G00203 Summary of Benefits Open

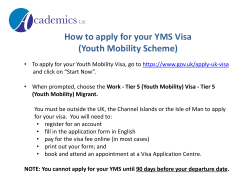

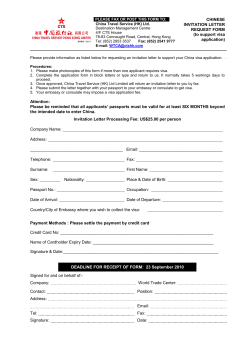

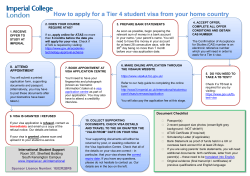

-1- G00203 Summary of Benefits Applicable to Headquarters-based Open-Ended and Term Staff The following is a summary of the benefits applicable to open-ended and term staff at Headquarters, Washington, D.C. (including staff appointed directly to Country Offices on position subject to international recruitment). It is compiled from various governing sources such as the Staff Rules and the Staff Retirement Plan, which may be amended from time to time and which provisions are controlling in all cases. All issues regarding benefits must be resolved according to the applicable, governing source documents, notwithstanding anything written in this Summary. In the event of a conflict between this Summary of Benefits and the Staff Rules, the Staff Rules shall prevail. The term “Bank Group” refers to the World Bank, IFC, MIGA, ICSID and GEF. Visa Services A staff member must have or obtain an appropriate visa and/or work authorization before undertaking any assignment for the Bank Group in the United States, namely: U.S. Citizenship; or U.S. Permanent Residency (“green card”); or Pending U.S. permanent resident status with valid Employment Authorization Card (work permit); or U.S. Asylum status with a valid work permit; or U.S. Refugee status with a valid work permit; or G4 visa, requested by World Bank Group’s HR Operations through a U.S. Consulate/Embassy outside the U.S. (no fee for a G4 visa). U.S. staff members and their dependents are ineligible for G4 visa services; or A dependent “A” (diplomatic) visa, with a valid work permit; or F1 (student) visa under curricular practical training (CPT) or optional practical training (OPT). Work authorization must be received via endorsement from the designated school official (DSO) on the student’s immigration Form I-20. Students may also have an Employment Authorization Card (work permit) issued by U.S. Citizenship and Immigration Services. Incoming staff members residing in the U.S. on all other non-immigrant visas not listed above must obtain a G4 visa prior to employment with the World Bank Group. A person in the U.S. on B1/B2 (visitor/tourist) or Visa Waiver Program is not authorized to work in the U.S., and must obtain a G4 visa outside the U.S. For staff members on a G4 visa, dependent G4 visas are available for immediate family members to accompany the staff member to the U.S. and to reside in the U.S. while the staff member is employed by the World Bank Group and based in the U.S. HR Operations - Revision 22-Jan-2015 G00203 -2G4 visas for staff members and dependents typically can be renewed within the U.S., and the G4 staff member is obligated to provide any mandatory documentation to support such a renewal of a dependent G4 visa. G4 Spouse and Dependent Employment Once resident in the U.S., a G4 dependent may apply through the World Bank Group’s HR Operations to the U.S. State Department and the U.S. Citizenship and Immigration Services for a work permit that allows the dependent to work in the U.S. while in G4 status. The Work Authorization process takes up to four months (and occasionally longer) due to mandatory security. The delay occurs as the U.S. authorities process the application; the World Bank Group has no influence or control over the process or the delay. World Bank Group staff members are obligated to provide the mandatory information to support a Work Authorization application or extension. Special Note for Spouses and Same-Sex Domestic Partners on H1B Visas or Other NonImmigrant Visas with U.S. Work Authorization U.S. immigration regulations require that any individual entitled to a G4 visa, such as a nonimmigrant spouse or same- sex domestic partner of a World Bank Group staff member holding a G4 visa, must be issued a G4 visa if the individual resides in the same household of the G4 staff member. [U. S. State Department, Reference: 22 CFR Sec. 41.24(b)(4)]. The sole exception to this rule is for A-visa holders (diplomats). In practice, this means that a spouse or same-sex domestic partner currently working in the U.S. on an H1B visa or other non-immigrant visa (other than an A-visa) with work authorization must change to a G4 dependent visa at the same time as the staff member obtains his/her G4 principal visa. The spouse/same-sex domestic partner must stop working from the time his/her status has changed to G4 dependent, until he/she is in receipt of a valid work authorization under the G4 dependent visa. The spouse/same-sex domestic partner can submit the application for a work authorization only after the: a) Staff member obtains the G4 principal visa, and b) Staff member commences employment with the World Bank Group, and c) Spouse/same-sex domestic partner has obtained the G4 dependent visa and is physically present in the U.S. The process of obtaining a G4 dependent work authorization may take approximately up to 4 months. G5 Visa G4 visa holders may employ, under the G5 Visa program, a domestic employee to work in their household as a child/elder care provider, nanny, housekeeper, etc. U.S. citizens, permanent residents and staff holding any other visas other than a G4 are not eligible for this program HR Operations - Revision 22-Jan-2015 G00203 -3The World Bank Group facilitates issuance of G5 visas, however many restrictions apply from both the U.S. State Department and the World Bank Group. G5 domestic employment is governed by U.S. and state employment laws. A G5 must be unrelated to the G4 staff member by blood or marriage, be at least 17 years old and must be a domestic by trade and experience. G5 domestics may work only in the home of the sponsoring G4 employer, and nowhere else in the U.S. For the terms and conditions refer to the G5 visa section. Domestic Partners The World Bank Group recognizes same-sex and opposite-sex domestic partnerships that meet the following criteria: The parties are not related by blood to a degree that would bar marriage where the parties reside. The parties are not married to anyone else. The parties are each other's sole domestic partner and intend to remain so indefinitely. The parties are legally competent to contract and of lawful age to marry. The parties have resided together in the same residence for at least 12 months and intend to do so indefinitely. The parties have been jointly responsible to each other for basic living expenses and welfare for at least 12 months. Registered domestic partners (and their children) receive spousal benefits with the exception of Dependency Allowance. Domestic Partners and Same-Sex Spouses: U.S. Visa Issues Same-sex domestic partners and same-sex spouses are eligible for dependent G4 visas to enter and reside in the U.S. Same-sex domestic partners and same-sex spouses on a valid dependent G4 visa may also apply for a Driver’s License and Work Authorization in the United States. However p er Department of State guidelines, opposite-sex domestic partners are ineligible for dependent G4 visas. HR Operations - Revision 22-Jan-2015 G00203 -4- Employing Spouses/Domestic Partners The spouse or domestic partner of a staff member who meets the normal selection standards may be employed by the Bank Group. A spouse or domestic partners may be assigned to the same vice presidency or department, if neither supervises the other, directly or indirectly, and if their duties are not likely to bring them into routine professional contact. They may not be assigned to the same division or equivalent unit. A spouse or a domestic partner of a staff member may be assigned to the same country office, provided that neither supervises the other, directly or indirectly, and provided that the Vice President responsible for the country office, in consultation with the Manager, Human Resources Operations approves the assignment. Dependency (Tax Equivalency) Allowances Staff members receive five percent of net salary per year for a spouse1 up to a maximum of $3,500, plus $600 for each dependent child. (For the purposes of Bank Group benefits, a dependent child means an unmarried child on whose account the staff member provides more than half the support and who is either under age 19, is physically or mentally incapacitated, or is under age 25 and is either a full time student or has a gross income of less than $10,712 gross per year.2) These allowances are adjusted if the spouse’s prior calendar year annual income exceeds $30,000 gross (the allowance is reduced by one percentage point for every $1,000 of spouse income over $30,000). If the staff member has a dependent child residing in his or her household and no spouse, the allowance shall be five percent of net salary up to a maximum of $3,500 for the first dependent child as defined above and living in the staff member’s household, and $600 for each additional child. 1 2 For information on domestic partners and same-sex spouses, see the relevant section above. Step-children have the additional requirement of primary residence with the staff member. Note also that dependency criteria for children for the purposes of dependency allowance are different—and more restrictive -- than eligibility criteria for covering a child in the Bank Group’s medical insurance plan. See the Medical Insurance Plan section below. HR Operations - Revision 22-Jan-2015 G00203 -5- Tax Allowance Staff members liable for the payment of national income taxes on the remuneration received from the Bank Group receive a tax allowance as determined by the Executive Directors. Generally, for appointments in the United States, such income tax liability extends to American citizens only (and not U.S. permanent residents).3 For Americans, Bank Group gross income will be reported to the IRS on a Form W2, and that amount must be reported as wages on state and federal income tax returns. American employees of international organizations are also responsible for 50% of the self-employment tax (in lieu of FICA and Medicare withholding) on the portion of gross income that relates to services within the U.S. for the Bank Group. Each W2 will also provide the amount of selfemployment income, which should be reported on Schedule SE and attached to Form 1040. The Bank Group does not withhold taxes from salary payments. Therefore, each American is responsible for payment of quarterly estimated taxes to state and federal authorities. For general questions regarding taxes, contact the Tax Service Desk, Accounting Department (email: tsection@worldbank.org, telephone: 202-458-4191). Leave Annual leave: 26 working days per year, increasing to 28 and 30 days per year after five and ten years’ service, respectively, accrued daily. Prior service generally applies towards the five and ten year service thresholds. Sick Leave and Disability Insurance: 15 working days of sick leave per year, accrued daily. Sick leave and disability insurance provide income replacement if you become disabled while working at the Bank Group. In the event you are no longer able to work because of sickness or injury, you may receive a monthly benefit equal to 100 percent of your pay while using sick leave and 70 percent of your pay after your sick leave is exhausted. These benefits will be paid as long you remain disabled and will discontinue on recovery, death, or attainment of age 62. The full cost of the program is paid by the Bank Group and enrollment in the program is automatic. Decisions regarding disability benefits and the duration of disability rest with our disability insurance administrator. Absences of 20 days or more must be reported by you, your leave coordinator or your manager to the disability administrator at (202) 473-0974 or via email to Disability Insurance. More information is available on the World Bank Intranet at http://benefits. Maternity/Adoption Leave: Up to 70 working days for childbirth and/or adoption. For staff with less than two years of service; full parental leave is granted, but if the staff member resigns prior to two years of service, the leave granted must be repaid on a prorated basis. 3 Americans are taxed on worldwide income. Other nationalities may be liable for income tax on Bank Group income only if the staff member resides in the country of nationality, e.g., a British citizen working for the Bank Group in London may be liable for income taxes, whereas the same individual working outside the United Kingdom would not be liable. Most countries exempt their citizens from income tax on their Bank Group income regardless of country of residence or employment. HR Operations - Revision 22-Jan-2015 G00203 -6Paternity Leave: Up to 10 working days for childbirth or adoption where the staff member is not the primary caregiver. Relocation Leave: Managers may authorize up to five working days of administrative leave to enable a staff member recruited from outside the duty station area to perform essential personal tasks associated with settling in the duty station area. Overtime Overtime is work performed in excess of the staff member’s regular work week beginning on Sunday and ending on Saturday. Annual, sick, and emergency leave and official holidays are counted as time worked in computing the work week required before overtime payment is made. Staff members at levels GA through GD only are eligible to be paid for overtime work. Staff Retirement Plan (SRP) Including Transfer of Pension Rights from Other Organizations The World Bank Group Staff Retirement Plan is mandatory for all open-ended and term staff members. Restoration provisions exist for individuals who previously received benefits from the World Bank Staff Retirement Plan. The World Bank Group currently has pension transfer agreements with some international organizations. In order to protect any possible transfer rights, you should not withdraw funds from the pension plan of your previous employer prior to contacting the Pension Administration Unit at 1pension@worldbank.org or (202) 458-2977 to seek clarification and further information. Medical Insurance Plan (MIP) The Bank Group sponsors a comprehensive medical/dental/vision/prescription drug insurance plan for staff members and their dependents including a choice of three options. Contributions, shared by the Bank Group and the staff member, are deducted from each paycheck. Benefits are maximized under all three options by using providers who participate in the Bank Group’s preferred provider network. One option (for U.S.-based staff only) allows the staff member to maximize their benefits by using a Primary Care Physician to direct medical care. Enrollment in the MIP is optional. Coverage is effective on the entry on duty date, provided enrollment is completed within 60 days of entry on duty. Staff members who do not submit any enrollment decision (waiver or enrollment) are automatically enrolled without dependent coverage into the Bank Group’s low premium, high deductible option. For dependents, enrollment must be provided within 60 days of the staff member’s entry on duty or the initial eligibility of the dependent via a life event (e.g., marriage after appointment), whichever occurs later. If a dependent enrollment is not received within 60 days after entry on duty or the life event that created eligibility, whichever occurs later, your dependent(s) will not be eligible for enrollment in the Bank's health insurance plan until the next open enrollment. Eligible family members may be enrolled or changes to the coverage options made during the HR Operations - Revision 22-Jan-2015 G00203 -7“Open enrollment” season, which takes place in late fall and the coverage is effective Jan 1. Eligible dependents are a legal spouse or registered domestic partner, a biological child aged 26 or younger, a legally adopted child aged 26 or younger, or the biological or legally-adopted child age 26 or younger of a legal spouse or registered domestic partner.4 A mentally or physically handicapped child may be eligible for coverage beyond age 26 if the onset of the handicap occurred while the child met the Bank Group’s dependency criteria (namely, age 25 or younger, unmarried, reliant on the staff member for principal support) and the handicapped child, with the exception of the age limitation, continues to meet those criteria. Application for handicapped status must occur on or before the 25th birthday. Grandchildren may be covered only if the parent (the staff member’s child) meets the Bank Group’s dependency criteria, and coverage occurs only while such criteria are met.5 Other dependents, including but not limited to parents, in-laws, siblings, nieces, nephews and in-laws, are ineligible. An unmarried dependent parent or parent-in-law residing in your household may be eligible for a separate, unsubsidized Sponsored Plan coverage. For U.S. nationals, the MIP is a “Section 125” plan and the premiums paid by staff members are pre-tax. Detailed MIP information may be found at http://go.worldbank.org/LQXR35B0U0. Retiree Medical Insurance Plan (RMIP) The Bank Group provides health care coverage (comprehensive medical, dental and prescription drug benefits) at retirement. To qualify for coverage, staff must have at least five years of pensionable service and their age plus pensionable service must equal 60 or more. Staff contributions are based on a cost sharing arrangement, with a subsidy from the Bank Group earned for each year of pensionable service and reduced for each year that RMIP coverage begins prior to age 62. The earliest age at which RMIP coverage can begin is age 50. Life Insurance Plan The Bank Group sponsors a Group Life Insurance Plan. All eligible staff members automatically receive Bank-paid basic coverage of 100 percent of annual net salary at no cost to the staff member.6 An additional 200 percent of annual net salary will be provided through the Staff Retirement Plan at no cost to the staff member. Additional coverage of up to 500 percent of annual net salary, at the staff member’s expense, is offered to all eligible staff. Total coverage (Bank-paid plus optional) cannot exceed 800 percent of annual net salary. Optional life insurance enrollment is effective upon 4 Thus, a child may be covered under medical insurance while not considered a dependent for dependency allowance. For example, a child who marries at age 23 ends dependency, but can remain insured through the last day of the months in which he/she turns age 26. (The child’s spouse is not eligible for medical insurance.) 5 For example, if an unmarried child parents a child (the staff member’s grandchild), the grandchild can be covered by medical insurance while the child remains a dependent. If the child married, dependency would end and thus the grandchild’s coverage would end. However, the child only could remain covered under the medical insurance through the last day of the months in which he/she turns age 26. 6 Former staff members who joined the Staff Retirement Plan on or before April 14, 1998 and who deferred their pension and who are now reappointed will receive basic life insurance coverage of one times annual net salary with the possibility of purchasing up to five times annual net salary in optional life insurance coverage. Staff members appointed who are ineligible for pension participation due to age are similarly treated. HR Operations - Revision 22-Jan-2015 G00203 -8completion of enrollment, provided enrollment is completed within 60 days of entry on duty. If a staff member delays enrollment for more than 60 days after entry on duty, evidence of good health must be furnished at the staff member’s expense to the insurance company, who may not accept the application if the health of the applicant is not satisfactory. Coverage is effective only after the insurance company approves the application. Coverage is reduced after age 65. Staff may increase their optional Group Life insurance following a life event (birth or legal adoption, marriage, divorce, death of dependent) by one times annual net salary coverage (subject to the maximum of optional coverage of five times annual net salary) without providing evidence of good health to the insurance company, provided the application for the increase in coverage is made within 60 days of the life event. Dependent life insurance is also available at the staff member’s expense. A standard option provides $20,000 coverage for a spouse/registered domestic partner and $8,000 for each eligible dependent child, and a high option provides $50,000 coverage for a spouse/registered domestic partner and $10,000 for each eligible dependent child. If a staff member delays enrollment for more than 60 days after entry on duty or the initial dependency event (marriage, birth or legal adoption), evidence of good health for each dependent must be furnished at the staff member’s expense to the insurance company, which may not accept the application if the health of an applicant is not satisfactory. Coverage is effective after the insurance company approves the application. Accidental Death Insurance The Bank Group sponsors a Group Accident Insurance Plan, which pays in the event of accidental death or dismemberment. All eligible staff members automatically receive basic coverage of 300 percent of annual net annual salary. A spouse/registered domestic partner is covered automatically at 50 percent of the staff member’s coverage amount, and each eligible dependent child is covered at 25 percent of the staff member’s coverage amount. Deaths from certain causes are excluded, including death during service with armed forces of any country, suicide, death from illness or infectious disease, or deaths in airplane accidents where the covered individual was part of the airplane crew. Deaths from certain other causes provide increased coverage, e.g., death in a commercial airline accident adds an additional two times the staff member’s net annual salary, and death resulting from an act of war (but not in a commercial aircraft) provides an additional $250,000 in coverage. Staff may, at their own expense, purchase Optional Group Accident Insurance coverage, which doubles the basic Bank-paid coverage. The same exclusions above apply, and the additional $250,000 act of war provision does not apply. Optional Group Accident Insurance can be purchased at any time for the staff member only, or for the staff member and his/her family. Evidence of good health is not required, but an enrollment form must be completed. Bank-paid and Optional Group Accident Insurance may provide partial payments in the event of dismemberment, permanent and total paralysis, or loss of eye(s), speech or hearing. HR Operations - Revision 22-Jan-2015 G00203 -9- Financial Assistance The Bank Group offers several loan programs to staff, including settling-in, education, leave without pay (LWOP) and housing. Each has different eligibility requirements, loan lengths and interest rates. Repayment is made through payroll deduction and cannot exceed the duration of the appointment. An eligible staff member who was relocated at Bank Group expense to the duty station area on appointment, or who has lived there for less than 60 calendar days prior to appointment, may apply for the settling-in loan within six months of appointment, for an amount not exceeding four months’ net salary. Access to Information Staff Rule 2.01 stipulates that access to salary, pension, insurance and benefits information is automatically granted upon request to spouses or registered domestic partners. The staff member is typically not notified of such disclosure unless authorized by the spouse or registered domestic partner. Relocation Benefits on Appointment (applicable to internationally recruited staff not residing in the appointment duty station) Relocation benefits are only applicable to staff who are appointed to positions that are subject to international recruitment and who are not residents of the Greater Washington-Baltimore metropolitan area at the time of appointment. Relocation benefits must be exercised within 12 months of joining the Bank Group. Relocation Travel Transportation. The Bank Group will pay for relocation air tickets for the staff member and his/her eligible dependents to fly from the place of recruitment to the new duty station by the most direct and cost-effective route as follows: a. b. c. Less-than-first-class air, or First class rail or bus where no air travel facilities are available for all or a portion of the relocation travel, or Payment for mileage for travel by private or rental automobile in accordance with AMS 3.10. Any savings resulting from a traveler opting to fly in a lower class of travel will revert to the Bank Group and cannot be used to cover the cost of an indirect routing. Travel arrangements will be made through the Bank Group’s designated travel contractor (American Express in Washington, D.C.). Travelers should not purchase their own tickets unless specifically authorized by the Bank Group, in advance, as it might impact the amount that will be reimbursed. HR Operations - Revision 22-Jan-2015 G00203 - 10 Travel Accident Insurance. Staff members and their dependents will be covered while in travel status against accident by an insurance policy to which the Bank Group subscribes. The standard beneficiaries of this life insurance are indicated in the “Accident & Accompanying Baggage Insurance” summary. Staff members who wish to designate a beneficiary other than the standard beneficiaries should follow the steps below: 1. Type http://www.worldbank.org/humanresources, in the address bar of a web browser. The World Bank Group Human Resources page displays. 2. Click on “Forms". The HR Forms page displays. 3. Click on “Life Insurance”. The HR Forms for Life Insurance displays. 4. Click on "F01604 Designation of Insurance Beneficiary for HQ Staff”. 5. Complete, sign and submit form as per instructions listed. Relocation Shipment You may choose to have the Bank Group handle your shipping arrangements, or you may elect the Optional Removal Grant. The Bank Group’s Shipping Office cannot assist staff members who elect the Optional Removal Grant. Optional Removal Grant. At the option of the staff member, the Bank Group will pay an Optional Removal Grant as follows: For intercontinental moves, staff members with a family be eligible to receive $14,000, and staff with a family size of receive $10,000. For intracontinental moves, staff members with a family be eligible to receive $12,000, and staff with a family size of receive $8,000. size of two or more may one may be eligible to size of two or more may one may be eligible to This grant will be included in the first possible paycheck and is in lieu of all surface freight shipments, storage, and insurance. If you choose the Optional Removal Grant, you must make your own shipping arrangements and may not contact the Bank Group’s Shipping Office for assistance. Surface/Air Shipments (available only to staff who do not choose the Optional Removal Grant). The Bank Group will provide a surface shipment of personal and household effects up to one 40-foot container for a sea shipment or 15,000 lbs. weight limit for a land shipment, plus an Excess Baggage Grant of $1,800. Shipping arrangements are made through the Bank Group by a local shipping company. The Bank Group does not arrange or pay for transportation or insurance for the shipment of motor vehicles, watercraft, aircraft, heavy machinery, plants, pets, livestock or other animals, firearms or ammunition. The Bank Group provides limited insurance coverage against loss or damage to baggage and personal effects which will accompany staff and their immediate dependent family. Additional coverage, if desired, can be arranged at the staff member’s own expense as indicated in the HR Operations - Revision 22-Jan-2015 G00203 - 11 “Accident & Accompanying Baggage Insurance” summary. The Bank Group also assumes the cost of limited insurance on shipment of household and personal effects. Further information and application forms are provided to the staff member directly by the shipping office. Staff should carefully read the instructions and follow them completely. The application(s) must be completed and sent to the Bank Group’s Shipping Office prior to shipment. Relocation Grant. After joining the Bank Group, payment will be authorized for a relocation grant of $12,000 for a staff member without dependent children and $15,000 for a staff member with dependent children. This relocation grant will be included in the first paycheck and covers the incidental expenses associated with relocation for staff and immediate family, at origin, in transit, and at destination. These expenses include, but are not limited to, miscellaneous travel and visa expenses, subsistence, lease and utility deposits, finders' fees for real estate agents, and 30 days of hotel lodgings or rental expenses at destination, departure expenses, stopover allowances en route, arrival expenses, temporary housing expenses, and payment of travel time. There are no additional payments in connection with relocation. Mobility Premium Expatriate staff members7 holding G4 visas appointed to an open-ended or term position subject to international recruitment on or after July 1, 1999 and whose duty station is the United States are eligible to receive a mobility premium. Eligibility for mobility premium is based on status at appointment; staff members who are appointed to a position subject to local recruitment but are later promoted to a position subject to international recruitment do not receive mobility premium upon or after promotion. Mobility premium is suspended when a staff member is on an extended field assignment outside the United States, on leave without pay, on a telecommuting assignment, or on external service. (During extended field assignments, if the staff member is an expatriate in his/her new work location, staff members receive expatriate benefits in accordance with the home country travel and education benefits policies then in effect.) Mobility premium is reduced while a staff member is on reduced work schedule. Once an eligible staff member returns to full pay status, or from telecommuting/external service/extended field assignment mobility premium resumes. Special provisions apply to: Staff members who are appointed eligible for mobility premium, but are married to or partnered with staff members of the Bank Group or International Monetary Fund who also are eligible to receive expatriate benefits. Staff members who are reappointed to the Bank Group within three years of end of employment and who received expatriate benefits during the prior appointment. The mobility premium provides assistance to staff members and their families towards general costs associated with expatriation. Staff members are expected to use the money in a manner that supports their expatriate needs, e.g., job search for a spouse/domestic partner, assistance with the care or travel of elderly parents, maintaining a residence in the home country, language lessons, home country travel, child education, etc. The Bank Group does not prescribe the use of this payment, nor are staff members required to report on its usage. HR Operations - Revision 22-Jan-2015 G00203 - 12 - 7 An expatriate staff member at Headquarters is defined as a staff member recruited to a position subject to international recruitment who does not hold U.S. citizenship or U.S. Permanent Residency (“green card”) at the time of appointment (or at any time in the 12 months preceding appointment), or at any time after appointment. Pending permanent residents (whose immigration status in the U.S. has changed), U.S. refugees and asylees are also ineligible. The mobility premium is paid for a period of 10 years; prior service for the Bank Group in receipt of expatriate benefits may count towards the 10 year period if less than three years transpires between end of employment of a prior eligible appointment and reappointment. The mobility premium is calculated by multiplying the midpoint of grade GG ($151,000 as of July 1, 2014)8 by the sum of the applicable percentages for the staff member, spouse/domestic partner, and each dependent child based on the zone corresponding to the staff member’s home country: Zone9 Staff member Zone A Zone B 7% 11% Spouse Domestic Partner 5% 5% or Each Dependent Child 4% 4% The premium is paid quarterly in arrears based on family status on the first day of the quarter at the end of March, June, September and December. The full amount of the mobility premium is paid in years one through four. The amount of the mobility premium then declines 15 percentage points per year until year 10, when 10 percent of the full amount is paid. The mobility premium ends at the end of the 10th year. Adjustments are made each quarter in the 10-year period to reflect changes in family circumstances, relevant work-related events (such as leave without pay) and in the standard reference salary. See Annex of examples below. Mobility premium is suspended during extended field assignments. When staff members return to the U.S., mobility premium resumes, assuming the staff member remains eligible. Resettlement Upon Termination Eligibility for resettlement benefits is as follows: after two or more years’ continuous service for staff members recruited to open-ended positions subject to international recruitment at the time of recruitment; after completing the term of appointment for staff members recruited to term appointments subject to international recruitment; or Advisor to Executive Director (the former Executive Director’s Assistant) appointments. Staff members who are appointed to position subject to local recruitment but are later promoted to a position subject to international recruitment do not receive resettlement benefits upon termination of employment. 8 9 The midpoint is adjusted in July of each year to reflect general pay increases awarded to Bank Group staff. Zone A countries are those where flying time to the capital city is less than nine hours from Washington D.C. (generally Western Europe, parts of Eastern Europe, North and Central America, the Caribbean, and parts of South America). See example below for specific countries. HR Operations - Revision 22-Jan-2015 G00203 - 13 Resettlement cost limits are based on the nationality and visa status of the staff member at termination of employment, and not location of the staff member upon recruitment. Resettlement consists of travel at less than first class for the former staff member and each eligible dependent, a resettlement grant, and shipment and related grants (or an optional removal grant). Resettlement is available to any destination outside of the former staff member’s duty station city/country, provided that the cost borne by the Bank Group does not exceed that of resettlement from the duty station city/country to the staff member’s home country. For shipments to the home country, there is no cost limit. For U.S. citizens, U.S. Permanent Residents, U.S. refugees and U.S. asylees who are stationed in Washington, D.C. and who resettle outside the United States, the cost limit is Washington, D.C. to San Francisco, California. HR Operations - Revision 22-Jan-2015 G00203 - 14 - Annex: Mobility Premium Examples for FY15 Zone A Children Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Total Single 0 $ 10,570.00 $10,570.00 $10,570.00 $10,570.00 $ 8,985.00 $ 7,399.00 $ 5,814.00 $ 4,228.00 $2,643.00 $1,057.00 $ 72,406.00 Single 1 $ 16,610.00 $16,610.00 $16,610.00 $16,610.00 $ 14,119.00 $ 11,627.00 $ 9,136.00 $ 6,644.00 $4,153.00 $1,661.00 $113,780.00 Single 2 $ 22,650.00 $22,650.00 $22,650.00 $22,650.00 $ 19,253.00 $ 15,855.00 $12,458.00 $ 9,060.00 $5,663.00 $2,265.00 $155,154.00 Married 0 $ 18,120.00 $18,120.00 $18,120.00 $18,120.00 $ 15,402.00 $ 12,684.00 $ 9,966.00 $ 7,248.00 $4,530.00 $1,812.00 $124,122.00 Married 1 $ 24,160.00 $24,160.00 $24,160.00 $24,160.00 $ 20,536.00 $ 16,912.00 $13,288.00 $ 9,664.00 $6,040.00 $2,416.00 $165,496.00 Married 2 $ 30,200.00 $30,200.00 $30,200.00 $30,200.00 $ 25,670.00 $ 21,140.00 $16,610.00 $12,080.00 $7,550.00 $3,020.00 $206,870.00 Zone A countries are based on travel times from Washington, DC less than 9 hours and include Antiqua & Barbuda, Austria, Bahamas, Barbados, Belgium, Belize, Bermuda, Canada, Costa Rica, Cuba, Czech Republic, Denmark, Dominica, Dominican Republic, Ecuador, El Salvador, France, Germany, Grenada, Guadalupe, Guatemala, Guyana, Guyana (French), Haiti, Honduras, Iceland, Ireland, Italy, Jamaic Luxembourg, Martinique, Mexico, Netherlands, Nicaragua, Norway, Panama, Peru, Portugal, St. Kitts, St. Lucia, St. Vincent, Spain, Suriname, Sweden, Switzerland, Trinidad & Tobago, United Kingdom and Venezuela. Zone B Children Year 1 Year 2 Year 3 Year 4 Year 5 Year 6 Year 7 Year 8 Year 9 Year 10 Total Single 0 $ 16,610.00 $16,610.00 $16,610.00 $16,610.00 $ 14,119.00 $ 11,627.00 $ 9,136.00 $ 6,644.00 $4,153.00 $1,661.00 $113,780.00 Single 1 $ 22,650.00 $22,650.00 $22,650.00 $22,650.00 $ 19,253.00 $ 15,855.00 $12,458.00 $ 9,060.00 $5,663.00 $2,265.00 $155,154.00 Single 2 $ 28,690.00 $28,690.00 $28,690.00 $28,690.00 $ 24,387.00 $ 20,083.00 $15,780.00 $11,476.00 $7,173.00 $2,869.00 $196,528.00 Married 0 $ 24,160.00 $24,160.00 $24,160.00 $24,160.00 $ 20,536.00 $ 16,912.00 $13,288.00 $ 9,664.00 $6,040.00 $2,416.00 $165,496.00 Married 1 $ 30,200.00 $30,200.00 $30,200.00 $30,200.00 $ 25,670.00 $ 21,140.00 $16,610.00 $12,080.00 $7,550.00 $3,020.00 $206,870.00 Married 2 $ 36,240.00 $36,240.00 $36,240.00 $36,240.00 $ 30,804.00 $ 25,368.00 $19,932.00 $14,496.00 $9,060.00 $3,624.00 $248,244.00 HR Operations - Revision 22-Jan-2015 G00203

© Copyright 2025