interests Shared

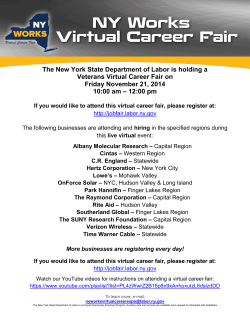

spring 2011 v Sharedinterests a q u a r t e r ly p u b l i c at i o n o f H u d s o n va l l e y f e d e r a l c r e d i t u n i o n In this issue Spring is here. What better time than now to improve your finances? Whether it’s shopping for a house or car, paying bills, choosing a financial advisor, or saving money at the ATM, HVFCU is here to help you make smarter choices. How to Shop For Your First Home You should buy a home. That’s what you’ve been hearing from friends and family, right? So, by now you have no doubt weighed the benefits and decided that home ownership is the best decision for you. That’s a major hurdle now passed. You are focused and certain, and that’s good. Defining Search Parameters for a First-Time Homebuyer. Nearly 80% of all home searches today begin on the Internet. With just a few clicks of the mouse, homebuyers can search through hundreds of online listings, take virtual tours, and sort through dozens of photographs and aerial shots of neighborhoods and homes. You’ve probably defined your goals and have a pretty good idea of the type of home and neighborhood you want. By the time you reach your real estate agent’s office, you are halfway to home ownership. Before you work with a realtor get pre-qualified for a mortgage so you know how much home you can afford. How Long Should It Take to Find a Home? Although it takes the average homebuyer two months to find the right house, at the right price, in the ideal neighborhood, you’ll want to shop at a pace that’s right for you. The maximum number of homes buyers should view in one day is seven. Any more than that, and the brain is on overload. A good real estate agent will listen to your wants and needs and arrange to show only those homes that fit your parameters. Rate Your Home Choices • Bring a digital camera and begin each series of photos with a close-up of the house number to identify where each group of home photos start and end. • Take copious notes of unusual features, colors and design elements. • Pay attention to the home’s surroundings. What is next door? Do 2-story homes tower over your single story? • Do you like the location? Is it near a park – or a power plant? • Immediately after leaving, rate each home on a scale of 1 to 10, with 10 being the highest. continued on page 2 How to Shop for Your First Home continued… View Top Choices a Second Time Before Buying That First Home. After touring homes for a few days, you will probably know instinctively which one or two homes you might like to buy. Ask to see them again and at a different time of day. You will see them with new eyes and notice elements that were overlooked the first go-around. This will help you narrow your choice down to the perfect home. Once you have made your choice, your agent should find out more about the sellers’ motivation and double-check that an offer hasn’t already been made. Once your offer has been accepted, you’re ready to begin the mortgage process. We’ve Got What You Need When you’re ready to finance, come to your credit union for great mortgages with low rates, free pre-approval, and no application or underwriting fees. 2 Remodeling Trends for 2011 Curious about what home remodeling trends 2011 will bring? Here are a few predictions in home design and remodeling trends to look forward to as homeowners revive their living spaces: LED or CFL (Compact Fluorescent) Lighting. Homeowners are moving away from incandescent fixtures toward more energy-efficient choices such as LED and CFL bulbs. Screened Porches. Homeowners are extending their living areas with screened porches that allow them to enjoy the outdoors throughout the year without the nuisance of insects. High Quality Synthetic Materials for Home Exteriors. Synthetic materials such as Hardie Plank siding and PVC trim pieces mimic the look of natural materials like wood, but are much more durable and better able to withstand climate changes. “Furniture-Like” Detailing in Kitchens. Varied cabinet and counter heights, distressed finishes and furniture-style toe kicks provide visual interest and help eliminate the “component” look of many kitchen cabinet designs. Large Format Bathroom Tiles. Smaller square tiles are being replaced with tiles measuring 12” x 12” or larger, as well as non-square shapes (12” x 18”), producing flooring and walls that showcase more tile and fewer grout lines. Heated Bathroom Flooring. Heated mats underneath bathroom flooring tiles provide radiant heat that is proven to keep homeowners warmer than forced-air heating systems, helping to save on energy costs. Multiple Finishes on Kitchen Cabinetry. Complimentary multiple stains and a mix of painted and stained finishes on cabinetry enables homeowners to escape the look and feel of a “cookie cutter” kitchen where all surfaces match. Kitchen Cabinet Accessories. With drawer inserts for cutlery, spices or dividers, homeowners are making better use of every available space within their kitchens. With spring here it’s time to get inspired and decorate or remodel your own space. Call or Stop by Today for options on how you can finance these home improvements with an HVFCU home equity loan, home equity line of credit, or Visa credit card. 3 New Lower Auto Rates! Visit us at hvfcu.org for current auto rates, auto shopping help with AutosMArT, and a free online insurance quote. Before You Get Your Next Vehicle Auto dealers are counting on you to make their sales goals this spring. Before you purchase, do your homework to get the best deal possible. What is the value of the vehicle you want? Check pricing guides like NADA and Kelly Blue Book so you know how to negotiate the purchase price confidently. What will insurance cost? Call your insurance representative and ask for a quote on your policy if you change cars or add a vehicle to your policy. You’d be surprised at the impact of certain makes and models. Be sure to ask about options that could qualify you for a rate discount. Mileage? With gas prices continuing to rise, what will the impact be on your monthly gas costs? If you’re upgrading from a small car to a sedan or SUV, the additional costs could be substantial. What will it actually cost? Consider your options before you walk into the showroom. Getting preapproved gives you the bargaining advantage so you’re negotiating PRICE and not payment amount. Get Smart. Go to the AutoSMART link under the “Loans” menu at hvfcu.org for the compare vehicles, vehicle history, JP Power ratings, consumer advice, calculators, and more to help you shop smarter. Once you’ve found your vehicle, you can apply for lowrate HVFCU financing online at hvfcu.org or right at the dealer (see participating dealer list at hvfcu.org). Bill Pay Can Make Your Life Easier It’s true! Using Bill Pay to help manage your finances takes less time, saves you money, and puts you in control. With Bill Pay, you can set up your recurring bills like utilities and loans so they are always paid on time. No more mail delays or tricky posting times means you can avoid late fees and missed payments—a great bonus when you’re traveling. your monthly bill are an environmentally-friendly and secure alternative to paper. If you’re not comfortable with automatic payment for your bills, Bill Pay has a reminder option that will alert you when a bill has arrived or is due to be paid. You can then review the bill first before you pay it electronically. Bill Pay also gives you the option of arranging for eBills—where available. These electronic versions of The Best Part of Bill Pay—it’s FREE. Once you’re enrolled in our FREE Internet Banking service, you can log on and sign up for FREE Bill Pay in minutes. What are you waiting for? Visit hvfcu.org or call us at 845-463-3011/800-468-3011 to get started. 4 Easy 24/7 access to Bill Pay puts you in the driver’s seat to manage your money. Now, from anywhere you have internet access, you can manage your cash flow, monitor payments, and make adjustments in emergencies. How to Reduce ATM Fees and Surcharges We all like to save money however we can. Here’s how to reduce ATM fees and surcharges when withdrawing cash from your checking account. Use HVFCU ATMs. Transactions are free for members withdrawing from their HVFCU accounts. ATMs are available at all our branches throughout the Hudson Valley. Use surcharge-free ATMs. Use our ATM location finder at hvfcu.org to find over 72,000 surcharge-free ATMs nationwide in the Allpoint, CO-OP, Presto!, and SUM ATM networks. Avoid gas station and independent ATMs. Most have high fees and surcharges added on to cash. If the fees seem excessive (you will be prompted to accept the fee), decline the fee, cancel the transaction, and go elsewhere. Get cash at the grocer. Instead of using an ATM and incurring an ATM fee, use your check card to get cash back in a grocery store. Swipe your check card for a debit transaction and select the desired cash back amount when prompted. Withdraw larger amounts of cash at a time. The fees are the same regardless of the amount of cash you withdraw. Obviously it makes more sense to withdraw eighty dollars at a $2.50 surcharge, then $20 four times with the same $2.50 per transaction surcharge. Stay within your free network transaction limit. Be conscious of your checking account free transaction limit to avoid unnecessary fees. A Worldwide Check Card get up to $500 cash daily from over 1.7 million Visa ATMs in more than 200 countries and territories with your HVFCU Visa Check Card. Visa/plus global ATMs provide cash access to funds, generally 24 hours a day, seven days a week. Visit us at hvfcu.org for a link to the Visa international ATM locator. Set a Goal For The Experience of a Lifetime Visa® Platinum & Visa Check Card ScoreCard Points. Discover a world of possibility with an Experience Award. Simulate an astronaut lift-off mission, fly-fish in Montana, or attend an NFL Pro Bowl Tailgate Party and game in Hawaii. These unique experiences and many others are possible through the ScoreCard Bonus Point Rewards program and your HVFCU Visa Point Rewards Platinum Credit Card and Visa Check Card. Set a Goal. Obviously, rewards like the experiences above require a large number of points. But who saves for vacation in just a day? Setting a points goal is the first step toward achieving them. Use your card as often as possible to keep growing your points, always remembering to use your card for credit purchases whenever possible. Here’s how it works. Enroll your cards at scorecardrewards.com (or link from the loans/credit cards section at hvfcu.org) to track your points and to see all that is available. There are literally hundreds of items, experiences, and travel options listed from which to choose. There’s no special trick to redeeming your points. When you’ve finally accumulated your goal points, simply make your choice and follow the purchase instructions. Enroll your card at scorecardrewards.com today to see all that’s available, and start planning ahead for your great experience! Get to your goal faster. Did you know you can combine your Platinum and Check Card points, or points with others in your household? Find out how at scorecardrewards.com. 5 Advice Life for sm You Deserve a Financial Advisor You Can Trust You want to invest with someone who puts your financial goals first—and provides you with personalized options and exceptional service. HVFCU Financial Services is a locally based organization dedicated exclusively to helping HVFCU members meet their financial goals. HVFCU Financial Services at Hudson Valley Federal Credit Union can help you build, recover and protect your investments. One of our experienced Financial Consultants will be glad to meet with you in person to review your portfolio, discuss your options and help you to plan for a better financial future. Schedule a no-cost, no-obligation consultation with an HVFCU Financial Services Consultant today. To get started call 845.463.3366 or go online to hvfcu.org and select Financial Planning. $75 Visa® Gift Card* Open your new investment account with $5,000 or more before April 15, 2011 and receive a $75 Visa gift Card. Securities, advisory services and insurance products offered through LPL Financial and its affiliates, a registered Investment advisor, Member FINra/SIPC. hudson Valley Federal Credit Union and hVFCU Financial Services are not registered broker/dealers and are not affiliated with LPL Financial. Not NCUA Insured No Credit Union Guarantee May Lose Value *Offer valid for members who open a new investment account with HVFCU Financial Services through LPL Financial between 1/20/11 and 4/15/11. Must be a new account with an opening value of $5,000 or more. Limit one gift card per member. Void where prohibited. You will receive your Visa gift card no later than 30 days after account is funded. 6 Stay in the know with our email newsletters Protect Yourself From Identity Theft Be one of the first to get the latest HVFCU information! Our free eNews and Investor Quarterly newsletters keep you up to date on promotions, seminars, credit union events and important consumer and investment news via email each month. Go to the eServices menu at hvfcu.org to register. Helping members protect their identity is a priority with Hudson Valley Federal Credit Union. According to the Federal Trade Commission, you can deter identity thieves by shredding documents and paperwork with personal information before you discard them. If you don’t have a personal shredder at home, or if you have a large amount of documents you no longer need to store, Hudson Valley Federal Credit Union can help you safely destroy them. Throughout the year, we provide shredder trucks at our branches and invite members to shred up to two boxes of confidential materials free of charge. Following is our upcoming shredder truck schedule. Please visit our website at hvfcu.org for a list of acceptable materials. Get an Online Insurance Quote from IAHV With access to multiple insurance carriers, it’s no wonder the Insurance Agency of the Hudson Valley has been able to save credit union members so much money. By comparing carriers side by side, we can find an insurance policy that’s both affordable and customized to meet all your needs. Online quotes are available for Homeowners and Renters insurance, Vehicles (Auto, Motorcycle, Recreational Vehicles, Watercraft), Business, as well as Accidental Death, Identity Fraud Protection, even Pet Insurance. Go to the quick quote tools under the “Insurance” menu at hvfcu.org and try us out. Insurance Agency Hudson Valley at Hudson Valley ® Federal Credit Union 866.397.3319 | Monday through Friday, 8 am – 8 pm Confidential Shredding Truck Schedule Hyde Park Branch April 8, 2011, 11:00 am – 2:00 pm Carmel Branch April 11, 2011, 9:00 am – 12:00 pm Pleasant Valley Branch April 29, 2011, 9:00 am – 12:00 pm Hopewell Junction Branch May 5, 2011, 3:30 pm – 6:30 pm Fishkill Branch May 6, 2011, 9:00 am – 12:00 pm Beacon Branch June 3, 2011, 10:00 am – 1:00 pm Middletown Branch June 10, 2011, 9:00 am – 12:00 pm Hollowbrook Branch June 10, 2011, 3:00 pm – 6:00 pm Kingston Branch June 24, 2011, 2:00 pm – 6:00 pm Insurance products are not deposits, obligations of, or guaranteed by Hudson Valley Federal Credit Union and are not insured by the National Credit Union Share Insurance Fund (NCUSIF), or any other agency of the United States, Hudson Valley Federal Credit Union, or CUSERVE, Inc. 7 Directory Directors & Officers T. S. Jones, Chairman Takao Inouye, 1st Vice Chairman Joseph E. Eppich, 2nd Vice Chairman David S. Bagley, Treasurer Henry J. Rodgers, Jr., Asst. Treasurer Larry J. Prescott, Secretary Misty Decker, Director Noreen Hennessy, Director Gabriel B. Roy, Director Jan. B. Mahar, Director Emeritus Ralph E. Plant, Director Emeritus Supervisory Committee Nancy Kappler-Foster, Chairman Kathleen A. Dispensa, Secretary Stephen M. Caswell, Member Noreen Hennessy, Member William J. Mulvey, Member Jeffrey S. Battistoni, Associate Member Elinor Speckman, Associate Member President & CEO Mary D. Madden Branches Monday-Friday 8:30-7:00 and Saturday 9:00-5:00 4 Tucker Drive, Arlington 324 Main Street, Beacon 449 Route 9, Fishkill 101 Tillson Avenue, Highland 415 Route 376, Hopewell Junction 4011 Albany Post Road, Hyde Park 1639 Ulster Avenue, Kingston Route 211, Fairgrounds Plaza, Middletown 953 Route 300, Newburgh 265 Windsor Highway, New Windsor 12 North Avenue, Pleasant Valley 159 Barnegat Road, Poughkeepsie 11 Marshall Road, Wappingers Falls Monday-Friday 8:30-5:30 and Saturday 8:30-12:00 1620 Route 22, Brewster 1995 Route 6, Carmel Monday-Friday 8:30-5:30 1 Civic Center Plaza, Poughkeepsie Monday-Friday 8:00-4:00 IBM Buildings 320, 330, 416, 705* *Employee accessible. Closed 1:30 pm to 2:00 pm. HVFCU ATMs All HVFCU Branches Adams Fairacre Farms, Route 44, Poughkeepsie Blue Cross/Blue Shield, Middletown* Gap/Old Navy Distribution Center, Fishkill* Kent Shopping Mall, 1100 Route 52, Kent Putnam National Golf Club, 187 Hill Street, Mahopac Mohonk Mountain House, New Paltz 1810 South Road, Nine Mall, Wappingers Falls Poughkeepsie IBM Bldg. 052 Putnam DMV, 1 Geneva Road, Brewster Putnam County Office Bldg, 40 Glenieda Avenue, Carmel East Fishkill IBM Bldgs. 300, 323* Vassar Brothers Medical Center, Poughkeepsie *Employee accessible. 24-Hour Drive-up ATMs Arlington, Fishkill, Highland, Hopewell Junction, Hyde Park, Kingston, Middletown, Newburgh, New Windsor, Pleasant Valley, and Poughkeepsie Branches Bridgeview Plaza, Route 9W, Highland 1810 South Road, Nine Mall, Wappingers Falls Online Services hvfcu.org Telephone 845.463.3011/800.468.3011 TDD (for hearing impaired) 845.463.1709 Supervisory Committee 845.463.6934/800.468.3011 P.O. Box 1624, Poughkeepsie, NY 12601 scmail@hvfcu.org Mailing Address 159 Barnegat Road, Poughkeepsie, NY 12601 Holiday Schedule Branches will be closed: Monday, May 30, Memorial Day Monday, July 4, Independence Day Branches within IBM will also be closed Friday, July 1 Your savings federally insured up to $250,000 and backed by the full faith and credit of the United States Government NCUA National Credit Union Administration a U.S. Government Agency 8

© Copyright 2025