Packed with interactive, strategic insights and ideas!

forum2015.com

April 29 – May 1, 2015 // Caesars Palace Resort // Las Vegas

{

The Financial Brand Forum 2015 is built specifically for

retail and marketing executives at both banks and credit unions.

}

WHO

SHOULD

ATTEND?

CMO

VP of Marketing

CEO

COO

VP Retail Experience

VP Brand ExperienceEVP/Chief Strategy Officer VP

Director of Marketing

VP Digital Channels

Branches

VP Retail Products

Digital Marketing Manager

VP Business Development

SVP Retail Banking

Social Media Director

Ideas, Insights & Innovations

in Retail Banking and Financial Marketing

The Forum 2015 will be unlike any other conference

you've ever been to. For starters, the Forum wasn’t just

built for banks and credit unions. The Forum was

actually built by financial institutions — people (like

you) who read The Financial Brand. For the last seven

years, bank and credit union executives have been

telling us what's most important to them. That's what

makes the Forum such a unique experience.

attendee receives a copy of the 140-page Financial

Brand Bible ($495 value), a copy of The Financial

Brand Branch Design Annual ($795 value), the 2015

Bank & Credit Union Marketing Trends Report ($595

value), three copies of the Digital Banking Report

($1,185 value), and a Forum 2015 USB Digital

Toolbox ($395 value) including electronic copies of all

session presentations.

The Forum delivers strategic insights on a range of

critical issues in retail banking, along with real-world

examples, ideas and practical advice focused on

generating results. The Forum 2015 is specifically

engineered to help you tackle your biggest branding,

marketing and retail challenges, with over 20 separate

strategy sessions and interactive workshops. You get

three full with the latest ideas and innovations that will

build your brand and your bottom line.

This is your invitation to participate in what has quickly

become the banking industry's must-attend event. Join

hundreds of leaders from financial institutions — of all

sizes, from around the world — for three jam-packed

days of networking and strategic insights.

We are so confident in the value the Forum provides

that we guarantee your ROI. If you don’t come away

from The Financial Brand Forum 2015 with at least a

dozen new money-making ideas, we will give you your

money back — no questions asked.

You'll also get the Forum 2015 Resource Pack, a

collection of exclusive tools worth $3,465. Every

We look forward to meeting you personally at Caesars

Palace Resort in April. It would be our honor to

welcome you to the Forum 2015 — we'd love to see

you there!

Most Sincerely,

Jeffry Pilcher

Founder, CEO & President

MONEY BACK GUARANTEE. If you don’t come away with at least a

dozen new ideas that will help you build your brand and your bottom

line, we will give you your money back — no questions asked.

CONFERENCE

HIGHLIGHTS

Keynote Address

Innovation & Simplicity in Banking

Josh Reich, Founder of Simple

Insider Secrets for Selling to Millennials

Jason Dorsey, The Gen Y Guy

“Banking on Facebook in a Mobile-First World”

Neil Hiltz, Head of Financial Services at Facebook

Forum 2015

Attendee Party

World’s Biggest

Credit Union

on Social Media

FEATURED SPEAKERS

Brett King, CEO/Founder of Moven

Tim Russell, Culture Guru at Nintendo

Pam Thomas, CMO at Frost Bank

Share ideas, insights

and strategies with

over 800+ of your peers

“Maximizing & Monetizing the Mobile Channel”

Niti Badarinath

SVP/Head of Mobile Banking at US Bank

3 MAKEOVERS

Brand • Website • Branch

Live on Stage!

Branch Design

Showcase

(100+ pages)

The Financial

Brand Bible

(140 pages)

AGENDA AT-A-GLANCE

WEDNESDAY, APRIL 29

9:00

1:30

5:00

Zappos Culture Tours Begin – Sponsored by

Interactive Workshop:

Culture Building: Turning Staff Into Brand Champions

Interactive Workshop:

Building a Best-in-Class Multi-Channel Onboarding Process

Exhibit Hall Grand Opening Reception – Sponsored by

THURSDAY, APRIL 30

9:00

11:00

Keynote: Innovation & Simplicity in Banking — Josh Reich, Simple/BBVA

BRANDING & MARKETING TRACK

ONLINE & DIGITAL TRACK

RETAIL EXPERIENCE TRACK

Branding Spotlight:

Frost Bank

The 7 Most Effective Digital

Marketing Strategies in Banking

Designing the

Micro-Branch of Tomorrow

12:00

Plated Lunch (sponsored by Deluxe)

1:30

FORUMx

2:45

Maximizing Results With Data

Driven Financial Marketing Strategies

4:00

Transforming Banking Websites

Into High-Performance Sales Channels

Leveraging Technology to

Engineer a Better Branch Experience

Website Channel Makeover

5:00

Welcome Reception – Sponsored by

FRIDAY, MAY 1

8:30

Insider Secrets for Selling to Millennials — Jason Dorsey, The Gen Y Guy

9:30

Branch Experience Makeover

11:00

Checking Account Acquisition

Strategies That Drive Growth

12:00

Successful Social Media

Strategies in Banking

Innovating Your

Digital Banking Nirvana

Plated Lunch – Sponsored by

1:30

Omni-Channel Brand

Identity Design in Banking

Innovations and Best Practices

in Email Marketing

Maximizing & Monetizing the

Mobile Channel in Banking

2:45

Growing Profitable Relationships

With Gen Y Financial Consumers

Banking on Facebook

in a Mobile-First World

Perfecting the Customer

Experience in Digital Channels

4:00

9:00

Brand Identity Makeover

Forum 2015 MX Attendee Party at Fizz Champagne Bar – Sponsored by

MARQUEE SESSIONS

& SPEAKERS

MOBILE FACEBOOK STRATEGIES

Neil Hiltz

Head of Financial

Facebook

DESIGNING MICRO-BRANCHES

Lisa Magana

VP/Branch Projects

Wells Fargo

MOBILE CHANNEL INNOVATIONS

Niti Badarinath

SVP/Head of Mobile

US Bank

Innovation & Simplicity in Banking

When Josh Reich launched Simple, his mission was

both bold and unapologetic: “To make banking suck

less.” This keynote address is a rare opportunity to

hear from one of the financial industry’s most

visionary thought leaders, as he shares the Simple

strategy: If you aren’t making banking easier, then

you aren’t innovating. This presentation is

guaranteed to be an edgy, brutally honest session

that will challenge your most basic assumptions

about banking and the role institutions play in

consumers’ financial lives.

DESIGNING MICRO-BRANCHES

Kelly Price

VP/Branch Environments

PNC

BREAKTHROUGH BRANDING

In 2014, international banking giant BBVA paid

Reich and company $117 million to acquire Simple.

Pam Thomas

EVP/Marketing

Frost Bank

Insider Secrets

for Selling to Millennials

DIGITAL BANKING

In this solution-packed session, best-selling

author Jason Dorsey reveals exactly how

to sell to Gen Y from the perspective

of an insider. He shares the latest

data, proven strategies and debunks

costly myths about Gen Y consumers,

including step- by-step actions

proven to drive Millennial sales now.

Jim Marous

Co-Publisher

The Financial Brand

SOCIAL MEDIA

Michael Toner

Social Media Manager

Navy FCU

Featured in major mainstream media outlets,

Dorsey is widely regarded as the voice of Gen Y.

The event to attend for big picture takeaways.

— Fran Cooper, Marketing Director

Kennett National Bank

(Forum 2014 Attendee)

INTERACTIVE

WORKSHOPS

WEDNESDAY, APRIL 29

ADD

$249

Culture Workshop: Turning

Staff Into Brand Champions

Zappos Company Culture

Tour Plus Q&A

Date: Wednesday, April 29

Time: 1:30 pm to 4:00 pm

Location: Caesars Palace Resort

Date: Wednesday, April 29

Times: 9:00 am, 11:00 am, 1:00 pm

Location: Buses depart from Caesars Palace Resort

Note: Sorry, we are sold out of Zappos tours.

Workshop led by Mark Weber,

CEO of Weber Marketing Group

How can you truly leverage staff to deliver a unique,

branded experience? Join a team of cultural design

experts from Weber Marketing Group for this highly

interactive, three-hour workshop. Dig deep into

the keys that will unlock ways to align, inspire

and direct your entire work force to live your

brand in bold, fresh ways.

What you’ll learn:

■ How the right cultural strategy elevates your brand to

new levels of performance, alignment and consistency

■ The transformational shifts required to deliver a truly

unique, branded experience

■ Ways to unite employees behind your brand promise

■ How get staff on board with your brand so that they

live it out — every day

A rare opportunity to learn from one of the best and

brightest brands around. This exclusive glimpse into

the Zappos family culture will show you what it takes

to build, manage and consistently execute a highlybranded experience. The workshop includes a

90-minute tour of the amazing new Zappos corporate

headquarters in Las Vegas, led by experts from the

Zappos Culture team.

What you’ll learn:

■ The “secret sauce” of culture building from

one of the greatest, most celebrated brands

■ How to apply the passion and energy of a company

like Zappos to your financial institution’s culture

■ How corporate values can be used to shape

company culture and the consumer experience

Workshop sponsored by

Packed with interactive, strategic insights and ideas!

Onboarding Workshop: Building a Best-in-Class

Multi-Channel Cross-Selling Process

Date: Wednesday, April 29

Time: 1:30 pm to 4:00 pm

Location: Caesars Palace Resort

Workshop led by Jim Marous,

Co-Publisher of The Financial Brand

New customer onboarding continues to be one of the most effective sales

strategies for banks and credit unions. But it is imperative that you

engage with consumers the way they prefer — whether it is in the branch,

online, via a mobile device, in person or over the phone — with the right

message at the right time. This intensive half-day workshop is built around

an interactive, how-to format that includes peer dialogue and

collaboration.

Bonus: Each participant will receive a free copy of the Digital Banking

Report, "Guide to Multichannel Onboarding in Banking" ($395 value).

SOLD

OUT!

— Reg Marrinier, VP/Retail Banking

BlueShore Financial

(Forum 2014 Attendee)

$249

What you’ll learn:

■ How to build and implement a multi-channel

onboarding process that improves

engagement, share of wallet, retention and

the long-term value of relationships

■ Best practices and keys to successful

onboarding and cross-selling programs

■ How to use easily available customer data to

improve cross-sell performance

■ How to integrate direct and digital marketing

for optimal response and performance

■ The best methods for catching customers

before they defect

Workshop sponsored by

ADD

FORUMx PRESENTERS

The Forum 2015 will feature it's own version of TEDx — short,

high-level strategic presentations from notable experts and thought

leaders focused on what financial industry executives need to do

to prepare themselves and their institutions for the future.

Disruptors, Differentiators

& Disappearing

Branch Revenues

Brett King, CEO/Founder of Moven

Futurist and best-selling author Brett King has been

studying the impact of technology and behavior disruption

on banking for over two decades since the commercial

Internet emerged. In the research for his next book

Augmented (due out Summer of 2015), King discovered

some amazing parallels in technology disruptions that

have occurred over the last 250 years, and what this

pattern of disruption means next for the way

banking works. The end result is that we

can now predict how consumers will react

to market forces — declining branch

activity and the examples provided by

disruptors like Moven, Simple, Lending

Club and others — with devastating

ramifications for branch networks.

Financial institutions that think that

their advice, products or “stores” are

differentiators had better get ready to

question their very existence.

Brett King is one of the most

progressive innovators in banking.

Finding Your

Banking Mojo

Tim Russell, Head of Cultural

Development at Nintendo

Tim championed leadership

development programs for Starbucks,

Microsoft and now Nintendo. Tim will

teach you the culture-building

principles he’s used at Fortune 500

companies to grow your organization.

Passion and

Purpose in Banking

Mark Zmarzly, CEO of Hip Pocket

This talk will explore how existing

players in the banking industry

identify unmet consumer

needs, reinvent their

products, and

reimagine their

business model

in new and

dramatic ways.

Mark Zmarzly is a regular

speaker at TEDx events.

BRANDING & MARKETING

SESSION DETAILS

Forum 2015 Brand Makeover

Gina Bleedorn, Executive Director at Adrenaline

Eduardo Alvarez, Managing Director at Adrenaline

Thomas Pitkin, CMO at Flagstar Bank

Jennifer Rossbach, VP at Flagstar Bank

Reality TV meets bank marketing in one of the most

riveting sessions you’ll ever see. Creative branding

concepts will be revealed for the first time to the marketing

team at Flagstar Bank on stage in front of a live audience.

This is your chance to spy on the rebranding process,

and a rare opportunity to learn firsthand how others

tackle their brand identity challenges.

What you’ll learn:

■ What it takes to create a differentiated image in the

banking world today

■ How to create, evaluate and refine a new brand identity

■ How you can prepare for your next rebranding initiative

Branding Spotlight: Frost Bank

Pam Thomas, CMO at Frost Bank ($27 billion in assets)

Learn how Frost Bank has remained true to its core philosophies and brand DNA as they’ve grown to become one of the

biggest banks in the U.S.

The perfect conference to

lift your brand to new heights.

— Andrea Boutté, VP/Marketing

Santa Clara County FCU

(Forum 2014 Attendee)

Maximizing Results With

Data-Driven Financial

Marketing Strategies

Tony Rizzo, General Manager and

Creative Director at MARQUIS

Three key themes will dominate the future of financial

marketing: segmentation, personalization and automation.

You need all three to succeed. This session will show you

how to exploit opportunities lurking in your institution’s

data, using a practical, scalable system that maximizes ROI

with pinpoint precision. What you’ll learn:

■ How to supercharge your marketing plan by turning digital

data into real results

■ How to craft better offers that get a bigger response —

without “buying” the business

■ How to effectively analyze customer and market data to

produce an actionable plan of attack

■ How to produce one-page summaries fit for a chairman

Checking Account

Acquisition Strategies

That Drive Growth

Robert Rubin, Managing Director at Novantas

As lending heats back up, so will the battle for deposits.

That means you’ll need to get the right checking products,

with the right features, in front of the right people, at the

right time. This session will offer you dozens of tips and

insights based on research from tens of thousands of

checking account shoppers... while they are actually

shopping for a new institution. What you’ll learn:

■ The hot-buttons and switching triggers driving checking

account shoppers, and how to leverage them

■ Identify how and where to invest marketing dollars

■ How to segment checking consumers into targeted,

manageable and profitable clusters

Omni-Channel Brand

Design in Banking

Jon Blakeney

Group Managing Director at I-AM

Most financial institutions struggle achieving consistency

from one touchpoint to the next, sending a confusing mix of

messages to consumers. What you need is an integrated

brand identity that ties everything together. In this session,

you’ll learn how to engineer a full, 360° brand experience

using a unique, customer-centric design process.

What you’ll learn:

■ How to unite every aspect of your brand experience and

express your organization’s personality with strategic design

■ How to craft a cohesive brand identity that transcends a

single channel — online, mobile and branches

■ How to engage and delight customers with branding

elements that resonate across all touchpoints

Growing & Cultivating

Profitable Relationships With

Gen Y Financial Consumers

Kristen Mashburn, VP of Marketing,

and Chris Anderson, Marketing Manager

at Listerhill Credit Union

Financial institutions struggle connecting with

Millennials, but Listerhill Credit Union gets it

right, and they have the results to prove it. They take an

integrated approach, building products, marketing and even

branches specifically tailored to the needs and preferences

of today’s younger consumers. What you’ll learn:

■ How to build a cohesive, integrated Millennial strategy

that gets real results

■ How to foster and sustain banking conversations with Gen Y

■ How to get Gen Y excited about actively engaging with

your brand and marketing initiatives

ONLINE, MOBILE

&

DIGITAL

SESSION DETAILS

The 7 Most Effective Digital

Marketing Strategies in Banking

Matt Wilcox, SVP/Marketing Strategy

and Innovation at Fiserv

Financial institutions need to dedicate more of

their marketing budgets to online and mobile,

specifically these seven digital strategies.

Session includes case studies and real-world examples

from dozens of the best institutions. What you’ll learn:

■ How to build a digital-first marketing strategy and how to

budget accordingly

■ How digital channels correlate to different stages within

the consumer lifecycle

■ How to integrate marketing between online and offline

channels

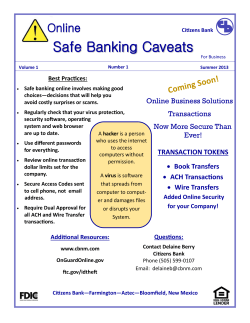

Successful Social Media

Strategies in Banking

Michael Toner, Social Media Manager

at Navy Federal Credit Union

Banking on Facebook

in a Mobile-First World

Neil Hiltz, Head of Global Vertical Strategy

for Financial Services at Facebook

Leveraging Facebook in the mobile channel will be one of

the most vital parts of your institution’s playbook. Banking

industry veteran and Facebook executive Neil Hiltz will

show you how to leverage Facebook to improve efficiency

and profitability in the mobile channel. What you’ll learn:

■ How financial institutions can achieve real, meaningful

business objectives with Facebook mobile

■ How Facebook mobile can help you build your brand,

generate new business, and improve profitability

Forum 2015 Website Makeover

Alexander Acker, President of Adventure House

Makeover Finalist: Ridgewood Savings Bank

Julie Perezaj, Internet Marketing Manager

Matthew Schettino, Director of Marketing

Navy FCU is one of the banking industry’s best at

harnessing the power and potential of social networks to

achieve real, strategic business objectives. This session

will show you how to boost your brand and build your

bottom line by facilitating and engaging authentic, two-way

conversations in social channels. What you’ll learn:

■ How Navy Federal monitors, builds their social media

communities and engages with them

■ Which social media channels work best and why

■ How to define metrics and analyze key measurements

that yield critical insights on social campaigns

Most financial institutions are way overdue

for a website overhaul. This session will walk you

through the process as Ridgewood Savings ($5.1 billion

in assets) gets an online makeover from a top-notch web

experience firm. A new website design will be revealed

for the first time — live on stage — along with the

strategy, design and features critical to success online today.

Transforming Banking Websites Into

High-Performance Sales Channels

Jason Rodriguez, Community Manager at Litmus

Mark Ryan, Chief Analytics Officer

at Extractable

With a data-driven website design process,

you can present the right message, to the

right people, at the right time. This session

will show you what it takes to build a best-of-breed website

that exceeds consumer expectations. What you’ll learn:

■ The critical areas where you need to optimize your

website for maximum impact on the bottom line

■ What data streams, metrics and analytics reports are

most valuable when looking for real, solid opportunities

to improve your web channel

■ How to balance UX, creativity and technology to deliver a

rejuvenated online presence

Innovations & Best Practices

in Email for Financial Marketers

The difference between two emails — one that

generates big results, and one that doesn’t —

can be little more than a single word or design

element. In this session learn dozens of tips

and tricks you can use to improve open rates,

clicks and conversions. What you’ll learn:

■ Why you need to think mobile first when designing emails

■ How to optimize emails for every environment and app

■ Why you need to “sell the click” and not the product

RETAIL EXPERIENCE

SESSION DETAILS

FEATURED

GENERAL

SESSION

Forum 2015 Retail Branch

Experience Makeover

Maximizing & Monetizing the

Mobile Channel in Banking

Chris Howe, Retail Design Strategist at Adrenaline

Mike Colvin, EVP/Principal with LEVEL5

Paul Seibert, Principal at EHS Design

Niti Badarinath,

SVP/Head of Mobile Banking at US Bank

Carole Porter, SVP at Municipal Credit Union

Agnes Payadue, VP at Municipal Credit Union

What should retail branches look like today? In this

session, three world-class branch design firms will tackle a

real branch project for Municipal Credit Union ($2.1 billion

in assets, 20 branches). Each firm will present their design

concept to the credit union live on stage in front of

hundreds of attendees. What you’ll learn:

■ The principles of strategic design, and how to craft a

dynamic branch experience

■ How to shape your institution’s branch strategy by

working through common issues defining the experience

■ How to attack the challenges of branch design —

with three perspectives and three different solutions

Innovating Your

Digital Banking Nirvana

Jim Marous, Co-Publisher of The Financial

Brand and the Digital Banking Report

This rapid-fire presentation will outline the best mobile and

tablet banking applications offered worldwide, with dozens of

examples illustrating the keys to developing successful

solutions, with an emphasis on simplicity, engagement and

context. What you’ll learn:

■ How to deliver a rich, robust mobile banking experience

■ What digital consumers expect from banks and credit

unions in the mobile channel

■ Which apps, tools and features are most important —

to consumers... and to your profitability

Engineering the

Micro-Branch of Tomorrow

Lisa Magana, VP/Branch Projects at Wells Fargo

Kelly Price, VP/Branch Environments at PNC

Paul Dilda, Head of Branch & ATM Channels at BMO

Moderator: Dave Martin, EVP/Financial Supermarkets Inc.

Learn from three of the banking industry’s leading pioneers

as they share their experience building new branch models

with radically smaller footprints — Wells Fargo (1,000 square

feet), BMO (900 sf) and PNC (160 sf). What you’ll learn:

■ How to engineer a new branch service delivery model in a

compact footprint

■ The adjustments and decisions that need to be made as

you scale back the size of your branches

■ The challenges involved with designing a compact branch

— from technology and staffing, to branding and sales

US Bank is a true pioneer in mobile channels.

Few have invested like they have. In this

session, US Bank will walk you through their

journey in the mobile channel — the strategy, goals, priorities

and decisions they’ve made on the path to becoming one of

the most mobile-centric institutions in banking. At the Forum,

they will also be revealing a major new mobile initiative

currently under development. What you’ll learn:

■ How to use mobile technologies to grow new relationships,

increase revenues and reduce operational costs

■ The advantages and challenges involved with rolling out the

mobile banking innovations consumers want most

■ How financial institutions can leverage mobile-specific

functionality (e.g., geolocational technology, biometrics, etc.)

Leveraging Tech to Engineer

a Better Branch Experience

David J. Cavell, FCIB

Independent Banking Adviser

The rapid rise in both the volume and sophistication of digital innovations are completely

revolutionizing the branch experience. This

session will present attendees with a wide

range of current case studies illustrating how institutions are

leveraging new, consumer-facing technologies in their

next-generation branch designs. What you’ll learn:

■ How new technologies — from interactive touchscreens to

video conferencing — are redefining the branch experience

■ How to strike the right balance between self-service

technologies and personal interactions

■ The range of differing branch models that have been

developed to leverage digital technology

Perfecting the Customer

Experience in Digital Channels

Nicole Sturgill, Research Director

at CEB TowerGroup

What does “omni-channel delivery” mean?

That you have to accommodate every need

in every channel the same way every time?

Absolutely not. You need to maximize, optimize and leverage

your service experience according to the strengths and

weaknesses of each channel. What you’ll learn:

■ Why consumers value efficiency over cross-channel

consistency

■ Which channels consumers prefer for resolving service

issues and why

■ The parameters consumers use to define their expectations

for a positive digital service experience

WORTH

FORUM 2015

$3,465

RESOURCE PACK

COMPLIMENTARY TOOLS FOR EVERY ATTENDEE

Some of the nation’s biggest financial institutions have

paid The Financial Brand thousands of dollars for these

materials. They’re all yours for attending the conference!

FREE TO ATTENDEES

$395

2015 Bank &

Credit Union Marketing

Trends Report

2015 BANK &

CREDIT UNION

VALUE

TRENDS

REPORT

This 35-page report breaks down

marketing trends in the retail banking

industry — budgets, media channels,

results, and much more.

$595

FREE TO ATTENDEES

VALUE

Forum 2015 Digital Toolbox

This 1GB drive is stuffed with resources and reports

that every financial marketer needs in their arsenal,

including PDF copies of every Forum 2015 presentation.

$495

VALUE

Forum 2015 Workbook

Includes printouts of all sessions

and a directory of all attendees.

$1,185

VALUE

FREE TO ATTENDEES

The Financial

Brand Bible

140-pages covering

brand strategy, design

and management in the

banking industry.

FREE TO ATTENDEES

FREE TO ATTENDEES

$795

VALUE

SAMPLE

ISSUES

These valuable reports tackling the most

critical issues facing financial institutions

in online and mobile channels today.

2015

BRANCH

DESIGN

ANNUAL

The Financial Brand

2015 Branch Design Annual

Over 100+ pages with photos of unique,

innovative and breakthrough branch designs

from financial institutions around the world.

So many valuable takeaways. An awesome experience.

— Kim Gunaka, VP Retail

Great Lakes Bank

(Forum 2014 Attendee)

ATTENDEE FEEDBACK

WHAT FORMER ATTENDEES ARE SAYING

The Financial Brand Forum

turned the world of banking

conferences upside down.

Fresh insight, ideas, and

a new outlook. Thank you!

— Floyd Morelos, Century Bank

— Melissa Wulf, American Bank Center

If you have the opportunity to attend only one marketing conference, this is the one.

— Katie Segner, SpiritBank

Very well done!! The materials,

content, speakers and overall

event coordination — all flawless!

— Pam LaBelle, General Mills FCU

An absolutely fabulous conference —

the best I’ve attended. Rich content, great

people, good food, and a great location.

I am astounded by how well it is organized

and the incredible attention to detail.

— Lianne Darby, BlueShore Financial

Powerful! Unbelievable content and great presenters!

— Angie Walterson, First State Bank of the Florida Keys

I am extremely selective about the time

I take out of the office. The Financial Brand

Forum is worth every minute and more!

— Meredith Gibson, Community Credit Union of Florida

Fabulous, relevant

and definitely

worth the time!

— Kelly Marzahl, Associated Bank

I felt like I was drinking from a fire hydrant and left wanting more!

Cutting edge ideas, trends and

tangible techniques I can use right away.

— Pamela Hatt, Pen Air FCU

— Betsy Knoblock Grabinski

Greater Iowa Credit Union

(Forum 2014 Attendee)

HOTEL APRIL

& TRAVEL

29 – MAY 1

SPECIAL ROOM RATE $99

PER NIGHT

Do to overwhelming demand, the group rate for Forum

2015 attendees at Caesars Palace has sold out. But

SINGLE/DOUBLE

TUESDAY, APRIL 28

WEDNESDAY, APRIL 29

good news! We have reserved more rooms at Bally’s

$139

Las Vegas in their brand new Jubilee Tower. But space

is limited, and rooms are going for over $500 on Friday

PER NIGHT

and Saturday at hotels across the city, so don’t delay!

SINGLE/DOUBLE

THURSDAY, APRIL 30

CALL BALLY’S & BOOK NOW! (800) 358-8777

Be sure to tell the reservation agent that you are

attending The Financial Brand Forum to receive your

special discount.

$299

PER NIGHT

SINGLE/DOUBLE

FRIDAY, MAY 1

10% DISCOUNT

ON UNITED AIRLINES

Call your professional travel agency or United

Meetings at (800) 426-1122 and provide the

Z Code ZTBU and Agreement Code 497684.

When booking online, enter both your Z-code

and Agreement code (ZTBU497684) in the

“Offer Code Box.”

There will be a $25 nonrefundable service fee collected per ticket for all

tickets issued through United Meetings Reservations (subject to change).

To avoid a service fee and receive an additional 3% discount (on published

fares only), book your reservations online at www.united.com.

RENTAL CAR DISCOUNT

Avis Car Rental is offering Forum 2015 attendees

discounted rates. To take advantage of these rates please

call (800) 331-1212 and mention AWD #T706699.

Bally’s Las Vegas

is located across the

street and within walking

distance from Caesars Palace.

U N W I N D

F O R U M

M X

2 0 1 5

A T T E N D E E

F R I D A Y

O P E N

A T

B A R

P A R T Y

M A Y

S T A R T S

1

A T

9

P M

L O C AT E D N E A R T H E

ENTRANCE TO THE FORUM SHOPS

AT C A E S A R S PA L AC E R E S O R T

Hosted and sponsored by

APRIL 29 – MAY 1 // CAESARS PALACE RESORT // LAS VEGAS, NV

[ ] YES! SIGN ME UP FOR THE FORUM 2015!

4 WAYS TO REGISTER

forum2015.com

Includes three meals (two lunches and one continental breakfast), a beefy

(866) 236-6228

conference workbook, a copy of the 140-page Financial Brand Bible ($495 value),

events@thefinancialbrand.com

a copy of The Financial Brand Branch Design Annual ($795 value), the 2015

Forum 2015

9737 Washingtonian Boulevard

Suite 200

Gaithersburg, MD 20878

Bank & Credit Union Marketing Trends Report ($595 value), and your

Forum 2015 USB Digital Toolbox including electronic copies of all sessions.

Conference

Registration

Names of Attendees to Register

Name _______________________________________

Title _______________________________________

Email _______________________________________

■ $1,245

Bank/Credit Union

Name _______________________________________

Title _______________________________________

Email _______________________________________

■ $1,245

Bank/Credit Union

Name _______________________________________

Title _______________________________________

Email _______________________________________

■ $1,245

Bank/Credit Union

■ $1,995

Vendor/Supplier

■ $1,995

Vendor/Supplier

■ $1,995

Vendor/Supplier

Pre-Conference Workshops

On Wednesday, April 29 (check one)

■ $249 Turning Staff Into Brand Champions

■ $249 Multi-Channel Onboarding & Cross-Selling

■ $249 Turning Staff Into Brand Champions

■ $249 Multi-Channel Onboarding & Cross-Selling

■ $249 Turning Staff Into Brand Champions

■ $249 Multi-Channel Onboarding & Cross-Selling

SPECIAL RATES FOR GROUPS – CALL OUR ATTENDEE CONCIERGE (866) 236-6228

PAYMENT INFO

TOTAL $ __________

MONEY BACK GUARANTEE! If you don’t come away with at least a

dozen new ideas that will help you build your brand and your bottom

line, we will give you your money back — no questions asked.

Contact Name __________________________________________

Title ________________________________________________

Email _______________________________________________

Company Name _________________________________________

Address _____________________________________________

City _________________________________________________

State ______________________________

Subtotal

ZIP ______________________

Phone ______________________________________________

Fax ________________________________________________

■ Check to “Forum 2015” enclosed

■ Charge

O

O

O

Card # _________________________________

Expiration Date ____________________________

Signature _______________________________

QUESTIONS?

(866) 236-6228

events@thefinancialbrand.com

Cancellation Policy. If you are unable to attend, you are welcome to send a substitute. Or if you cancel in writing by March 6, 2015, you can receive a full

refund. After that date, there is a $500 fee, provided we receive a written cancellation notice from you prior to the conference date. Registrants who do not

cancel in writing before March 6 or do not attend are not eligible for a full refund of their conference registration fee.

{

The Financial Brand Forum 2015 is proud to partner with

many of the biggest, best and brightest businesses in banking.

}

forum2015.com

(866) 236-6228

events@thefinancialbrand.com

APRIL 29 – MAY 1 // CAESARS PALACE RESORT // LAS VEGAS, NV

© Copyright 2025