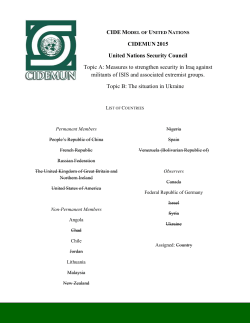

Belarus Business and Investment Guide Tax Issues 2015