Document 352536

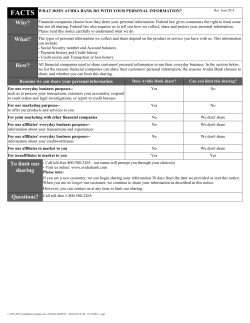

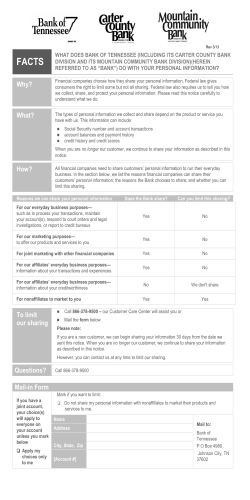

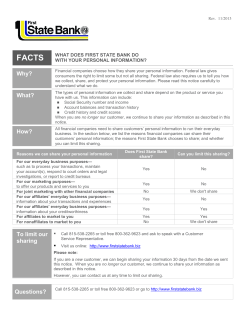

VOLUME 39 , NO. 4 United Credit Union is … “Your Financial Partner for Life” FALL 2014 nterprise Fall Vehicle Sal E l a i c e e Sp RATES VALID THE ENTIRE MONTH OF OCTOBER 2014 ONLY 100% 2011- 2014 models (1) Rates as low as… 1.75 FINANCING Enterprise Fall Car 87906 Sale FREE Checking Plus 2 It Pays To Read Chairman’s Report Savings Minimum Balance Get pre-approved for your vehicle purchase, before you shop! Visit Enterprise Car Sales on-line to view the vehicles available or visit any Enterprise Location listed below. 3840 N. Western Ave. Chicago, IL 60618 ENTERPRISE CAR SALE LOCATIONS 11429 S. Harlem Ave. 395 Roosevelt Road CALL (866) 855-5452 Worth, IL 60482 Glen Ellyn, IL 60137 www.enterprisecarsales.com Holiday 61952 Closing Schedule President’s Message What Does United Credit Union do with your Personal Information? Member Education Seminars Trade-Ins Welcome Superior Friendly Service Affordable Low Prices 7 Day Re-Purchase Agreement FREE - 12/12 Limited Power Train Warranty Extended Service Agreement Available Fully Equipped Vehicles with Popular Options All Prices Clearly Marked If You Are Not a Member - JOIN NOW! Get Your Pre-Approval Today! Choose From many Late Model Vehicles Member Education Registration Hours & Location United Credit Union offers the ease and convenience of having a FREE Checking Account Plus FREE Home Banking and FREE Bill Pay! APPLY TODAY and get a totally FREE Checking Account with United Credit Union without the worry of maintaining a daily balance or completing a certain number of transactions each month. Visit any of our United Credit Union locations to apply for our FREE Checking Account, Plus FREE Home Banking and FREE Bill Pay! Find your account number in this Report Card issue and win $20.00 deposited into your savings account! Offer Expires October 31, 2014 Chairman’s Report COLUMBUS DAY Monday, October 13, 2014 President’s Message VETERAN’S DAY Tuesday, November 11, 2014 THANKSGIVING DAY Thursday, November 27, 2014 CHRISTMAS DAY Thursday, December 25, 2014 NEW YEARS DAY Thursday, January 1, 2015 Dear Fellow Members: Let me take this opportunity to again thank each of you that I have had the pleasure to meet and those of you that I have not met as of now. Your welcoming me as the new Chairman has been very heartfelt and warming. I intend to try to meet each of you. United Credit Union will be open until 3:00 PM Wednesday December 24,2014 and Wednesday December 31, 2014 Your Board of Directors are in the process, of updating 99148 some of the systems we have and offering new products. One such enhancement, is a new Mortgage system that will make it easier for you to do business with the Credit Union. We also hope to expand this system to our other loans, cars, signature, home equity loans etc. We are also looking at convenience checks, to make it easier for you to borrow without having to fill out long forms. We have also increased some of the credit card limits, the Holidays are coming. As usual my personal belief and each member of the Board of Directors belief is that WE NEED YOU, WE NEED AND WANT YOUR LOANS. We can only survive and grow by your, 58154 and your family members active participation in the credit union. As always if there is something that we can do or suggestions that you have to make doing business with you easier please let us know!! Remember we want, need and appreciate your business. Dolphin Harris, Chairman Effective August 1st, 2014 the Par Value of a Share at United Credit Union was reduced from $100.00 to $25.00. Whether you or your family member have a specific savings goal 36981 in mind, get started by opening a savings account with United Credit Union! In today’s world, the use of Debit and Credit Cards is continuing to increase. The use of these instruments is a great convenience, because an individual does not have to carry cash or their checkbook with them. They are easy to use for purchases. However, the ability for hackers to access a merchants computer system is also increasing. With that in mind, you should always have a backup plan in the event your Debit or Credit Card is 55479 compromised. When we are notified that your account has been compromised, we immediately restrict your card and issue you a new card. You never know when or where this will happen! A Financial Institution is NOT REQUIRED to provide CASH when a withdrawal is requested. With the small branches many Financial Institutions have limited amounts of cash. United Credit Union has a limit of $500.00 for cash withdrawals, provided the cash is available. We try to honor all cash withdrawal requests, however when the cash in not available a check will be issued. The checks we issue through the Teller Department are our Official Check. Because it is our Official Check, if you are taking this to another Financial Institution, they should accept it without delay, however, we cannot control what another Financial Institution will do. We request that if you require a large cash withdrawal, you notify us at least five (5) days in advance so that we can make the necessary preparations. 53810 In addition, members now have the ability to withdraw up to $500 at an ATM and with a Point of Sale Transaction on both Debit and Credit Cards! Gary Peck President FACTS WHAT DOES UNITED CREDIT UNION DO WITH YOUR PERSONAL INFORMATION? WHY? Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. WHAT? The types of personal information we collect and share depend on the product or service you have with us. This information can include: Social Security number and account transactions checking account information and credit history payment history and transaction or loss history When you are no longer our member, we continue to share your information as described in this notice. HOW? All financial companies need to share members’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their members’ personal information; the reasons United Credit Union chooses to share; and whether you can limit this sharing. Reasons we can share your personal information. Does United Credit Union share? Can you limit this sharing? For our everyday business purposes — such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or to report to credit bureaus YES NO For our marketing purposes — to offer our products and services to you For joint marketing with other financial companies For our affiliates’ everyday business purposes — information about your transactions and experiences For our affiliates’ everyday business purposes — information about your creditworthiness For nonaffiliates to market to you YES NO YES NO NO WE DON’T SHARE NO WE DON’T SHARE NO WE DON’T SHARE QUESTIONS? WHAT WE DO Call 773-376-6000 or email us at unitedcu@unitedcreditunion.com How does United Credit Union protect my personal information? How does United Credit Union collect my personal information? To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Why can’t I limit all sharing? We collect your personal information, for example, when you open an account or apply for a loan use your credit or debit card or apply for financing give us your contact information We also collect your personal information from others, such as credit bureaus, affiliates, or other companies. Federal law gives you the right to limit only sharing for affiliates’ everyday business purposes — information about your creditworthiness affiliates from using your information to market to you sharing for nonaffiliates to market to you State law and individual companies may give you additional rights to limit sharing. DEFINITIONS Affiliates Nonaffiliates Joint Marketing Companies related by common ownership or control. They can be financial and nonfinancial companies. UCU Financial Services, Inc. Companies not related by common ownership or control. They can be financial and nonfinancial companies. Nonaffiliates we share with can include insurance companies, government agencies, plastic card processors (credit/ debit/A TM), financial statement publishers or printers, mailhouse, mortgage service companies, consumer reporting agencies, data processors, and check/share draft printers. A formal agreement between nonaffiliated financial companies that together market financial products or services to you. Our joint marketing partners include CUNA Mutual Group’s MEMBERCONNECT. OTHER IMPORTANT INFORMATION Protecting our member’s privacy and confidentiality of personal information is one of our highest priorities FINANCIAL WORKSHOPS November, 2014— January, 2015 United Credit Union is committed to providing its members, at no cost, quality financial education 43899 which is essential in this day and age. These educational seminars cover relevant and important topics for our members. Member Suggestion If you have a topic of interest you would like for a Financial Workshop, please let us know. SATURDAY, NOVEMBER 1, 2014 FINANCIAL 66541 EDUCATION Attendees will learn to understand how their money flows through the system. How to prepare for financial situations and the importance of managing your expenses: •How to create a Budget • Understanding Your Credit Report •Managing Your Checking Account • Managing Your Credit •How to Save • Handling Delinquency SATURDAY, NOVEMBER 8, 2014 C ASH MANAGEMENT For individuals who may benefit from ideas on how to better manage their day-to-day financial resources SATURDAY, DECEMBER 6, 2014 SOCIAL SECURITY AND YOUR RETIREMENT Achieving a secure and comfortable retirement requires careful financial planning. Understanding the role of Social Security will help develop an effective retirement strategy that meets your needs and brings peace of mind. 83899 SATURDAY, JANUARY 17, 2015 RISK MANAGEMENT Managing risk is a fundamental part of financial planning. You may be saving and investing. Maybe you think you are doing everything right. Don’t let unanticipated events - like an unexpected accident or natural disaster - derail your financial future! CHECK SEMINAR(S) YOU WISH TO ATTEND: SATURDAY, NOVEMBER 1, 2014, FINANCIAL EDUCATION SATURDAY, NOVEMBER 8, 2014 CASH MANAGEMENT SATURDAY, DECEMBER 6, 2014, SOCIAL SECURITY AND YOUR RETIREMENT SATURDAY, JANUARY 17, 2015, RISK MANAGEMENT MEMBER’S ACCT # MEMBER’S NAME ADDRESS CITY/TOWN GUEST NAME REGISTRATION / CONTINENTAL BREAKFAST, 8:30AM-9:00AM SEMINAR, 9:00AM LOCATION: MEMBER SERVICE CENTER (WEST) 4444 S. PULASKI RD. (COMMUNITY ROOM) PHONE # STATE Limit one guest. Thank you for your cooperation. Mail coupon to ZIP United Credit Union Financial Workshops Attn: Nancy Sanchez 4444 So. Pulaski Road, Chicago, IL. U N ITE D CR E D IT U N I O N M E M B E R S E RVI CE CE NTE R S CHICAGO WEST EVERGREEN PARK 4444 S. Pulaski Rd. Chicago, IL 60632-4011 773-376-6000 9730 S. Western Ave, Ste 633 Evergreen Park, IL 60805-2863 773-843-9300 OUTSIDE ILLINOIS 1-800-848-3444 WEBSITE www.unitedcreditunion.com E-MAIL unitedcu@unitedcreditunion.com CHICAGO NORTH CHICAGO EAST 5901 N. Cicero Ave., Ste. 106 Chicago, IL 60646-5711 773-843-8500 1526 E. 55th St. Chicago, IL 60615-5550 773-843-8900 Your savings fedreally insured to at least $250,000 and backed by the full faith and credit of the United States Government Follow us on: National Credit Union Administration, a U.S. Government Agency

© Copyright 2025