SMALL COMPANIES DIVIDEND TRUST PLC

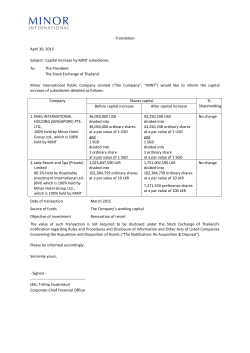

SMALL COMPANIES DIVIDEND TRUST PLC Trust facts August as at 30.6.05 2010 Investment Objective The investment objective of the Company is to provide Ordinary shareholders with a high income and opportunity for capital growth. Investment Policy The Trust’s funds will be invested principally in companies with a market capitalisation of up to £500 million; a maximum of 20 per cent. of the Group’s portfolio may be invested in companies without reference to their market capitalisation at the discretion of the Investment Manager. The Trust's portfolio will comprise companies listed on the Official List and companies admitted to trading on AIM. The Trust will not invest in preference shares, loan stock or notes, convertible securities or fixed interest securities or any similar securities convertible into shares. The Trust will not invest in other investment trusts or unquoted companies. FUND FACTS Gross Assets: 19.48m (includes unaudited revenue reserve to 30.7.10) NAV: 92.05p per Ordinary share Share Price: 83.00p per Ordinary share £4m £4.m Fixed Term Bank Loan Share Capital: 16,250,000 Ordinary shares Management fee: 1% pa. Plus performance fee Charge to Capital: Management fee and bank interest (75% to Capital : 25% to Revenue) Launch date: 12 May 1999 Dividends: June, September, December and March Yield: 20% approx. Year end: ASSET ALLOCATION % Support Services 14.10 Insurance 12.29 Construction & Materials 10.95 Financials 8.59 Engineering 8.05 Household Goods 7.39 Retailers 5.94 Travel & Leisure 4.66 Food & Beverages 3.77 Transport 3.49 Chemicals 3.16 30 April Electronic & Electrical Eqt 2.74 AGM: September Pharmaceuticals 2.67 Fund Managers: Dave Taylor and David Horner Industrials Suppliers 2.44 Directors: Lord Lamont (Chairman), Bryan Lenygon, David Harris, William van Heesewijk Technology Software 2.27 Media 2.17 Bank Debt: historic 1.82 Mining Utilities, Other 1.80 General Industrials 1.71 Total 100.0 www.chelvertonam.com N D Trust facts August 2010 T SMALL COMPANIES DIVIDEND TRUST PLC R UFund Manager’s comments as at 31.8.10 S T The last month, traditionally a quiet one for UK market volumes, was dominated by evidence of a Pdeteriorating macro environment both here and in the US. In particular the timing of a recovery in the Lbuilding and construction industries now appears to have moved further to the right, although we remain with our exposure to this area of the economy as we are generally being paid premium Ccomfortable yields to ‘wait’ for the eventual pick up in activity Corporate profitability remains on track and in line with or ahead of expectations but it is fair to say that the scale of upgrades has slowed in recent T r weeks. Looking at our investible universe however it is reassuring to note that we can still find stocks uthat are growing earnings and dividends trading on premium yields and single figure multiples. s t We made a number of relatively small changes to the fund in the last month with a focus on increasing f the underlying yield of the portfolio. We sold part of our holding in Avesco, which currently is not paying a a dividend after an exceptionally strong run. Monies were also raised from partial sales of Dee Valley, c Wm Sinclair, D S Smith, Hilton Foods and Nichols all at prices which equated to yields that were below t the fund average. We then made additional purchases of Office2Office, HMV, Fiberweb, Chaucer and s Morgan Sindall the latter performing particularly well since as it has announced the acquisition of a book a s of business from the administrators of Connaught. a t Portfolio breakdown by market capitalisation 3 0 . Number of Companies Percentage of portfolio 6 £500m . £250m-£500m 5.05% £500m+ 0 3.51% £0-25m £250m7 5 £0-25m 21.84% £500m 2 19 £100m-£250m 21.40% £100-250m 11 £25-50m 11 £75-100m 3 £75-100m 6.50% £50-75m 6 Small Companies Dividend Trust PLC is registered in England Company No: 3749536 Price Information: Reuters: SEDOL: Financial Times SDV.L (Ords); 0661582 Marketmakers: Fairfax I.S, Cazenove and Winterflood £25-50m 22.12% £50-75m 13.80% HOW TO CONTACT US Telephone : Email: 01225 483 030 cam@chelvertonam.com By Post: Chelverton Asset Management 11 George Street Bath BA1 2EH www.chelvertonam.com SMALL COMPANIES DIVIDEND TRUST PLC S M Risk Factors The value of investments and the income from them may go down as well as up and you may not get back your original investment. Investment trusts can borrow money to make additional investments on top of shareholders funds (gearing). If the value of these investments fall in value, gearing will magnify the negative impact on performance. Particular share classes may also be structurally geared by other share classes that have earlier entitlement to the Company’s assets up to a predetermined limit. If an investment trust incorporates a large amount of gearing the value of its shares may be subject to sudden and large falls in value and you could get back nothing at all. Some split capital shares have higher risk characteristics than conventional equities which can result in capital erosion. An investor could lose all of their capital. Smaller companies are riskier and less liquid than larger companies which means their share price may be more volatile. Some of the annual management fee is currently charged to the capital of the Fund. Whilst this increases the yield, it will restrict the potential for capital growth. The level of yield may be subject to fluctuation and is not guaranteed. Net Asset Value (“NAV”) performance is not the same as share price performance and investors may not realise returns the same as NAV performance. Risk rating of Shares Ordinary shares High The information contained in this document has been obtained from sources that Chelverton Asset Management Limited (“CAM”) considers to be reliable. However, CAM cannot guarantee the accuracy or completeness of the information provided, and therefore no investment decision should be based solely on this data. This document is issued by CAM, authorised and regulated by the Financial Services Authority. This document does not represent a recommendation by CAM to purchase shares in this Trust. We recommend private investors seek the services of a Financial Adviser. Trust facts August 2010 Largest Holdings as at 31.8.10 % 1 Macfarlane Group 4.10 2 Portmerion Group 3.97 3 Sinclair (W) Holdings 3.62 4 S&U 3.48 5 Clarke (T) 3.42 6 Victoria 3.42 7 Zotefoams 3.16 8 Cineworld Group 2.96 9 Chesnara 2.94 10 Alumasc Group 2.81 11 Stadium Group 2.74 12 Consort Medical 2.67 13 Arbuthnot Banking Group 2.50 14 Trifast 2.48 15 Marshalls 2.40 16 Sanderson Group 2.27 17 Hilton Food Group 2.13 18 Abbey Protection 2.11 19 Avesco Group 2.10 20 Office2Office 1.98 Top 20 Total Percentage 57.26 Other holdings 42.74 Total 100.0 HISTORIC RECORD OF EARNINGS AND DIVIDENDS 15.5p 15.0p 14.5p 14.0p 13.5p 13.0p 12.5p 12.0p 11.5p 11.0p 10.5p 10.0p 9.5p 9.0p 8.5p 8.0p 7.5p 7.0p 6.5p 6.0p 5.5p 5.0p 1.14 0.46 0.7 2.39 0.31 0.48 0.86 0.48 0.5 13.00 8.30 9.00 9.50 9.75 10.00 10.35 10.75 13.65 11.25 7.30 1999 2000 2001 DIVIDENDS 2002 2003 2004 RETAINED EARNINGS 2005 2006 2007 2008 2009 7.85 2010 SPECIAL DIVIDEND RECEIVED www.chelvertonam.com

© Copyright 2025