March 2015 - Healthcare Financial Management Association

NEWSBRIEF NEWSLETTER OF THE SOUTHERN CALIFORNIA CHAPTER OF H.F.M.A. Southern California Chapter 2014 | 2015 VOLUME 24 / NUMBER 4 WWW.HFMA-SOCAL.ORG P R E S I D E N T ’ S M MARCH 2015 E S S A G E OFFICERS Kathy Hammack, FHFMA President Frank P. Matricardi, DrPH, MPH President Elect Lynn Otani Vice President Brian J. Mattson Treasurer Robert Heinemeier Secretary Please enjoy this March 2015 Newsbrief issue which includes information on chapter events that have occurred since our Holiday issue in December. I want to extend my appreciation to the chapter leaders, committee chairs, and the many volunteers who contributed their time to make the events successful. We saw many of you while attending the educational sessions and thank you for your support of the chapter! James Moynihan, FHFMA, MBA,CTP Immediate Past President Steven R. Blake, FHFMA, CPA Advisor DIRECTORS Kathi Athey Paul Bouganim Eric Delgado, FHFMA Kiet Lam Joe Perry Erin Quillen Lisa Wada Shery Weaver Gretchen Works INSIDE THIS ISSUE Wicked PAGE 3 A Sweet Ending On February 16th, we celebrated President’s Day and this issue includes an article about the February 5th event held at the Japanese American National Museum. There your Southern California HFMA chapter celebrated with a tribute to chapter past presidents. Please read more in the article included in this issue. I know that many of you attended the Region 11 Symposium in San Diego in January. There were over 530 members and sponsors in attendance from the 7 chapters who participate and make up Region 11. If you missed it, mark your calendars for January 24 -27, 2016 and meet us at the Manchester Grand Hyatt in San Diego. The chapter received the results of the member satisfaction survey in January and the Board is reviewing the results in detail. Your feedback gives us actionable ideas and opportunities for improving the chapter. The idea is to once again take those suggestions as input for next year’s strategic plan with programs, locations, et cetera, and to address those issues where possible. The good news is that the results improved over last year by 8%. Thank you to those who responded and don’t forget that you may also send us an email or call me any time that you have an idea or feedback. PAGE 6 Changes to Certification Program PAGE 7 “Immediate Jeopardy” PAGE 8 2015 Revised Payment Policies Please remember to review the upcoming events and webinars for the March 19th Spring Education Program that will be held in Monrovia. You also have 24/7 access with your membership to the many recorded and live webinars at HFMA.org. I hope you enjoyed Valentine’s Day with your loved ones, and now Spring is just around the corner! PAGE 11 Education Outreach Updates PAGE 14 Kathy Hammack, FHFMA President, HFMA Southern California Chapter NEWSBRIEF Southern California Chapter VOL.24/NO.4 • MARCH 2015 • PAGE 2 2014-2015 CORPO RATE SPONSORS _________________ 2O14 |2O15 _________________ GOLD LEVEL COMMITTEES Certification Robert Rivas, CHFP CFO Roundtable Eric Delgado, FHFMA DCMS Coordinator SILVER LEVEL Lisa H. Wada – CHAIR Educational Outreach/Webinars Joe Perry Fall Conference James Moynihan, FHFMA, MBA,CTP ProgressiveManagement Systems Employee Owned Founders Points Shery Weaver Government Programs Paul Bouganim Legislative Committee BRONZE LEVEL Christopher Hapak Link Committee Steven R. Blake, FHFMA, CPA Long Term Care Stephen David, CPA Member Contact Lori M. Kuwahara Membership Committee Gretchen Works Networking/Social Committee Erin Quillen Newsbrief Genevieve Nelwan Program Planning Lynn Otani Region 11 Symposium Steven R. Blake / Frank Matricardi Revenue Cycle Kiet Lam Sponsorship James M. Cummings Student Recruitment /Scholarship Brian Mattson Website Kathi Athey Yerger Coordinator Kathy Hammack NEWSBRIEF COMMITTEE & EDITORS Genevieve Nelwan – CHAIR Alice Dunlap – CO-CHAIR | NEWSBRIEF Tracy Donegan – CO-CHAIR | SOCIAL MEDIA Lisa Wada – SENIOR EDITOR Denise Cawley Joe Perry PHOTOGRAPHER Richard A. Anzalone HFMA SO-CAL ADMINISTRATIVE ASSISTANT Lori M. Kuwahara 714-279-8675 714-844-9354 FAX lori@hfma-socal.org Why Not Join HFMA SoCal on Facebook? Our HFMA SoCal Chapter is a part of that social connector that everyday grows in scope and members. Keep up to date on upcoming events and other important news, or just look at our fun posts and pictures too. Get connected now! You can request to become a member of the Facebook page at https://www.facebook.com/groups/hfmasocal/ NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 3 INkindRECOGNITION Recognition of Companies that provide non-cash support There are many companies that support the Southern California chapter of HFMA but are not participants in the corporate Sponsor Program. Additionally, there are companies that are participants in the corporate sponsor program and also support the chapter in other ways. In recognition of their support and belief in the chapter’s goals, the Southern California chapter of HFMA would like to recognize the following companies: US Bank Progressive Management Systems CMRE The following companies are our newest corporate sponsors: Medical Data Systems S U N D A Y , J A N U A R Y Turning Point 2 5 HFMA SO. CALENDAR 2015 EVENTS_______________________ _____________ _ March 19 | HFMA So Cal Spring Educational Program 7:30am - 4:00pm / Doubletree by Hilton, Monrovia, CA 91016 On Sunday, January 25th, 2015 the Southern California Chapter of HFMA met in the heart of Hollywood for a fun-filled evening complete with food, cocktails, and L.A.’s most popular musical, WICKED. First, guests trickled into Wood & Vine, a New American restaurant and cocktail bar that offers a menu of market-driven seasonal shared plates, craft cocktails, and local small batch wines and beers. Networking and social interactions were encouraged and accompanied by a fantastic selection of cheeses, charcuteries, and truffle chips. Guests enjoyed a self-serve wine bar, and as the night waned, dishes of diver scallops, lamb merguez, and chicken and waffles for the kiddos paraded around our private party space. Soon the wine bottles emptied and plates were cleared and we made our way across the street to the Pantages Theater. The highlight of our evening was fast approaching. Winner of over 100 international awards, including a Grammy and three Tony Awards, WICKED is acclaimed as “Broadway’s biggest blockbuster” (The New York Times) and HFMA had some of the best seats in the house, Orchestra Center. Quickly we were thrown into the story of The Land of Oz, The Emerald City and The Yellow Brick Road long before Dorothy and Toto. Chandralee Schwartz (as Glinda) and Emma Hunton (as Elphaba), better known as The Good Witch and The Wicked Witch of The West, led the pack in a groundbreaking performance, proving to create another successful “Night at the Pantages” with HFMA. May 14 | Annual Chapter Awards Banquet & Ceremony 6:30 -10:00pm / Aquarium of the Pacific,Long Beach, CA 90802 May 21 | Chapter Lunch & Learn Webinar Details TBA June 5 | Chapter Kick Off Meeting Embassy Suites Glendale, Glendale, CA 91203 September 13-15 | HFMA Southern California and San Diego/Imperial Chapter Fall Conferenc Hyatt Regency Long Beach, Long Beach, CA 90802 2016 EVENTS_______________________ _____________ _ January 24-26 | Region 11 Symposium Manchester Grand Hyatt, San Diego, CA 92101 Details on all events can be found on the chapter’s website: www.hfma-socal.org/, click on Events Listings. NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 4 Patient-Friendly Billing: Creating a Positive Feedback Loop that Benefits Patient and Provider __________________ Randy Blue, M.Ed, CRCR __________________ Patient billing traditionally hasn’t been a focal point for customer service efforts in healthcare. But that’s changing today as organizations pursue the benefits of a more patient-friendly billing experience. ___________________________________________________ Improving the patient side of revenue cycle management can strengthen customer satisfaction, contribute to performance bonuses, increase loyalty and generate new referrals. It can also reduce bad debt by improving the odds that self-pay balances will be collected in a timely fashion. Strategies for developing patient-focused billing involve improved communications, simplified statements and providing a single point of contact for billing issues. Even seemingly minor tweaks like reducing customer hold time can have a dramatic impact on customer perceptions, studies show. Customer Satisfaction Takes Center Stage Customer satisfaction has emerged as a key component in the Patient Protection and Affordable Care Act’s (ACA) overall push to improve healthcare quality. Today, customer satisfaction data collected through the Hospital Consumer Assessment of Healthcare Providers and Systems (HCAHPS) survey is used to help calculate performance bonuses and penalties developed under the Center for Medicare & Medicaid’s (CMS) Hospital Value-based Purchasing Program.1 Patient satisfaction scores figure prominently in CMS’Accountable Care Organization quality measurement efforts, as well as the physician performance bonuses and penalties implemented through the Physician Quality Reporting System (PQRS).2 Beyond supporting these reform-driven programs, positive customer experience scores generate dividends in their own right. The continued growth of high-deductible health plans means that consumers increasingly are shopping for care based on both cost and perceived value. As a result, the ability to promote customer satisfaction represents another way for providers to differentiate themselves in a competitive environment. A positive billing experience can generate word-of-mouth referrals and positive customer feedback on social media sites. Significantly, a 2013 survey conducted by Connace found that 88% of patients with highly positive billing experiences would recommend a hospital to friends.3 And as patient financial responsibilities increase due to highdeductible plans, strengthening effective patient communications also can translate into accelerated cash flow. That means reduced days in A/R, reduced collection expense and less bad debt. According to a 2014 survey by TransUnion, 75% of responding patients stated that pre-treatment estimates of out-of-pocket costs would improve their ability to pay for healthcare.4 Communication: Key to Patient-friendly Billing Effective communications about a patient’s financial obligations– provided both before and after the episode of care–are at the heart of a customer-friendly billing process. Organizations should make every effort to develop a system that can give patients an accurate estimate of their total out-ofpocket expense at the time of registration or procedure check-in. Patients who may have difficulty immediately paying their entire balance should be given the opportunity to make installment payments over time. Additionally, statements submitted after care should be clearly written and concise. Whenever possible, the balances due from all providers involved in a care event should be consolidated into a single, easily understood statement. While many organizations may not yet be sufficiently integrated to offer this service, they should nonetheless work with their care partners to determine how such a statement could be produced. A consolidated statement is critical, since multiple bills for what the patient rightly views as a single episode of care can confuse and frustrate customers and lead to slow or no pay. Patient-friendly billing can be further enhanced by providing a dedicated customer service contact for patient questions about billing issues. The ability for patients to connect with a specific individual conversant in all financial aspects of their care should help reduce consumer frustration and ill-will. This level of service can be taken a step further if the billing representative offers to facilities or government agencies on the patient’s behalf.5 Continued on page 5 NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 5 Patient-Friendly Billing that Benefits Patient and Provider __________________ Continued from page 4 __________________ Best Practices from Remote Call Centers Since telephone conversations are the primary method for communicating with patients about financial matters, setting the groundwork for a positive phone experience from the consumer’s perspective is critical. In fact, a study by Frost & Sullivan Research suggests that being on hold for an extended period of time is one of the primary causes of customer dissatisfaction. Moreover, it can take only two negative phone experiences for a consumer to develop a diminished opinion of the service provider.6 To meet the challenge of prompt, personable and knowledgeable communications, organizations may wish to contract with a dedicated outsourced call center. Call centers focused specifically on revenue cycle issues can provide detailed information regarding co-pays, dates of service and amounts due, and also work with patients to develop workable plans for paying down balances. Additionally, qualified centers offer a scalable solution that can be ramped up as patient volume increases. Finally, reasonable billing procedures and accessible, respectful billing personnel can help strengthen cash flow, reduce collection costs and cut bad debt. All told, patient-friendly billing is a positive feedback loop that–once in place–can continue to generate key benefits for both consumers and healthcare organizations for years to come. ––––––––––––––––––––––––––––––––––––––– 1 “HCAHPS: Patients’ Perspectives of Care Survey,” Centers for Medicare & Medicaid Services, Sept. 25, 2014, http://www.cms.gov/Medicare/Quality-Initiatives-Patient-AssessmentInstruments/HospitalQualityInits/HospitalHCAHPS.html 2 “Quality Measures and Performance Standards,” Centers for Medicare & Medicaid Services, Dec. 31, 2014, http://www.cms.gov/Medicare/Medicare-Fee-for-ServicePayment/sharedsavingsprogram/Quality_Measures_Standards.html 3 Dustin Whisenhut,“Making the Revenue Cycle an Ambassador for Your Organization,”hfma.org/rcs, November 2014, http://bit.ly/1yrWIYF 4 Fostering Loyalty and Goodwill to Boost Referrals As a patient’s healthcare financial obligations increase, their interactions with billing personnel carry an ever-greater weight. For many, perceptions formed during these encounters can have a major, if not decisive, impact on the way the overall organization is viewed. “TransUnion Survey Finds Patients Willing to Pay More of Their Bills With Improve Billing Information at the Time of Service,” TransUnion, April 7, 2014, http://transunion.mwnewsroom.com/press-releases/ transunion-survey-finds-patients-willing-to-pay-mo-1104086?feed= abde9b49-8716-4c7b-b7a3-bff44ca35beb#.VLkjrSvF_h4 5 Whisenhut,“Making the Revenue Cycle an Ambassador for Your Organization,” hfma.org/rcs, November 2014, http://bit.ly/1yrWIYF 6 For that reason, it is critical that providers work to develop truly customer-friendly billing services. By reducing wait times, empowering dedicated, knowledgeable personnel, offering payment flexibility and creating easy-to-understand statements, providers will foster loyalty and goodwill. These positive feelings not only improve the likelihood of return business, but also boost the prospect of referrals and beneficial social media reviews. Affirmative patient feedback, in turn, supports quality scores that can produce performance bonuses. The San Diego Symposium “This is Your Wake-Up Call: Ten Ways to Improve the Patient Experience,” McKesson Business Performance Services, January 2015, http://bit.ly/1wggkth ––––––––––––––––––––––––––––––––––––––– Randy Blue M.Ed, CRCR, is an Executive Director with McKesson’s Business Performance Services division. Randy is located in Seattle, WA and has over 25 years experience in sales and marketing, specifically in the healthcare space. Randy is committed to helping health systems and physician organizations manage the rapidly evolving healthcare landscape to improve business performance. www.mckesson.com/BPS J A N U A R Y 10-14 | 2 0 1 5 NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 6 3 A Sweet Ending to LONG CAREERS Scott Ujita _________________________________ On February 6, 2015 the Southern California Chapter celebrated the retirement of three outstanding members, James Stewart, Ira Alexander and George Colman at the Japanese American National Museum in downtown Los Angeles. Each of these members served at both the Chapter and National level of HFMA, and were instrumental in shaping and building our chapter to be the best HFMA chapter in the Nation. Over 100 people attended the event. The night started off with great music from Bart and Lori Andrews, who have played at many HFMA events in the past. A slideshow was presented which showed many pictures of Ira, George, and James going back to the early 1990’s. There was also wine and a delicious dessert buffet for everyone to indulge. Kathy Hammack, our current Chapter President, gave an introduction and acknowledged the fifteen past Chapter Presidents in attendance that evening. Susan Labow, Past President and one of the planners of this event, kicked off the introductions with a brief history of each retiree. Also, Past Presidents Greg Labow and Dave Canfield shared some great personal stories of Ira, George, and James. One of the surprises of the evening came when Kathy Hammack announced that three student scholarships will be named after Ira Alexander, George Colman, and James Stewart. These scholarships will help our chapter gain additional visibility in the local college campuses in Southern California in order to attract potential HFMA members. Special messages and sentiments were submitted to Denise Ransdell and Susan Labow, who put together beautiful memory books for each retiree. I was able to look through each of the books and read how special Ira, George, and James are, and how they had such a positive influence on so many of our chapter members. This was a great event to celebrate with three great leaders of our chapter. I am glad that I had the opportunity to say thank you to Ira, James, and George for all the time they gave and the hard work that they put into our chapter. NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 7 Changes Coming to National Certification Program __________________ Debby Chanen, MNBA, FHFMA __________________ Starting in June 2015, the healthcare industry's premier certification in healthcare finance will adopt an integrated approach that extends beyond its traditional focus on demonstrating competence in finance and accounting. The changes in Healthcare Financial Management Association’s (HFMA) signature certification program, the Certified Healthcare Finance Professional (CHFP), are designed to prepare leaders for a new era in health care. According to HFMA President and CEO Joseph J. Fifer, FHFMA, CPA, healthcare leaders in all sectors will require a deep understanding of the new financial realities of health care that reflect an integrated delivery system with the complexities of the provider, payor, and physician perspectives intertwined. The reconfigured CHFP consists of two online modules: • The Business of Healthcare: A big-picture overview of healthcare finance, risk and risk mitigation, new payment models, financial accounting and cost analysis, strategic financial issues, management of financial resources, and shifts in payment models. • Operational Excellence: The application of business acumen includes exercises that use a case study approach to understanding the business of health care. More information on the new Certification Program will be distributed by National in the next few months prior to the new start date of June 2015. In the meantime, the current program will continue and the Southern California Certification Committee suggests that you go forward with the National online study program or studying the materials from the Region 11 Practicum. Another option is to take the in person education which will next be offered at the Chapter’s Educational Program on March 19th at the Hilton Doubletree in Monrovia. Our instructor will be Christoph Stauder, CPA, FHFMA, who wrote the 450 page practicum participant guide, and teaches the practicum at our Fall Conference Sunday sessions. Katie Glynn, one of our Chapter members recently took and passed the exam. Katie, manager in the Advisory and Finance Risk Transformation practice at Deloitte and Touche LLP, credits her success in passing the exam to the HFMA Certification Candidate Practicum. After completing the online study course offered through the HFMA website, she still felt that there were some areas of weakness in her knowledge where she hadn’t had requisite experience. She also attended four certification practicums offered via webinars by the Region 11 Chapters. Katie noted that “After completing the four webinars presented by Christoph Stauder I felt much more confident and prepared for the exam. The Practicum not only provided me with an overview of all areas covered on the exam, but also helped highlight those areas of focus by providing specific case studies. I don’t think I would have been as prepared for the exam with the online study course alone and recommend to all those planning to sit for the exam to use both the online study course and Practicum to help them best prepare for the exam.” The Southern California chapter offers an incentive program to encourage our members to obtain certification. At this time, any Chapter member who obtains CHFP certification is eligible to get their examination fees ($395) refunded in full by the chapter! Members can also get access to the online training offered by HFMA National for free ($249 value), subject to a $95 deposit that is refunded after the exam is passed. The member can take the certification exam either from the comfort of your home/office or at Castle Worldwide testing centers. You can get full details from the chapter website (http://hfma-socal.org/certified.html). Also, if you have any questions regarding our incentives, your exam preparation or about taking the exam, you can always contact any of the Certification Committee members listed below: Robert Rivas, CHFP 213-553-1972 / rrivas@deloitte.com Debby Chanen, FHFMA 626-813-4927 / dchanen@mail.cvhp.org Ananta Mukerji, CHFP 714-583-6246 / ananta@avianaglobal.com After you pass the exam, don’t forget to contact the chapter Certification Committee to get reimbursement for your paid fees and your $95 deposit! NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 8 “Immediate Jeopardy” Penalties Soar in California __________________ J. Stuart Showalter, JD, MFS __________________ Regulations that became effective last April subject California hospitals to significant financial penalties for noncompliance with licensing requirements and other healthcare-related laws. Hospital executives should prepare to appeal these staggering penalties rather than pay them routinely. Background Between October of 2007 and July of last year, the California Department of Public Health (CDPH) issued 297 administrative penalties against California hospitals based on allegations that noncompliance with licensure requirements “has caused, or is likely to cause, serious injury or death.”The penalties have ranged from $25,000 to $100,000, and they total nearly $14 million. “The CDPH is on a mission,”says Mark Kadzielski, partner and national chair of the health law practice of Pepper Hamilton, LLP in Los Angeles,“and it is pursuing this mission vigorously. It has become a significant aspect of the Department’s regulatory activity and is, in effect, a new tax on California hospitals.” CDPH’s authority to issue these so-called“immediate jeopardy”(IJ) penalties began on January l, 2007, and the fines were first levied at $25,000 for each violation. Over time, however, the maximum penalty has increased five-fold to $125,000 for a single IJ violation and up to $25,000 for each“non-IJ” violation. Although each penalty alone might seem immaterial, Kadzielski says they can quickly become a huge financial burden on a hospital’s bottom line. The Process An IJ investigation begins when the department receives a self-report or complaint of an adverse event. The investigation can take a single day or many months, and at some point long after the investigation has been concluded CDPH makes a determination that an IJ violation has occurred. The facility is then issued a “statement of deficiencies” and is given 10 days to submit a corrective action plan. But Kadzielski says the hospital cannot appeal the department’s decision until an administrative penalty has been assessed,“and this often does not occur for many months.” Not all deficiencies investigated by CDPH are found to be IJ’s, and not all IJ’s result in penalties. The CDPH has provided “absolutely no guidance as to how it determines that an IJ has occurred or which deficiencies warrant administrative penalties,” Kadzielski says, and “there is no discernible pattern to the department’s fining practices.” For example, from FY 2007-08 to FY 2011-12, CDPH received 1,061 reports of post-surgical retention of a foreign object. Of those incidents, only 57 resulted in an administrative penalty, and a review of those cases reveals that no uniform criteria were applied and no consistent decisions were made. The department’s practice has been to wait many months to tell a hospital that an IJ finding will be issued and to assess penalties years after the incident.“So hospitals languish in constant limbo, waiting to find out whether a penalty will be assessed for long-past alleged deficiencies,” he says. Regulatory Criteria are Vague and Confusing In theory, some new regulations covering IJ penalties should have provided much-needed clarification. But the regulations — which dramatically expand the circumstances in which a penalty may be issued and significantly increase the maximum penalties that may be assessed — are complex and confusing and provide no additional transparency regarding whether and when a fine will be imposed. “Hospitals might have expected a clear explanation of the circumstances in which they will be fined and the size of the penalties, but that has not occurred.” Instead, Kadzielski says, figuring out the possible penalty involves a calculation worthy of the Internal Revenue Code: 1. Determine there is a“deficiency,”that rises beyond a “non-minor” violation. 2. Calculate the “Initial Penalty,” as follows: a. Select one of six“Levels of Severity”; b. Select one of three“Scopes of Noncompliance”; c. Identify a percentage from the“Scope and Severity Matrix”; d. Identify the maximum statutory penalty amount; and e. Multiply the values from c. and d. Continued on page 9 NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 9 New SoCal Chapter Members JOINED FEBRUARY 2015 Murtaza Mogri Raymond Chang Mary Nguyen Alon Asefovitz Stanson Health COPE Health Solutions Moss Adams LLP Cedar Financial Raj Kadam Cindy Malouin Virginia L. Ripslinger Medvantics Malouin Marketing St. Joseph Health Join HFMA SoCal Chapter www.hfma-socal.org YOUR INDUSTRY YOUR FUTURE YOUR VOICE “Immediate Jeopardy” Penalties Soar in California Continued from page 8 __________________ 3. Derive the “Base Penalty,” which may be higher than the statutory maximum, by applying “adjustment factors” to the Initial Penalty. Those factors are: a. The patient’s physical and mental condition; b. Any actual financial harm to the patient; c. Factors beyond the hospital’s control; and d. Whether the violation was “willful.” 4.“Final Penalty,” by applying additional“adjustment factors” to the Base Penalty. Those factors are: a. Whether there was an immediate correction; and b. The facility’s history of compliance with related state federal laws. 5. Assess the lesser of the Final Penalty or the statutory maximum. It is beyond the scope of this article to explain these calculations, but Kadzielski says each of these decision-points is vague, ambiguous, and open to interpretation and dispute.“For example, the legislature included as a required adjustment factor ‘the demonstrated willfulness of the violation.’ But, the definitions of willfully and willful violation are written so broadly that this adjustment factor will probably be applied against a hospital every time an employee or medical staff physician does anything that results in an adverse outcome.” What Hospitals Should Do Kadzielski and his team of health lawyers have helped numerous clients prepare for and successfully appeal these CDPH penalties. Given that the fines are often assessed months or years after the underlying incidents, he says some hospitals have chosen simply to pay the fines.“This is because the event usually happened long before, memories have faded and witnesses are impossible to find. Hospitals sometimes think it would be easier to pay the penalty than go to all that trouble.” But he usually advises against this approach.“Paying now is often a short-sighted decision, and it can be more expensive than possibly paying something a few years down the road, given the time value of money.” He recommends that whenever an adverse event occurs an internal investigation be conducted immediately to document the facts, take witness statements, make copies of the medical records, and otherwise prepare to defend against a fine. He and his team work closely with hospitals to perform these tasks. Then hospitals are ready to appeal any fines. “And above all,” he adds,“alert the CFO, finance department, risk management team, and any other appropriate departments of the hospital not to pay any CDPH fines merely for the sake of convenience without a thorough consideration of the situation.” –––––––––––––––––––––––––––––––––––––––––––––––– Author: J. Stuart Showalter, JD, MFS, is a contributing editor to HFMA’s Legal & Regulatory Forum. Interviewer for this article: Mark A. Kadzielski is a partner in the Los Angeles law firm of Pepper Hamilton, LLP and chair of the firm’s national health law practice. He can be reached at 213.928.9820 or kadzielm@pepperlaw.com. NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 10 Win a trip to Paradise! 2014-2015 Member-Get-A-Member Contest Vacation Destination Giveaway to Puerto Vallarta, Mexico The Southern California Chapter of HFMA, in association with Sponsors Progressive Management Systems and CMRE, Inc. Have given its members a chance at winning the following prizes: 1st Place: Trip to Puerto Vallarta, Mexico. Included in this trip give-away is 7 days, 6 nights beach-front condo in Puerto Vallarta & $1,000.00 towards travel expenses 2nd Place: Apple iPad 3rd Place: One free admission, for the winner, to all three 2015-2016 So Cal Chapter Educational Programs *HOW TO WIN* Refer a new member to our Chapter ² Each new member who lists you as their sponsor gives you an additional chance for the drawing at the end of the year. The more sponsored new members you have, the better the chance to win the grand prize drawing. Each new member will be required to provide your name and your HFMA member number at the time of registration. ,I\RXGRQ·WNQRZ\RXUPHPEHU, number, contact Lori Kuwahara at (714) 279-8675 or lori@hfma-socal.org. We encourage you to have them join via the National HFMA website at: www.hfma.org/membership The contest begins on June 1, 2014 and ends on April 19, 2015. We will announce the winners at WKHFKDSWHU·V$QQXDO$ZDUds Dinner in May of 2015. If the member with the most sponsored new members does not win the grand prize, he/she will receive the second place prize. Kathy Hammack, President HFMA Southern California Chapter NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 11 S B 1 2 7 6 HOSPITALS AND EMERGENCY PHYSICIANS IN California Will Ring in the New Year with Revised Charity Care and Discount Payment Policies __________________ Julie A.Simer, Esq. / Shareholder, Buchalter Nemer __________________ You changed the batteries in your flashlights and smoke detectors, but did you revise your charity care and discount payment policies prior to the stroke of midnight on December 31, 2014? A new law, SB 1276, took effect in California on January 1,2015, and it means that many California hospitals 1 and emergency physicians 2 will need to revise their charity care and discount payment policies (collectively “financial assistance policies”) 3 to comply. The law imposes duties4 upon hospitals, physicians, and collection agencies that bill or collect payment for medical services provided to a“financially qualified patient.”A“financially qualified patient”5 is a patient who satisfies both of the following criteria: 1. a self pay patient or a patient with high medical costs; and 2. family income that does not exceed 350 percent of the federal poverty level (“FPL”).6 The term“high medical costs”is defined in the statute as annual out of pocket medical expenses that exceed 10 percent of the patient’s family income (or a lower threshold amount pursuant to the hospital or emergency physician’s financial assistance policies).7 The law also requires that any affiliate, subsidiary, or external collection agency that collects receivables on behalf of a hospital or emergency physician must agree to adhere to the standards and scope of practices and comply with the definition and application of a reasonable payment plan established by the hospital or emergency physician.8 The original“Hospital Fair Pricing Policies”legislation, AB 774, was enacted in 2006 after several years of debate between consumer advocates and hospitals. It requires hospitals to establish financial assistance policies and provide patients with notice of those policies. It also limits hospital charges to uninsured patients with family incomes below 350 percent of the FPL to no more than the hospital could expect to receive for the same services from Medicare, Medi-Cal (California’s Medicaid program) or other government-sponsored benefits. It requires hospitals to screen patients for government subsidized programs for which they may qualify and establish practices for medical bill collection, including that a hospital or collection agent may not take adverse action against a consumer for at least 150 days after the initial bill. In 2010, AB 1503 imposed similar, but not identical, fair pricing obligations upon emergency physicians. It requires hospitals to include a statement in its notice to patients that the emergency physician is required by law to provide discounts to uninsured patients or patients with high medical costs who are at or below 350 percent of the FPL. It also specifies billing and collection procedures to be followed by the emergency physician and his or her assignee, collection agency, or billing service. With the enactment of the Patient Protection and Affordable Care Act (“ACA”), many previously uninsured Californians became eligible for Medi Cal or subsidized insurance purchased through Covered California, California’s health benefit exchange. Under the ACA, however, insurance plans with the lowest premiums also have the highest out of pocket costs. Thus, the Western Center on Law and Poverty (“WCLP”), the sponsor of SB 1276, observed that even with third party coverage, a patient may be unable to pay or negotiate a payment plan on the balance due and still have enough money left over to survive. The WCLP noted that the law existing at the time provided no guidance on how to determine a reasonable payment plan for a financially qualified patient. Apparently, the WCLP had received reports of collection agencies demanding unaffordable monthly payments. Continued on page 12 NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 12 Ringing in 2015 : Revised Charity Care and Discount Payment Policies __________________ Continued from page 11 __________________ SB 1276 made the following changes: 1. Revised the definition of “high medical costs,” thereby allowing a financially qualified patient to become eligible for a hospital’s financial assistance program, regardless of whether the patient previously received a discount from the hospital as a result of third party coverage. 2. Defined a “reasonable payment formula” for purposes of determining the monthly payment obligation of a financially qualified patient under the hospital’s or emergency physician’s financial assistance program, as not more than 10 percent of a financially qualified patient’s family income for a month, excluding deductions for essential living expenses. 3. Defined “essential living expenses” as expenses for any of the following: rent or house payment and maintenance, food and household supplies, utilities and telephone, clothing, medical and dental payments, insurance, school or child care, child or spousal support, transportation and auto expenses, including insurance, gas, and repairs, installment payments, laundry and cleaning, and other extraordinary expenses. 4. Revised the notice that hospitals and emergency physicians are required to provide patients to inform them that they may be eligible for various public insurance programs and required that the notice include references to the California Health Benefit Exchange (Covered California), and other state or county funded health coverage programs. 5. Required hospitals and emergency physicians, in addition to the existing notice requirements, to also provide patients with a referral to a local consumer assistance center housed at legal services offices. 6. Specified that if a patient applies, or has a pending application, for another health coverage program at the same time that he or she applies for a hospital’s financial assistance program, neither application precludes eligibility for the other program. 7. Required a hospital or emergency physician to negotiate the terms of a payment plan with a financially qualified patient, taking into consideration the patient’s family income and essential living expenses and specified that this also applies when a patient wishes to renegotiate the terms of a defaulted payment plan. 8. Permits, for purposes of determining the reasonable payment formula, the emergency physician or his or her assignee to rely on the determination of family income and essential living expenses made by the hospital at which emergency care was provided, and permitted the emergency physician at his or her discretion, to accept self-attestation of family income and essential living expenses by a patient or a patient’s legal representative. The law requires California hospitals to file updated charity care program policies with the Office of Statewide Health Planning and Development (“OSHPD”) biennially on January 1, or when a significant change is made to the policies.9 OSHPD is required to collect from each hospital a copy of its charity care policy, discount payment policy, eligibility procedures for those policies, review process, and application form.10 Copies of all filed hospital policies are available on the OSHPD website.11 Submitted information is reviewed by OSHPD to ensure compliance with reporting requirements. Beginning January 1, 2015, the OSHPD audit staff will contact hospitals on issues of possible noncompliance to obtain clarification and/or revised information. Compliance with the law is a condition of licensure for general acute care hospitals in California, and noncompliance may be the basis for the imposition of penalties by the California Department of Public Health (“CDPH”).12 When deciding whether to impose a penalty, the CDPH will consider the extent of noncompliance, the amount of financial harm to the patient, whether the violation was willful, and the willingness of the hospital to take corrective action.13 Compliance with the law is not a condition of licensure for physicians and surgeons, however.14 Nonetheless, if a hospital or emergency physician collects payments in excess of the amount due under the law, the hospital or emergency physician must repay the excess plus interest.15 Many open questions remain with respect to SB 1276. For example, the law does not clearly specify whether hospitals must provide financial assistance for nonemergency services, such as elective surgeries or long term care. OSHPD directs each hospital to make its own determination as to the scope of covered services under its financial assistance policies. Therefore, it is important for hospitals and emergency physicians to consult with their legal counsel before revising financial assistance policies, which will eventually be available to the public on the OSHPD website. SB 1276 is just one of the many new laws and regulations affecting health care providers that became effective on January 1. A New Year’s resolution that every health care provider should make is a renewed focus on regulatory compliance. ––––––––––––––––––––––––––––––––––––––– 1 The term“hospital” means a facility that is required to be licensed under Health & Safety Code § 1250 (a) [general acute care hospitals], (b) [acute psychiatric hospitals], or (f) [special hospitals that provide inpatient or outpatient care in dentistry or maternity] of Section 1250, except a facility operated by the State Department of State Hospitals or the Department of Corrections and Rehabilitation. Health & Safety Code §§ 127400(d) and 127450(f). 2 ”Emergency physician” means a physician and surgeon licensed pursuant to Chapter 5 (commencing with Section 2000) of Division 2 of the Business and Professions Code who is credentialed by a hospital and either employed or contracted by the hospital to provide emergency medical services in the emergency department of the hospital, except that an“emergency physician”shall not include a physician specialist who is called into the emergency department of a hospital or who is on staff or has privileges at the hospital outside of the emergency department. Health & Safety Code § 127450(c). Continued on page 13 NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 13 The San Diego Symposium Ringing in 2015 Continued from page 12 ___________ 3 The term “charity care” is used to describe the situation where the patient is not expected to pay any amount for provided services, based on the hospital’s determination that the patient is unable to pay for that care. This may also be referred to as“full charity care” or “free hospital care.” The term“discount payment plan” describes the situation where the hospital has determined that the patient does not qualify for completely free care but is eligible for a discount and is expected to pay only a part of the bill. See, OSHPD Frequently Asked Question PQ3 available at: http://www.oshpd.ca.gov/HID/Products/Hospitals/ FairPricing/FAQPublic.html#PQ3 4 Health & Safety Code §§ 127405(a)(1) and 127454(b)(4). 5 Health & Safety Code §§127400 (c) and 127450(e). 6 Health & Safety Code §§ 127400(g) and 127450(i). 7 Health & Safety Code §§ 127400(g) and 127450(i). 8 Health & Safety Code §§ 127425(b) and 127455(b). 9 Health & Safety Code § 127435. 10 Id. 11 The SyFPHR website: https://syfphr.oshpd.ca.gov/Logon.aspx 12 Health & Safety Code § 127401, 22 C.C.R. § 70959. 13 22 C.C.R. § 70959. 14 Health & Safety Code § 127451. 15 Health & Safety Code § 127440 and 127458. J A N U A R Y 10-14 | 2 0 1 5 NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 14 E D U C A T I O N A L O U T R E A C H FEBRUARY CHAPTER HIGHLIGHTS Customer Service and Revenue Cycle101 __________________ Joe Perry __________________ The chapter recently held two revenue cycle training opportunities for members in the San Fernando Valley and Inland Empire areas on February 4th and 5th. Chapter past President, Vickie Morgan, served as presenter for both days of education that focused on a review of the revenue cycle process and how to apply customer service best practices throughout the revenue cycle process. Both classes were interactive courses, with Vickie and others attending the class sharing best practices from their experiences. At the February 4th event, held at Valley Presbyterian Hospital, Vickie stressed the impact that the little things can make a difference when striving to deliver excellent customer care. Simple things like maintaining good eye contact, describing what and how you are going to help the customer, and being sensitive to cultural differences were all part of the training in best practices. At the February 5th event, held at the Kaiser Fontana Hospital, Vickie gave an overview of the revenue cycle process by reviewing the lifecycle of a claim from physician order, scheduling, and authorization, to the management of payments and denials. During the presentation, Vickie repeatedly pointed to the importance of communication between the multiple groups that make up the revenue cycle process. Included in the main case study, Vickie also pointed out the continually evolving role of case management in assisting with the process of getting the appropriate authorizations throughout the continuation of a patient’s care. Both sessions would not have been possible without the support of our hosting facilities and our presenter. Thank you to both Valley Presbyterian Hospital and the Kaiser Fontana Hospital for graciously hosting the education events, and a tremendous thank you to Vickie Morgan for presenting both days. We hope that you will be able to join us for another education event in the very near future. Be sure to check the chapter events page on the website for details about all of our upcoming events. Educational Outreach Upcoming Events Calendar April 29-30, 2015 | Education Outreach (TBD) May 21, 2015 | Chapter Webinar – “Lunch and Learn” Be sure to check the“Events”page on the chapter website for more details on the full upcoming calendar. NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 15 2 0 14 -2 0 1 5 C O R P O R A T E S P O N S O R P R O G R A M WHY BECOME A CORPORATE SPONSOR? southern california chapter Visibility is a powerful advantage. As a sponsor of the Southern California Chapter of the Healthcare Financial Management Association (HFMA SoCal), you gain exposure to a select audience that is over 1,000 members strong. Our membership consists of CEOs, CFOs, Revenue Cycle leaders, Patient Financial Services directors, and other healthcare finance professionals.You emerge as a leader by demonstrating your support of professional education and quality programs. 2014-2015 Southern California Corporate Sponsorship Program As an HFMA SoCal sponsor, a wealth of recognition opportunities is yours. At a minimum, you will see your organization’s name and logo on pertinent marketing materials and gain on-site acknowledgement and signage at educational conferences. Additional promotional opportunities are available, depending on the category of sponsorship you select. The Corporate sponsorship program is now in its fifth year. We currently have thirteen corporate sponsors at a variety of sponsorship levels. It is my belief that corporate sponsors truly value the unique position of being a corporate sponsor. As a corporate sponsor they are recognized at each of our three chapter education sessions. That recognition takes three forms: 1)All employees of the sponsoring firm wear name tags that identify them as a sponsor, 2)The names of all corporate sponsors are posted prevalently in the registration lobby, 3) All sponsors are featured in a PowerPoint presentation that highlights them and upcoming chapter events. With your support and technical expertise, HFMA SoCal will continue to thrive and provide more valuable services to our members and potential members. The Southern California Chapter is proud of its current affiliations with sponsors and looks forward to hearing from you. In addition to the increased visibility at chapter events, Corporate Sponsors have links to their corporate website posted on the SoCal chapter website. Our chapter has approximately one thousand members who routinely visit the website, in addition to members of other HFMA chapters who also visit our website. And finally, in every edition of Newsbrief, there is a list of corporate sponsors along with their corporate logo. Sponsorship registration forms are available on the chapter website www.hfma-socal.org. The contributions for corporate sponsorship are prorated so it is always a good time to sign up as a corporate sponsor. Should you have any questions about becoming a corporate sponsor, contact James Cummings, Sponsorship Chairperson, at: cummingsllc@aol.com. All sponsorships are received with great appreciation and in good faith; we are the stewards of your investment. CATEGORIES AND BENEFITS OF CORPORATE SPONSORSHIP BENEFITS BRONZE $1,000 SILVER $2,500 GOLD $3,500 PRESIDENT’S CLUB $5,000 Posting at all chapter meetings X X X X according to sponsorship category. –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Listing of sponsor according to X X X X level in all Chapter program brochures. –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Listing of sponsor according to X X X X category in each issue of the Chapter newsletter and on Chapter website with link to sponsor website or email addess. –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Option to sponsor an Information table X at all chapter education events. –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Free registration certificates at Chapter 1 2 3 5 educational program* (as indicated). –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Quarter (1/4) page ad in every newsletter. X –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Option to host a hospitality suite at any X Chapter educational program,* with President’s approval (i.e. sponsoring company will pay fees of hospitality suite). –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Special ribbon and/or name tag X X X X designating Chapter Sponsor. –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Opportunity to introduce speakers X at an educational program.* –––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––– Opportunity to speak for one minute X at a general session on their company. * Educational programs for the upcoming year are scheduled for Aug.14, 2014, Nov. 20, 2014 and Mar. 19, 2015. NEWSBRIEF VOL.24/NO.4 • MARCH 2015 • PAGE 16 2 0 14 - 2 0 1 5 C O R P O R A T E S P O N S O R P R O G R A M CORPORATE SPONSOR INFORMATION SHEET START DATE This Corporate Sponsorship Program began on June 1, 2014, and runs through May 31, 2015. DETAILS OF THE PROGRAM Enrollment period will be throughout the chapter year. An email announcement will be sent to all chapter members and vendors listed in the current membership directory. Selected vendors who have expressed an interest in sponsoring past HFMA events will also be contacted. PAYMENTS Payments are due with the application/agreement and can be submitted at any time during the chapter year. Quoted rates assume a full year’s sponsorship at the various levels. Payments received between June and August will pay 100% of stated donation; Payments received between September and November will pay 75% of stated donation; and those paying between December and February will pay 50% of the stated donation. A confirmation letter will be mailed after the potential sponsor commits to the agreement. The sponsor will be sent a “Thank You” note once the payment is received. The website will be updated to reflect sponsorship agreement within two weeks of receiving payment. Corporate Sponsor Registration southern california chapter PLEASE COMPLETE AND RETURN THIS FORM TO: James M. Cummings, HFMA-SoCal Chapter Sponsorship Chair 20638 Merridy Street, Chatsworth, CA 91311 NOTE: Please make checks payable to“Southern California Chapter-HFMA” To pay by credit card, please go to: http://www.cvent.com/d/scqpcj/1Q SPONSOR’S COMPANY NAME _______________________________________________________________________ ___ CONTACT NAME _________________________________________________________________________________ CONTACT PHONE NUMBER __________________________________________________________________________ BILLING ADDRESS ________________________________________________________________________________ CITY | STATE | ZIP ________________________________________________________________________________ E-MAIL _______________________________________________________________________________________ WEB SITE ADDRESS _______________________________________________________________________________ We would like to participate at the following sponsorship level: PRESIDENT’S CLUB ($5,000) GOLD ($3,500) SILVER ($2,500) BRONZE ($1,000) We would like to make two installment payments. For More Information, Contact: James M. Cummings, Sponsorship Chair, HFMA-SoCal Chapter. E-mail: cummingsllc@aol.com / Phone: 818-642-2990 Contributions to 501(c)(6) organizations are not deductible as charitable donations for federal income tax purposes. Donations may be deducted as a business expense if they are “ordinary and necessary” in the conduct of the taxpayer’s business. Always consult your tax advisor for assistance.

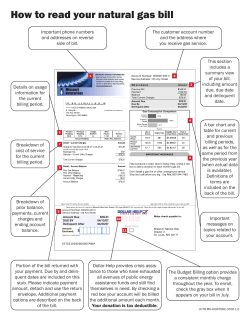

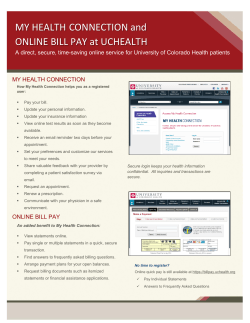

© Copyright 2025