other Income 4 4 - 4 (9.2) 16 19 (14.8) 5.5 32 (46.1) 98 82 19.8 7.5 7.9 PBT 17 16 (% of Sales) 5.6 6.4 Tax (% of PBT) Reported PAT Extraordinary Expense/(Inc.) 5 5 32.1 33.6 12 11 - - Adjusted PAT 12 11 PATM (%) 3.8 4.3 7.8 0.7 11 (52.2) 34 27 35.1 32.7 (42.6) 64 55 - - (42.6) 64 55 4.9 5.3 36.2 7.9 20 7.9 20 5.0 28.6 15.6 15.6 Source: Company, Angel Research October 13, 2014 2 Siyaram Silk Mills | Company Update Investment arguments Leadership in blended fabric & widening of portfolio to drive growth Revenue to growth at a CAGR of 17.8% over FY2014-16 to `1,810cr SSML is the largest manufacturer of blended high fashion suitings, shirtings and apparels. Increasing demand for polyester viscose fabric, shifting preference of consumers from unbranded fabrics to branded blended fabrics on the back of improved standard of living, and rising disposable incomes in tier II and tier III cities would likely aid the company’s growth prospects. A portfolio of strong and value-for-money brands like Siyaram’s, J Hampstead and Mistair in the fabric segment, place SSML in a sweet spot. The company has launched two new premium cotton brands – Zenesis and Moretti, and has penetrated further into new growth areas like cotton shirting, linen fabrics etc. SSML has been able to differentiate itself from unorganized and organized competitors in a highly fragmented market. With a strong market position, pan-India presence and high brand recognition, along with the increasing diversification in its revenue profile, we expect the company’s revenue to grow at a CAGR of 17.8% over FY2014-16E to `1,810cr. Strengthening financials make the company a lucrative investment In the last few years, SSML has enhanced its fabrics and garments manufacturing capacity to meet growing demand for its branded products with funding coming in through internal accruals and loans. Additionally, with improving operational efficiency on the back of gradually increasing contribution of outsourced manufacturing from 40% in FY2014 to 60% by FY2016E and consolidation of expenses, the asset turnover (Gross Block) is expected to improve from 2.4x in FY2014 to 3.1x in FY2016E. Exhibit 2: Asset turnover to improve 3.1 3.0 (`) 2.7 FY2016E FY2014 2.0 FY2015E 2.3 FY2013 2.4 2.3 FY2012 2.5 Source: Company, Angel Research October 13, 2014 3 Siyaram Silk Mills | Company Update Angel ROIC estimated at 22.3% in FY2016E compared to 16.6% in FY2014 In addition, with the cash flow coming in, the debt is expected to reduce to `201cr in FY2016E from `275cr in FY2014, thereby easing interest expenses. All these factors will lead to improvement in return ratios to the earlier levels (Angel ROIC estimated at 22.3% in FY2016E from 16.6% in FY2014), making the company a lucrative investment candidate. Moreover, following its trend, we expect the company to increase dividend pay out to `12/share in FY2016E from `8/share issued in FY2014. Exhibit 3: Return ratios to improve to earlier levels 24.0 23.3 22.7 Exhibit 4: Expect dividend payout to increase 14.0 12.0 12.0 7.0 8.0 18.5 6.0 8.0 Source: Company, Angel Research FY2016E FY2016E ROE FY2015E FY2015E FY2014 FY2014 Angel ROIC (Pre-tax) FY2011 FY2013 5.0 4.0 16.6 15.7 FY2012 7.5 6.0 19.3 15.0 7.5 FY2013 18.6 FY2009 18.0 10.0 10.0 FY2010 (%) 18.9 22.3 (`) 19.8 FY2012 21.0 Source: Company, Angel Research Rigorous advertisement and retail expansion to push demand SSML spent ~`36cr in FY2014 on advertisement SSML has built a strong brand presence in the country through continuous advertisement and brand-building efforts. Its emphasis on latest fabrics, innovative and latest designs and affordable pricing points give it an edge over competition. Every brand holds a distinct position in the consumers’ minds which has helped the company in creating a niche for itself in a highly competitive industry. Additionally, the company has been spending rigorously on advertising for the recognition of its brands. The company has signed up celebrities like M S Dhoni (Siyaram’s, MSD), Neil Nitin Mukesh (Mistair), Saif Ali Khan (Oxemberg) and Hrithik Roshan (J. Hampstead) as brand ambassadors for its products. In FY2014, the company spent ~`36cr on advertising. Moreover, SSML has one of the largest distribution networks in the country with over 1,600 dealers and 500 agents supplying to more than 40,000 outlets across India. This enables the company to launch new products with a high success ratio and low marketing cost, giving it an edge over competition. In order to expand its retail footprint, the company continues to add stores through the franchise model (franchisees invest ~`25lakh on an average for interior works and inventory with minimum space requirement being 800 sq ft). It plans to increase the number of stores through franchisees to 500 by FY2017E. October 13, 2014 4 Siyaram Silk Mills | Company Update Venturing into women’s segment – a long term driver Company has roped in celebrities like Parineeti Chopra and Karishma Kapoor to endorse Siya October 13, 2014 The company has ventured into the salwar kameez and ethnic women’s wear segment with its brand - Siya. The Siya brand comprises of semi-stitched cotton, polyester and embroidered designer fabrics, with prices ranging from `700 to `7,000. In FY2014, the company generated a revenue of `30cr and it plans to grow it to `500cr in the coming four to five years as there are hardly any national-level mass brands in the category. SSML has roped in celebrities Parineeti Chopra and Karishma Kapoor to endorse the brand through photo shoots. As per industry reports (Technopak study in 2011), salwar kameez and ethnic women’s wear is a `20,690cr category, growing at a CAGR of 10%, which gives immense opportunity to the company. 5 Siyaram Silk Mills | Company Update Financials In FY2014, the company showed a promising revenue growth of 25.2% yoy to `1,303cr, aided by robust volume growth and some price hike. The garment segment grew by 48.6% for the year (30.8% volume and 13.6% value) to `213cr followed by 19.7% growth in the fabric segment (11.4% volume and 7.5% value growth) to `995cr. Going ahead, the growth in these segments is expected to moderate, but still will be relatively higher on account of rigorous advertisement and value-for-money positioning. Moreover, we believe that factors like 1) leadership position in blended fabric manufacturing, 2) increasing demand for polyester viscose fabric, 3) shift in demand from unbranded fabrics to branded ones in tier II and tier III cities, and 4) focus on improving product mix towards premium and high margin products, will continue to drive revenue growth for the company. On back of these driving factors, we expect the revenue to grow at a CAGR of 17.8% over FY2014-16E to `1,810cr in FY2016E. Exhibit 5: Revenue growth momentum to continue 30 25.2 1,600 (` cr) 3.8 10.5 3.1 12.7 3.7 13.7 83.5 81.8 79.8 80 3.8 3.5 16.3 18.8 20.0 76.4 77.5 76.5 3.5 25 1,400 1,200 1,000 20 17.9 17.8 15 13.7 800 600 1,810 1,536 1,303 916 860 6.5 1,041 10 400 200 100 35 30.3 0 FY2012 FY2013 Revenue (LHS) Source: Company, Angel Research FY2014 FY2015E FY2016E Revenue growth (RHS) 40 20 5 0 FY2011 60 (%) 1,800 (%) 2,000 Exhibit 6: Mix to improve in favour of garments 0 FY2011 FY2012 FY2013E FY2014E FY2015E Finish Cloth Readymade Garments Yarn FY2016E Others Source: Company, Angel Research The increasing share of readymade garments segment in SSML’s product mix, which has higher margins, will contribute towards an improvement in the overall EBITDA margins. Polyester viscose, which is a crude derivative, forms ~85% of the company’s raw material. With declining crude oil prices, the raw material cost is expected to decline gradually. Thus, we expect improvement in the EBIDTA margin by FY2016E to 11.4%. We will continue to see higher depreciation expenses going ahead, due to new provisioning requirements in the Companies Act. With cash flow coming in and capex requirement expected to be minimal, we expect the company to start repaying its debt. We estimate the debt to stand at `201cr in FY2016E from `275cr in FY2014, thereby easing the interest expense for the company. Consequently we expect the profit to grow substantially at a CAGR of 32.1% over FY2014-16E to `111cr in FY2016E. October 13, 2014 6 Siyaram Silk Mills | Company Update Exhibit 8: PAT margin to improve on lower interest cost 250 15.0 12.7 10.6 150 10.7 11.4 100 9.0 50 7.0 6.1 6.2 80 11.0 10.9 6.7 100 13.0 (%) (` cr) 200 120 (` cr) 12.8 6 5.2 5.3 4.9 60 7 5 (%) Exhibit 7: EBIDTA margins to improve 40 110 117 110 140 168 206 FY2011 FY2012 FY2013 FY2014 FY2015E FY2016E 0 4 20 5.0 EBITDA (LHS) 58 57 55 FY2011 FY2012 FY2013 PAT (LHS) 80 111 3 EBITDA Margin (RHS) Source: Company, Angel Research 64 0 FY2014 FY2015E PATM (RHS) FY2016E Source: Company, Angel Research Exhibit 9: Relative valuation Mcap Sales OPM PAT EPS RoE P/E P/BV EV/Sales EV/ (` cr) (` cr) (%) (` cr) (`) (%) (x) (x) (x) EBITDA (x) FY2015E 673 1,536 10.9 80 85.4 19.8 8.4 1.5 0.6 5.2 FY2016E 673 1,810 11.4 111 118.4 22.7 6.1 1.3 0.5 4.0 FY2015E 7,285 8,195 13.8 433 16.7 16.0 17.7 2.6 1.3 9.3 FY2016E 7,285 9,659 14.0 536 20.7 17.3 14.3 2.3 1.1 7.7 FY2015E 2,824 5,149 10.7 154 25.7 9.7 16.8 1.6 0.8 7.5 FY2016E 2,824 5,756 11.0 209 35.2 11.8 12.3 1.5 0.7 6.5 Company Year end SSML Arvind Ltd.* Raymond* Source: Company, Angel Research; * Bloomberg estimates SSML is trading at a much lower valuation than its peers despite its higher ROE and lower EV/EBITDA, which makes the company a strong investment candidate. October 13, 2014 7 Siyaram Silk Mills | Company Update Outlook and valuation: We believe that with market leadership in blended fabrics, strong brand building, wide distribution channel, strong presence in tier II and tier III cities and emphasis on latest designs and affordable pricing points, SSML will be able to post a revenue CAGR of 17.8% over FY2014-16E to `1,810cr with an EBITDA margin of 11.4%. We expect the profit to grow at a CAGR of 32.1% over FY2014-16E to `111cr. On account of the improved brand acceptance and strong profit growth, we reiterate our Buy rating on the stock with an upgraded target price of `947, valuing the stock at a revised target PE of 8x FY2016E earnings. Exhibit 10: One-year forward P/E band 700 600 500 (`) 400 300 200 100 Price (`) 2x 4x 6x Sep-14 Mar-14 Sep-13 Mar-13 Sep-12 Mar-12 Sep-11 Mar-11 Sep-10 Mar-10 Sep-09 0 8x Source: Company, Angel Research Concerns Competition from the unorganized sector: SSML, being in a sector that’s highly unorganized, faces intense competition from unorganized players as they usually sell their products at a much cheaper rate compared to it. However, due to strong branding efforts, huge distribution network and affordable price points, the company is easily able to differentiate its products from those of competitors. Fluctuation in raw-material prices: SSML operates in a highly price-sensitive market. Any fluctuation in raw-material prices can lead to margin compression, as the company may not be able to pass on the entire increase to the end-user. Also, polyviscose is a crude derivative, so any wide fluctuation in crude prices may further affect the EBIDTA margin of the company. October 13, 2014 8 Siyaram Silk Mills | Company Update Company background SSML is the largest manufacturer of blended fabrics in India. The company enjoys a strong brand presence across the country, with brands such as Siyaram’s, Mistair, MSD, J. Hampstead and Oxemberg in its kitty. The company has also recently launched three premium brands - Royal Linen (linen fabrics for men and women), Moretti (cotton shirting) and Zenesis (cotton suitings). SSML has built a strong brand presence in the country through continuous advertisement and brand-building efforts over the past 30 years. The company has created a niche for itself in a highly competitive industry. It has a wide distribution network comprising 1,600 dealers and 500 agents supplying to more than 40,000 outlets across India and has ~160 franchise stores with plans to increase the network to 500 stores by FY2017E. The company operates four plants – one at Tarapur near Mumbai for weaving and yarn dyeing, two at Daman for garments and one at Silvassa for weaving. October 13, 2014 9 Siyaram Silk Mills | Company Update Profit and loss statement Y/E Mar. (` cr) Net Sales Other operating income Total operating income % chg Net Raw Materials % chg Power and Fuel FY2013 FY2014 FY2015E FY2016E 916 1,041 1,303 1,536 1,810 - - - - - 916 1,041 1,303 1,536 1,810 6.5 13.7 25.2 17.8 17.9 460 532 671 768 894 5.7 15.7 26.2 14.3 16.4 16 19 27 31 36 18.4 21.5 37.9 14.3 17.9 63 89 108 124 147 % chg 34.5 41.8 21.0 15.4 17.9 Other 260 290 357 445 528 % chg Personnel % chg 2.3 11.6 23.1 24.7 18.5 Total Expenditure 799 931 1,163 1,368 1,604 EBITDA 117 110 140 168 206 % chg 6.0 (5.4) 27.1 19.8 22.8 12.7 10.6 10.7 10.9 11.4 Depreciation 22 22 29 44 45 EBIT 94 88 111 124 161 % chg 5.9 (6.2) 25.5 11.9 29.8 10.3 8.5 8.5 8.1 8.9 24 25 29 25 21 (% of Net Sales) (% of Net Sales) Interest & other Charges Other Income 11 19 16 20 25 (% of Net Sales) 1.2 1.8 1.2 1.3 1.4 Recurring PBT 70 63 82 99 140 (5.1) (9.9) 30.0 21.0 40.9 81 82 98 119 166 % chg PBT (reported) Tax (% of PBT) PAT (reported) Extraordinary Expense/(Inc.) 24 27 34 39 55 30.1 32.7 35.1 33.0 33.0 57 55 64 80 111 - - - - - 57 55 64 80 111 (1.4) (3.0) 15.6 25.9 38.6 6.2 5.3 4.9 5.2 6.1 Basic EPS (`) 60.5 58.7 67.8 85.4 118.4 Fully Diluted EPS (`) 60.5 58.7 67.8 85.4 118.4 % chg (1.4) (3.0) 15.6 25.9 38.6 7 7 8 9 11 50 48 56 71 100 ADJ. PAT % chg (% of Net Sales) Dividend Retained earnings October 13, 2014 FY2012 10 Siyaram Silk Mills | Company Update Balance sheet Y/E Mar. (` cr) FY2012 FY2013 FY2014 FY2015E FY2016E SOURCES OF FUNDS Equity Share Capital 9 9 9 9 9 Reserves& Surplus 258 305 360 429 527 Shareholders’ Funds 267 314 370 439 536 Total Loans 215 241 275 237 201 23 23 26 28 31 Other Long Term Liabilities Long Term Provisions 3 5 6 6 7 16 19 22 19 16 525 602 698 729 791 Gross Block 403 499 570 584 601 Less: Acc. Depreciation 173 194 220 264 309 Net Block 230 305 349 320 292 15 16 3 5 5 - - - - - 3 0 0 0 0 20 8 13 15 18 Deferred Tax (Net) Total liabilities APPLICATION OF FUNDS Capital Work-in-Progress Goodwill Investments Long Term Loans and advances Other Non-current asset Current Assets Cash Loans & Advances - - - - 458 530 613 739 2 3 6 33 47 78 33 39 46 63 Inventory 188 222 225 263 310 Debtors 190 200 260 271 320 - 0 0 - - Current liabilities 201 186 198 225 264 Net Current Assets 257 273 333 388 476 - - - - - 525 602 698 729 791 Other current assets Misc. Exp. not written off Total Assets October 13, 2014 458 11 Siyaram Silk Mills | Company Update Cash flow statement Y/E Mar. (` cr) Profit before tax Depreciation FY2013 FY2014 FY2015E FY2016E 81 82 98 119 166 22 22 29 44 45 Change in Working Capital (26) (15) (57) (28) (74) Direct taxes paid (24) (27) (34) (39) (55) Others 8 6 30 (20) (25) 61 68 66 76 57 (Inc.)/Dec. in Fixed Assets (30) (97) (58) (16) (18) (Inc.)/Dec. in Investments 15 3 (0) (0) (0) 1 12 (5) (3) (3) Cash Flow from Operations (Incr)/Decr In LT loans & adv. Others Cash Flow from Investing Issue of Equity 5 10 2 20 25 (8) (73) (61) 2 5 - - - - - (30) 26 34 (39) (36) (8) (8) (9) (11) (13) Others (16) (12) (28) 0 0 Cash Flow from Financing (54) 6 (3) (50) (49) Inc./(Dec.) in loans Dividend Paid (Incl. Tax) Inc./(Dec.) in Cash October 13, 2014 FY2012 (1) 1 2 28 13 Opening Cash balances 3 2 3 6 33 Closing Cash balances 2 3 6 33 47 12 Siyaram Silk Mills | Company Update Key ratios Y/E Mar. FY2012 FY2013 FY2014 FY2015E FY2016E Valuation Ratio (x) P/E (on FDEPS) 11.9 12.2 10.6 8.4 6.1 P/CEPS 8.5 8.8 7.3 5.4 4.3 P/BV 2.5 2.1 1.8 1.5 1.3 EV/Net sales 1.0 0.9 0.7 0.6 0.5 EV/EBITDA 7.6 8.3 6.7 5.2 4.0 EV / Total Assets 1.7 1.6 1.4 1.2 1.1 EPS (Basic) 60.5 58.7 67.8 85.4 118.4 EPS (fully diluted) 60.5 58.7 67.8 85.4 118.4 Cash EPS 84.3 82.0 99.0 132.1 166.5 Per Share Data (`) DPS Book Value 7.5 7.5 8.0 10.0 12.0 285.0 335.2 394.5 468.2 572.5 10.3 8.5 8.5 8.1 8.9 0.7 0.7 0.6 0.7 0.7 DuPont Analysis EBIT margin Tax retention ratio Asset turnover (x) ROIC (Post-tax) Cost of Debt (Post Tax) Leverage (x) 1.9 1.8 2.0 2.3 2.5 13.5 10.6 10.8 12.4 14.9 7.3 7.4 7.2 6.4 6.4 0.8 0.8 0.7 0.5 0.3 18.3 12.9 13.4 15.1 17.4 ROCE (Pre-tax) 18.5 15.2 16.4 17.5 20.8 Angel ROIC (Pre-tax) 19.3 15.7 16.6 18.5 22.3 ROE 23.3 18.9 18.6 19.8 22.7 Asset TO (Gross Block) 2.3 2.3 2.4 2.7 3.1 Inventory / Net sales (days) 67 72 63 58 58 Receivables (days) 77 68 64 64 64 Operating ROE Returns (%) Turnover ratios (x) Payables (days) 84 76 60 60 60 102 94 92 84 87 Net debt to equity 0.8 0.8 0.7 0.5 0.3 Net debt to EBITDA 1.8 2.2 1.9 1.2 0.7 Int. Coverage (EBIT/ Int.) 3.9 3.5 3.9 5.0 7.7 WC cycle (ex-cash) (days) Solvency ratios (x) October 13, 2014 13 Siyaram Silk Mills | Company Update Research Team Tel: 022 - 39357800 E-mail: research@angelbroking.com Website: www.angelbroking.com DISCLAIMER This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Pvt. Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Pvt. Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Pvt. Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Pvt. Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Pvt. Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Pvt. Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Pvt. Limited and its affiliates may have investment positions in the stocks recommended in this report. Disclosure of Interest Statement Siyaram Silk Mills 1. Analyst ownership of the stock No 2. Angel and its Group companies ownership of the stock No 3. Angel and its Group companies' Directors ownership of the stock No 4. Broking relationship with company covered No Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors Ratings (Returns): October 13, 2014 Buy (> 15%) Reduce (-5% to -15%) Accumulate (5% to 15%) Sell (< -15%) Neutral (-5 to 5%) 14

© Copyright 2025