Spring 2015

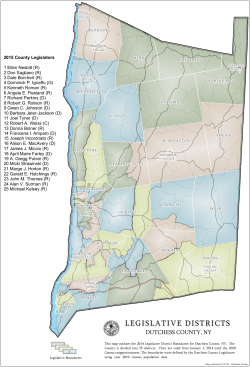

SPRING 2015 SHAREDinterests A Q U A R T E R L Y P U B L I C AT I O N O F H U D S O N VA L L E Y F E D E R A L C R E D I T U N I O N In this issue How to Negotiate an Offer........................................................ 2 Ask the Dealer for HVFCU Financing ................................... 2 Make the Switch to Better Checking....................................... 3 Home Improvements = Added Value...................................... 3 New Generation: New Kind of Vacation................................... 4 Membership: Pass it On............................................................. 5 One Text or Call Could Wreck it All ...................................... 6 Re-engineering Retirement....................................................... 7 Social Security Seminars........................................................... 7 Certificate Accounts: The Perfect Haven veryone welcomes a windfall whether it’s a complete surprise or not. Maybe you’re anticipating a larger than usual tax refund, or you’ve received word that a long lost relative has unexpectedly left you a large sum of money. E accounts come with low minimum deposits and an option for automatic renewal— providing you with an easy, safe, and guaranteed way to build your nest egg. Now What? • Stop by any branch The answer isn’t as obvious as it seems. Whether it’s just enough to cushion your rainy day fund, your ticket to an early retirement, or something in-between, it can be easy to overspend or even to misspend a sudden windfall. You’ll want to do some financial planning— and HVFCU certificate accounts should be part of your considerations. These federally insured accounts offer you a competitive fixed interest rate for a specified time, from as little as three months to as long as seven years. Dividends can be withdrawn without penalty and we’ll inform you when the account is due to mature so you can plan your next move. You may even want to consider laddering your certificates; staggering them in differing amounts and maturities to maximize both your earnings and accessibility. • Apply through Internet Banking at hvfcu.org Of course, certificate accounts aren’t just for windfalls; they provide an attractive savings option for any purpose. These Open your certificate account today! • Call us at 845.463.3011 GREAT RATE Like to know more? Go to Certificate Accounts in the Accounts menu at hvfcu.org. 2.00 % APY* 2-Year Certificate • $500 Minimum Balance • IRA and Roth IRA • Individuals and businesses • Available in Jumbo amounts * See disclosures on page 8. 1 How to Negotiate an Offer A fter looking at what feels like a hundred different homes over several months you have finally found ”The One.” At last, it’s time to make an offer. Putting in an offer on a property can be a tricky business because you don’t have any idea how flexible the seller is on the sales price. It’s only revealed when the seller accepts your offer or proposes a counter offer. The challenge is to know how to structure your offer going in so you have the best opportunity to get pricing that works for both you and the seller. Here are a few tips to help you with negotiations: • F ind out what the interest level is – Why is the seller selling? Have offers already been presented and, if so, how many? How long has it been on the market? This can help you assess the motivation of the seller so you and your agent can determine how to best structure your initial offer. • D o your homework on the current market – Familiarize yourself with the competition in the area by looking at other homes for sale in the neighborhood to help you determine fair pricing, even if they don’t entirely meet your criteria. • B e realistic about your ideal price – Determine in advance what you are willing and able to pay, based on what you can afford, the down payment and monthly mortgage costs, maintenance, and taxes. Offer only what you can afford – and walk away if you can’t. • Expect several offer rounds – Negotiations require both parties to give and take some, hopefully ending in a mutual agreement. Many sellers are very emotionally attached to the home they’ve lived in for years, so it may be difficult for them to see the real worth of the property. • S plit the difference – One common approach for coming to an agreement on price is to split the difference between how much the seller wants to sell for and how much you, the buyer, want to pay. Doing so can often make for a win–win situation for both parties. Right now mortgage rates are very favorable to buyers. This summer may just be the perfect time to purchase a home with the best terms possible. When you’re ready to take the next step, apply for your mortgage online at hvfcu.org, or stop by any branch. Ask the Dealer for HVFCU Financing Next time you are shopping at the dealer for a vehicle, ask about credit union financing. Most of our Hudson Valley area dealers offer HVFCU financing on-the-spot, which means you can take advantage of the same low rates and terms at the dealer as you would if you applied at one of our branches or online. The dealer will process your loan in just minutes and HVFCU will send your check directly to the dealer. It’s fast and friendly all the way. To see which of your favorite dealers participate in HVFCU on-the-spot financing, look under the Loans menu on our website at hvfcu.org, visit any branch, or call us at 845.463.3011. 2 Home Improvements = Added Value Make the Switch to Better Checking Debit If you think all checking accounts are created equal, it’s time to take a closer look at ours. You’ll find HVFCU’s free checking offers more of what you need—like maximum convenience, free official checks, money orders, and more. There’s never a monthly service charge or a per-check fee and your account balance earns daily dividends.. Accessing your money is easy. Your HVFCU checking account comes with a free HVFCU Visa® Debit card, which can be used for purchases and as your ATM card. Purchases are deducted directly from your checking account so you won’t have to deal with writing a check. Use your card at any HVFCU ATM as much as you like; you’ll never incur a fee. You’ll also receive fifteen free nonHVFCU transactions per month; and because you’re a credit union member, you’ll have access to more than 77,000 surcharge-free1 ATMs across the country. Your HVFCU Visa Debit card has other great benefits, too. Earn points toward gift cards, cash back credit, name-brand merchandise, and travel with HVFCU Rewards!2 If you already have your savings, loan, or other services with HVFCU, wouldn’t it make your life easier to have your checking account in the same place? Stop by any branch to see how easy it is to make the switch to better checking, or go to hvfcu.org for our checking account switch kit. (1) ATM owner may assess a surcharge. Visa Debit card reward points require signature-authorized transactions to earn points. PIN-based, point- of-sale, ATM transactions, cash withdrawals, and checks do not earn points. (2) Even if you’re not planning to sell your home anytime soon, it’s an inevitable question when you consider remodeling: How much will this improvement add to the value of my home? The actual cost and payback for each project can vary, depending on both your home’s condition and overall real estate market values in your area. The top-ranking home improvement? A new front door, which on average, adds 92.5% of the amount spent to the value to your home, according to Remodeling magazine’s annual Cost vs. Value Report for 2015. Here are a few more, based on mid-range pricing and national averages: Job Cost* Average Return Replace front door (steel) $1,230 92.5% Vinyl siding (foam backed) $12,013 82.2% Attic bedroom (with dormer & bath) $51,696 79.9% Replace windows (vinyl) $11,198 75.0% Minor kitchen remodel $19,226 74.9% Replace roof $19,528 74.9% Bathroom remodel $16,724 68.4% Major kitchen remodel $56,768 66.7% Adding a deck (composite) $15,912 66.3% Home office remodel $29,066 49.1% Improvement *Job costs are estimates only and may vary based on your location, size, quality of materials, and scope of project. Of course, not every home improvement decision is based on return. Some improvements, like turning a basement into a playroom or a garage into a home office do more to enhance the enjoyment of your home or make it more functional if moving isn’t an option. Whatever your reason—when you’re ready to begin your remodel, be sure to stop by HVFCU for affordable financing options. 3 3 New Generation: New Kind of Vacation L ounging in peace on the beach or calmly taking in a view of the Grand Canyon is no longer satisfying enough for today’s youth (or the young of heart). If you are one of those who crave a little more adventure in life and your downtime–try a more unusual approach to vacationing with an offbeat destination. Here are just a few suggestions to get your adrenaline pumping: Trift Suspension Bridge, Gadmen, Switzerland: If a simple hike is just too tame, the Trift Glacier in the Swiss Alps features one of the Alps’ longest and highest pedestrian bridges, suspended 350 feet above a gorge. A replacement in 2009 gave this bridge higher handrails and stabilizing cables to prevent it from swinging violently in the wind, but it still provides quite an adrenaline rush. Trip Advisor gives it 5 stars. La Tomatina Fiesta, Bunol, Spain: Join 30,000 people in an all-out, no-holds barred tomato fight to end all tomato fights. This messy event has been held annually in the town of Bunol since1944. Whether you plan to watch or participate, you’ll probably not want to wear white. Tundra Lodge Rolling Hotel, Manitoba, Canada: This hotel on wheels allows guests to live comfortably within the polar bears’ environs 24/7. In addition to viewing from their windows, large outdoor platforms further enhance guests’ bear-watching options. You can’t get more up close and personal in the wild than this. Travel with Platinum When arranging your out-of-the-ordinary vacation (or even an ordinary one), it’s nice to know that in addition to worldwide acceptance and access to ATMs around the globe, your HVFCU Visa® Platinum credit card also provides free travel services. These include emergency cash and card replacement, emergency ticket replacement, medical referral assistance, emergency translation service, emergency transportation service, and more. To apply for your Visa Platinum credit card, or for more details on these special services, go to hvfcu.org. Take HVFCU With You When traveling out of town for work or pleasure, your accounts are as close as your fingertips with these convenient e-services*: 4 hvfcu.org and Internet Banking: Most hotels offer wi-fi so you can readily access our website and Internet Banking from your laptop or web-enabled mobile device. Text Banking: Get your available account balances and conduct transfers via text messaging. Mobile Banking: View balances, transfer between your accounts, deposit checks with our remote deposit capture feature—even find the nearest surcharge-free ATM with our free app. Download via Google Play or the Apple Store. notifications via text messaging. CUAlerts: Get instant account information and *Enrollment in Internet Banking is required for access to all listed services. Visit hvfcu.org and click on eServices or stop by your nearest branch to learn more. Core Upgrade Coming soon – HVFCU will upgrade our main computer system in September 2015. Watch for more details in the July issue of Shared Interests and at hvfcu.org. OUR 2014 ANNUAL REPORT is now available at hvfcu.org to download or at any branch. To receive a copy by mail, request one at hvfcu.org or call us at 845.463.3011. New Service Saves You Timee We understand your time is valuable. Don’t spend it waiting on hold. When you call the Contact Center, you now have the option to receive a call back instead of waiting on hold. We’ll keep your place in line and a Contact Center Specialist will call you when it’s your turn. To take advantage of this new service, simply follow the prompts when you call the Contact Center. Membership: Pass it On One good turn deserves another, as they say. If you enjoy everything that Hudson Valley Federal Credit Union has to offer why not extend the benefits of membership to your friends, family, neighbors, and colleagues? Tell them that HVFCU strives to offer the most affordable options available to help them save, borrow, and manage their finances throughout life. Whether it’s getting married, buying a home, going to college, starting your first job or retiring, let them know we’re always here to help. If you know anyone who lives, works, worships, volunteers, or attends school in Dutchess, Ulster, Orange, or Putnam County, tell them they can belong. A membership account can be opened easily online at hvfcu.org, or stop into any branch. Retaining Membership Status A reminder that each member of Hudson Valley Federal Credit Union must have $5.00 on deposit with us in a Primary savings account. If you do not have that amount in your savings account with us or have questions about your membership, please visit any branch or call us at 845.463.3011. 5 One Text or Call Could Wreck it All In today’s society, multi-tasking is often our way to keep up with ever increasing demands on our personal and professional time. All this multi-tasking is contributing to an emerging traffic safety epidemic on America’s roadways that demands immediate attention: distracted driving. In 2012, crashes involving distracted drivers killed 3,328 people. One of the most alarming and widespread forms of distracted driving is cell phone usage. According to a Carnegie Mellon study, driving while using a cell phone reduces the amount of brain activity associated with driving by 37 percent. And a report from the National Safety Council found that people talking on cell phones or sending text messages cause more than 25% of all traffic accidents. Text messaging is of heightened concern because it combines three types of distraction – visual, manual and cognitive. In other words, texting involves taking your eyes off the road, your hands off the wheel, and your mind off the task of driving. To tackle this ever-increasing problem, the National Highway Transportation and Safety Administration is focusing on ways to change the behavior of drivers through legislation, enforcement, public awareness and education. Their message is simple – “One Text or Call Could Wreck it All.” With supporters ranging from President Obama to Oprah and legislation being WEDNESDAY APRIL 22 2015 7:00 P.M. 3 Annual Meeting Reminder Wednesday, April 22, 2015, 7 pm The Marriott Theatre at the Culinary Institute of America 1946 Campus Drive, Hyde Park, NY 6 passed across the nation to discourage distracted driving, we hope drivers get the message loud and clear. So the next time you are pressed for time, and it seems like multitasking in the car is the best decision, remember those 3,328 lives that were taken because someone decided they could do two things at once. A text or call is not worth a life— yours or someone else’s. Holiday Closing Schedule All Branches will be closed Monday, May 25 – Memorial Day Saturday, July 4 – Independence Day Re-engineering Retirement In this seminar, we’ll help you plan for retirement shortages and needs, learn how to transition from accumulation building to retirement income, and use illustrations and worksheets that take the complexity out of retirement. Tuesday April 28th 4:30-6pm Poughkeepsie Hampton Inn 2361 South Road, Poughkeepsie, NY 12601 Tuesday May 12th 4:30-6pm Fishkill Hyatt 100 Westage Business Center Drive, Fishkill, NY 12524 Tuesday June 2nd 4:30-6pm Poughkeepsie Hampton Inn 2361 South Road, Poughkeepsie, NY 12601 Seating is free, but limited. To RSVP, register online at hvfcu.org or call 845.463.3366. Social Security Seminars This seminar will help you understand and maximize your Social Security benefits. Learn key facts about Social Security and how to navigate the decisions surrounding the program, including how benefits are calculated, what is full retirement age, and how to choose the right time to file. Tuesday May 5th 5:30-6:30 Newburgh Branch 953 Route 300, Newburgh, NY 12550 Thursday May 14th 3:30-5pm Poughkeepsie Hampton Inn 2361 South Road, Poughkeepsie, NY 12601 Tuesday May 19th 3:30-5pm Fishkill Hyatt 100 Westage Business Center Drive, Fishkill, NY 12524 Seating is free, but limited. To RSVP, register online at hvfcu.org or call 845.463.3366. Securities and advisory services offered through LPL Financial, a registered investment advisor. Member FINRA/SIPC. Insurance products offered through LPL Financial or its licensed affiliates. Hudson Valley Federal Credit Union and HVFCU Financial Services are not registered broker/dealers and are not affiliated with LPL Financial. Not NCUA Insured | No Credit Union Guarantee | May Lose Value 7 Directory Board of Directors Noreen Hennessy, Chairman Takao Inouye, First Vice Chairman Joseph E. Eppich, Second Vice Chairman David S. Bagley, Treasurer Nancy Kappler-Foster, Assistant Treasurer William L. Spearman, Secretary Misty V. Decker, Director T. S. Jones, Director Henry J. Rodgers, Jr., Director Jan Mahar Sturdevant, Director Emeritus Supervisory Committee Stephen M. Caswell, Chairman Jeffrey S. Battistoni, Secretary Kathleen Dispensa, Member John Hogan, Member William J. Mulvey, Member Carlos L. Acosta, Associate Member Elinor Speckman, Associate Member President & CEO Mary D. Madden Branches Monday-Friday 8:30-7:00 and Saturday 9:00-5:00 4 Tucker Drive, Arlington 324 Main Street, Beacon 2 Terrace Drive, Carmel 449 Route 9, Fishkill 101 Tillson Avenue, Highland 415 Route 376, Hopewell Junction 4011 Albany Post Road, Hyde Park 1639 Ulster Avenue, Kingston Route 211, Fairgrounds Plaza, Middletown 30 Hawkins Drive, Montgomery 953 Route 300, Newburgh 265 Windsor Highway, New Windsor 12 North Avenue, Pleasant Valley 159 Barnegat Road, Poughkeepsie 6740 Route 9, Rhinebeck 11 Marshall Road, Wappingers Falls Monday-Friday 8:30-5:30 and Saturday 9:00-2:00 1620 Route 22, Brewster Monday-Friday 8:30-5:30 1 Civic Center Plaza, Poughkeepsie Monday-Friday 8:00-4:00 IBM Buildings* 330, 705 *Employee accessible only. Closed 1:30 pm to 2:00 pm. 8 HVFCU ATMs All HVFCU Branches Adams Fairacre Farms, Route 44, Poughkeepsie Bridgeview Plaza, Route 9W, Highland 1810 South Road, Nine Mall, Wappingers Falls East Fishkill IBM Bldgs.* 300, 320, 323 Gap/Old Navy Distribution Center, Fishkill* Nine Mall, 1810 South Road, Wappingers Falls Poughkeepsie IBM Bldgs.* 052, 416 Putnam Hospital Center, 670 Stoneleigh Avenue, Carmel Vassar Brothers Medical Center, Poughkeepsie *Employee accessible only. Online Services hvfcu.org Telephone 845.463.3011/800.468.3011 TDD (for hearing impaired) 845.463.1709 Supervisory Committee 845.463.6934/800.468.3011 P.O. Box 1624, Poughkeepsie, NY 12601 scmail@hvfcu.org Mailing Address 159 Barnegat Road, Poughkeepsie, NY 12601 Like us on Facebook Follow us on Twitter Certificates: The Perfect Haven. continued from page 1: *APY=Annual Percentage Yield. Substantial penalty for early withdrawal. Fees may reduce earnings. Rate effective beginning 4/4/15 and is subject to withdrawal at any time. Higher rate for higher balances not available with this offer. Federally insured by the NCUA

© Copyright 2025