The Automotive Industry's Last Pot Of Gold Delivering Sales Excellence in

The

Automotive Industry's

Last Pot Of Gold

Delivering Sales Excellence in

Challenging Markets

Pan-European Automotive

Sales Excellence Study 2007

June 2007

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

1

Contents

Page

A. Car distribution today – The industry's last pot of gold

3

B. Joint Roland Berger & IBM Study – Pan-European survey of the sales &

distribution landscape

11

C. Selected Results – Current situation, opportunities and hurdles

16

D. Implications for stakeholders – How to lift the pot of gold

31

E. Outlook – The road ahead

59

F. Survey team – Roland Berger Strategy Consultants &

IBM GBS Consultants

64

This document was created for the exclusive use of our clients. It is not complete unless supported by the underlying detailed analyses and oral presentation. It must not

be passed on to third parties except with the explicit prior consent of Roland Berger Strategy Consultants or IBM GBS Consultants.

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

2

A.

Car distribution today –

The industry's last pot of gold

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

3

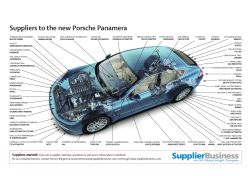

2.5 m people in Western Europe market, sell and service new and

used cars

Car Distribution in Western Europe, 2006

• 2.5 m people in marketing, sales, distribution, service etc.

• 16 major OEMs with 33 brands and 329 manufacturerowned NSCs/importers

• > 74,300 sales and 97,900 service outlets

• > EUR 92 bn sales & distribution cost (new cars only)

• 16.7 m new and 32.0 m used cars sold in 2006

• 5.2 m leasing/financing contracts closed by Captive

Finance companies

• 205.1 m cars on the road

Source: Datamonitor; J.D. Power; Company Reports; Roland Berger analysis; IBM GBS Consultants Analysis

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

4

Up to 30% of a car's retail price are spent for sales, marketing and

distribution

Breakdown of sales & distribution cost [%]

100

2

18

80

Sticker/

List Price

(MSRP1))

Reductions

Dealer

Margin

2

Turnover Personnel

Vehicle

Manufacturer

3

Marketing

30%

1

Guarantee

and Warranty

1

3

Cost of

Stock

Distribution

70

Cost of

Goods

1) MSRP = Manufacturer’s suggested retail price

Source: Institute for Automotive Industry (Prof. Dr. Seeba, UAS Braunschweig)

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

5

Sales and distribution cost amount to EUR 92 bn p.a.

Sales related cost estimate for new cars, Western Europe

EUR 18,400

weighted avg. net MSRP1) new car

30%

EUR 5,520

for sales, marketing &

distribution

X

16.7 m cars

sold in

Western Europe 2006

West-European

top-selling models 2006

['000 units]

Renault Clio

70%

455

Peugeot 207

425

Opel Astra

415

VW Golf

409

Ford Focus

404

=

EUR 92 bn p.a.

New cars only

• Dealer margin

• Discounts/incentives/

reductions

• Labor

• Marketing

• Distribution

• Stock

• etc.

1) MSRP = Manufacturer’s suggested retail price

Source: J.D. Power; Roland Berger Analysis

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

6

Stakeholders are still not satisfied with the current state of

automotive sales & distribution and finance

CUSTOMERS

DEALERS

OEMs

CAPTIVE

FINANCE

• Customer satisfaction gradually increasing

• Customer loyalty decreasing

• Dealer satisfaction stable/slowly decreasing

• Collaboration with OEMs unsatisfactory

• Profitability unattractive

• Not satisfied with their sales operations

• Adversative rather than cooperative relation to dealers

• Program results behind expectations

• Lack of integration with OEM at the Point of Sale

• Profitability endangered with new competitors

entering the market, especially universal banks

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

7

Customer satisfaction gradually increasing – However, European

brands need to catch up with Japanese competitors

Customer satisfaction with the buying experience, Western Europe, 2002-2006

[CSI Index Western Europe]

844

POSITIVE

EXCEPTIONS

842

831

831

817

822

825

825

820

816

797

807

787

835

786

800

791

784

788

Industry

average

Europe

767

2002

2003

2004

2005

2006

Source: NCBS; J.D. Power

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

8

Dealer satisfaction on average stable/slowly decreasing

Dealer satisfaction with OEM, Germany, 2003-2007 [DSI Index Germany]

POSITIVE

EXCEPTIONS

2,24

2,32

2,35

2,36

2,37

2,43

2,38

2,62

2,74

2,47

2,42

2,74

2,76

2,82

2,81

2,87

2,85

2003

2,92

2,90

2,85

2004

2005

2006

Industry

average

Germany

2007

Source: Schwacke Markenmonitor

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

9

Despite indisputable progress, all market players see significant

areas for improvement in their sales operations

How do you rate the performance of your sales operation?

A

B

Excellent

Good

C

D

Satisfactory Sufficient

E

Insufficient

New car sales (B2C)

New car sales (B2B/fleet)

Used car sales

Financial service sales

After sales, parts &

accessories sales

OEMs

Retailers

Captive Finance

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

10

B.

Joint Roland Berger & IBM Study –

Pan-European survey of the sales &

distribution landscape

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

11

Our pan-European study addresses the key performance levers in

automotive sales and after sales

Study's focus

COST DOWN

How to improve operating efficiency?

• OPPORTUNITIES

SATISFACTION UP

How to exceed customer and dealer

expectations?

• HURDLES

SALES UP

How to turn excellence into market

share gains?

• KEY SUCCESS FACTORS

• KEY LEVERS

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

12

Western Europe's key automotive players provided their insights

Study participants include

Vehicle Manufacturers1)

Audi

BMW/Mini

Alfa Romeo

DaimlerChrysler

FIAT

Honda

Ford

Jaguar

Kia

Land Rover

Mitsubishi

Nissan

Opel

PSA

Renault

SEAT

Suzuki

Volkswagen

Wholesale/Retail1)

Captive finance

AVAG Holding

DaimlerChrysler Bank

DaimlerChrysler

DaimlerChrysler

Financial Services

Denzel

BMW Bank

D'Ieteren

BMW Financial Services

Gottfried Schulz

VW Leasing GmbH

Grill Gruppe

GMAC

ifas

Niedermair&Reich

Analysts/Institutions

Pon

International Car

Distribution Programme

Porsche Holding

J.D. Power

United Auto

Weller Gruppe

QUADIS Group

JPMorgan

Deutsche Bank (London)

Zentralverband

Deutsches

Kraftfahrzeuggewerbe

Sal. Oppenheim

1) Some participants expressed the wish not to be listed. Their input, however, is included in the study's results

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

13

Our study's findings are highly representative

Study's market coverage

Participating brands …

Audi

BMW/Mini

Alfa Romeo

DaimlerChrysler

FIAT

Ford

Honda

Jaguar

Kia

Land Rover

Mitsubishi

Nissan

Opel

PSA

Renault

SEAT

Suzuki

Volkswagen

… represent more than

80%

71%

64%

43%

of major passenger car

brands offered in

Western Europe

of Western Europe's

new car sales (2006)

of Western Europe's

branded sales and

service outlets

of Captive Finance new

contract volume in

Western Europe

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

14

Our findings are based on senior management input

Top executive participants

Participating brands …

… represented by

VEHICLE

MANUFACTURERS

•

•

•

•

•

•

WHOLESALERS/

RETAILERS

• Member of the Board

• Owner/Managing Director

• President/ General Director

CAPTIVE FINANCE

• Managing Director Leasing Worldwide

• Vice President Sales & Marketing Europe

• Chief Executive Officer

ANALYSTS/

INSTITUTIONS

•

•

•

•

Managing Director and COO

Vice President Sales

Director Corporate Strategy

Director Network Development & Direct Sales

Director Marketing/Brand Director

Director Aftersales

(London)

President

Chairman

Executive Vice President

Senior Vice President World Operations

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

15

C.

Selected Results –

Current situation, opportunities and hurdles

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

16

Our study investigated automotive sales excellence along three

dimensions

1

The Situation

PANEUROPEAN

AUTOMOTIVE

SALES

EXCELLENCE

STUDY 2007

2

The Opportunities

3

The Hurdles

• Sales performance

• Benchmarks

• Top issues/priorities

• Cost reduction

• Sales increase

• Key levers for performance

improvement

• Communication/Change

Management

• Cost management

• Transparency/data availability

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

17

"We plan the perfect sales process

to the very last detail – but then we

do not apply it. Incredible."

VP Sales Strategy, Volume Car Manufacturer

"One cannot imagine how much

energy is wasted."

MD of a multi-brand dealer group

"We need to come to our senses –

this volume pressure is madness.

Chairman of the Board, Car Retailing Group

SITUATION

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

18

1

SITUATION

Particularly emerging brands see significant improvement

potential in their own sales performance

Looking at the current state of your sales operation, how do you rate its performance?

Premium, Volume and Emerging Brands

A

B

C

D

E

Excellent

Good

Satisfactory

Sufficient

Insufficient

New car sales

(B2C)

New car sales

(B2B/fleet)

Used car sales

Financial service

sales

After sales, parts &

accessories sales

Premium Brands

Volume Brands

Emerging Brands

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

19

1

SITUATION

Sales excellence is mainly determined by dealer competence in

sales and service

How would you define "sales excellence" for automotive sales?

DEFINITION (all respondents)

Dealer competence (sales/service)

53%

Customer satisfaction

40%

Profitable business management

38%

Professional CRM

32%

Stable end-to-end sales processes

26%

End-to-end brand perception

23%

Dealer satisfaction

Optimized marketing mix

OEM leadership

17%

6%

2%

Note: Multiple answers possible

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

20

1

SITUATION

Retail network optimization viewed as key lever to significantly

improve sales performance

What would you improve/change within the sales network if you had no limitations/

political restrictions?

DESIRED CHANGES (all respondents)

Optimize retail network

49%

Increase OEM leadership/influence

27%

Increase freedom for dealers

27%

Price policy and cost management

Improve end-to-end brand perception

24%

16%

Strengthen customer orientation

13%

Improve dealer qualification

13%

New IT infrastructure

7%

Motivation of staff

7%

Rate of innovation

4%

Note: Multiple answers possible

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

21

1

SITUATION

Toyota and BMW perceived as benchmarks in terms of quality of

sales operations today

Which car manufacturer today would you rate as benchmark/best practice in Europe

(not considering your own brand)?

DEFINITION (all respondents)

Comments

1

Toyota

2

BMW

3

Audi

4

Porsche

11%

Mercedes-Benz

11%

5

6

51%

32%

19%

Lexus

5%

Mazda

5%

Volvo

5%

Fiat

3%

Ford

3%

Jaguar

3%

Opel

3%

Renault

3%

Subaru

3%

• Premium brands

widely perceived as

best practice

• Toyota’s overall

success influences

rating of its sales

organization

Note: Multiple answers possible; alphabetical listing of same rank

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

22

SITUATION

1

Toyota and Audi perceived as the brands with the greatest

potential to become benchmarks in Automotive sales

Which car manufacturer/brand has the greatest potential to "revolutionize" automotive

sales by 2015?

DEFINITION (all respondents)

1

Toyota

2

Audi

3

Mercedes-Benz

12%

Volkswagen

12%

4

47%

21%

Alfa Romeo

6%

BMW

6%

Kia

6%

Lexus

6%

Porsche

6%

Note: Multiple answers possible; alphabetical listing of same rank

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

23

"Of course we can reduce sales cost

by 25% – the manufacturers have

allowed to really bloat their sales

administrations."

MD/Owner of European Dealer Group

"Which manufacturers are the least

profitable? Those with the strongest

intra-brand competition."

VP Network Strategy Premium Brand

OPPORTUNITIES

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

24

2

OPPORTUNITIES

Our study delivered the key levers to improve sales performance

and reduce cost

KEY LEVERS

SALES UP

+11%

• Qualification of dealers/salespeople

• Cooperation of sales, after sales

and captive finance

+38-383 m EUR EBIT

Substantial EBIT/EBT increase for

both OEMs and Retailers achievable

+24-123 k EUR EBT

COST DOWN

-12%

• Professional incentive/discount

management

• Incentive reduction through

limited intra-brand competition

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

25

2

OPPORTUNITIES

SALES UP

Staff qualification, aligned processes and local market knowledge

are key to improve sales

What are the top-3 reasons for unexplored sales potential?

REASONS (all respondents)

Qualification of dealers/passive sales people

59%

Unaligned/unprofessional sales and CRM processes

31%

Lack of market and target group knowledge

25%

Lack of organizational alignment

19%

Eroding brand image and loyalty

19%

Wrong product and pricing

16%

Frequent changes in strategy and organization

16%

Cross selling potentials unexplored

16%

Lack of controlling

13%

Other

6%

Note: Multiple answers possible

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

26

2

OPPORTUNITIES

SALES UP

Salespeople's qualification perceived as key to successful sales

management by OEMs …

What are the most important levers for sales management?

OEMs

Salespeople qualification

72%

Cooperation of sales, captive finance and after sales

56%

Closure of open points

56%

44%

Integrated CRM and Lead Management systems

33%

Used car re-marketing

28%

Service staff qualification

17%

Salespeople’s Financial Service know how

Promotion program communication

11%

Collaboration between OEM, wholesaler and retailer

11%

Up- and cross-selling

6%

Note: Multiple answers possible

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

27

"The difference between a successful

program and a failure is simple:

communication, communication,

communication!"

Managing Director of an OEM Leasing company

"We do not have KPIs for cost controlling on the sales side – we are solely

steered by volume figures. We do not

even have transparency about our

bottom line results."

Manager Network Planning at a German OEM

HURDLES

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

28

3

HURDLES

Poor change management and lack of transparency identified as

main hurdles

POOR

CHANGE

MANAGEMENT

MAIN

HURDLES

• Change Management principles not

(always) applied

• Importance of timely, exhaustive and

frequent communication often neglected

IMPEDING

ACHIEVEMENT

OF REAL

• Reliable controlling data

SALES

EXCELLENCE

LACK OF

TRANSPARENCY

• External benchmarks

• KPI tracking and communication

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

29

3

HURDLES

All stakeholders emphasize the importance of dedication, culture

and trust …

What are the key human/cultural factors that affect sales performance?

ASSESSMENT of TOP 6 LEVERS (all respondents)

Dedication to customer satisfaction of every single

person in the sales network (OEM-Wholesale-Retail)

76%

Motivate employees for continuous improvement

45%

Live a culture of trust for cross-organizational

teamwork and networking within your organization

Ability to gain and maintain commitment within your

organization

Ability to react fast on shifting market requirements

Live a culture of trust for cross-organizational

teamwork and networking with your retailers/OEMs

30%

27%

24%

21%

Note: Multiple answers possible

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

30

D.

Implications for stakeholders –

How to lift the pot of gold

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

31

The case for change is obvious

All stakeholders demand improvement

The benefits are evident

OEMs

• Better performing sales organizations

• Better brand experience on POSlevel

• Lower distribution cost

• Higher sales volumes

• Increased customer loyalty

Dealers

• Higher margins and higher volumes

• More entrepreneurial freedom

• Higher profitability

• Higher investment return

• Increased customer loyalty

Captive

Finance

• Closer collaboration with sales

• Better partnering onPOS-level

• Higher market shares

• Increased profitability

Customers • More reliability and convenience

• Good cars and services at

reasonable prices

• Better brand experience

• Better dealer experience

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

32

Volume pressure and intra-brand competition destroy the

profitability equation

Strategic shortcomings of retail networks

Intra-brand

Competition

Dealer

Profitability

Dense Dealer

Networks

Customer

Retention/

Acquisition

Production

Push

Investment/

Improvement

Ability to

hire & retain

Top Talent

Dealer

Satisfaction

POSPerformance

Marketing

cost

Volume pressure

Qualification cost

No. of programs

Distribution cost

Collaboration

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

33

Our study's participants call for action

Two options for car distribution – which one's yours?

OPTION 1 – CONTINUE

OPTION 2 – SHAPE

• We're working on it, it just takes time

• We will really reduce intra-brand competition

• Bold moves only cost too much, the network

issue will solve itself over time

• We will jointly improve network profitability

• We will prevent the worst and our great cars

will make the difference

• We will develop a long-term strategy and will

stick to it

• We will bring our sales network to a higher

level

• ...

• ...

Continuation of the decline

Opportunity knocks

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

34

"We've got to change drastically. We

have such exciting products but so

outdated sales organizations."

Managing Director, Dealer Group

"You want automotive sales

excellence? Go get a good dealer

body, a loyal group of sales

managers and an excellent training

process."

EVP Market Research Provider

ELEVEN PRINCIPLES TO ACHIEVE

SALES EXCELLENCE

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

35

To improve network performance and maximize joint value

creation stakeholders should follow 11 key recommendations

Key levers to improve performance

SALES

STRUCTURE

1

Optimize your retail network !

2

Clean up your wholesale structure !

PEOPLE

3

Collaborate within the network !

4

Remove functional silos !

5

Qualify your retail network to the next level !

6

Know your customers (current and potential) !

7

Get to grips with incentives !

8

Live the brand !

9

Market used cars !

10

Don't forget the other half (fleet) !

MARKET &

CUSTOMER

ORIENTATION

SEGMENTS

Dare to

follow your

11

long-term

strategy !

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

36

" The best way to reduce cost? Sell

OEM owned branches to professional

dealers. Instead OEMs are trying to

keep dead bodies alive…"

CEO, Multi-brand dealer

"We simply have too many dealers.

That drives incentives and destroys

the profitability equation."

VP, Automotive Service Provider

"We need the soft pressure of the OEM

to bring competing retailers together

and to force them to their luck…"

Chairman, Car Retailing Group

PRINCIPLE 1:

OPTIMIZE YOUR RETAIL NETWORK!

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

37

PRINCIPLE 1: OPTIMIZE YOUR RETAIL NETWORK!

Network optimization will ensure higher returns

WHAT STAKEHOLDERS SHOULD DO

OEMs &

Dealers &

Captive

Finance

• Jointly develop local market strategies to

ensure dealer – profitability and higher

standards of brand representation

OEMs

• Establish moderation teams to resolve local

intra-brand issues

• (Emerging brands) resist the volume pressure

and take the opportunity to establish perfect

networks

Dealers

• Reduced intra-brand

competition

• Reduced incentive

spending

• Ensure a strong local, systematic market

development and use your entrepreneurial

opportunities

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

38

"We have so many structural

redundancies and waste so

much money"

VP Sales Strategy, Volume Maker

PRINCIPLE 2:

CLEAN UP WHOLESALE STRUCTURE

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

39

PRINCIPLE 2: CLEAN UP WHOLESALE STRUCTURE!

Re-organize your resources to improve business performance

WHAT STAKEHOLDERS SHOULD DO

OEMs &

PanEuropean

Dealer

Groups

• Streamline your wholesale

organization and

infrastructure

• Improve coordination of

activities across countries

and between regions

• Enable systematic market

development

• Strengthen customer and

local focus to provide a

better level of service to

customers

Re-organize

wholesale

structure to

increase

market impact

and efficiency

of your sales

operations

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

40

"There's a giant wave of insecurity

concerning the OEMs' dealer

policies – and that's why

investments are held back."

MD, Multi-Franchise Dealer

"It's 'us' and 'them' – not 'we' or

'together'. We're great at blaming

each other. But this way, we all

loose."

VP Sales, Volume Manufacturer

PRINCIPLE 3:

COLLABORATE!

Find common ground for an honest, trustful cooperation

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

41

PRINCIPLE 3: COLLABORATE!

Successful collaboration is based on mutual trust

WHAT STAKEHOLDERS SHOULD DO

OEMs &

Dealers &

Captive

Finance

• Go from "what should they do?" to "what can we do

together?" to be more successful

• Produce a joint plan for growth for the next five years

• Exchange personnel part-time to improve mutual

business understanding

OEMs

• Treat dealers as preferred partners

• Communicate with dealers as you should/would with

end customers

• Increase continuity and reliability for dealers

Dealers

• Do not mistake every OEM initiative as interference

• Take planning seriously (have a plan!) – gut feeling is

not enough for challenging markets

Joint basis for an

honest, trustful

and productive

collaboration

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

42

„Cooperation between new car

sales, used car sales and aftersales

is very important"

CEO, Retail Group

"We simply do not understand each

other – that's the reason for 90% of the

problems between the OEM and

Financial Services"

VP, Leasing Provider

PRINCIPLE 4:

REMOVE FUNCTIONAL SILOS!

Change to better collaboration between Sales, After Sales and Finance

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

43

PRINCIPLE 4: REMOVE FUNCTIONAL SILOS!

Teaming across units and processes is the only way to be

competitive in the future

WHAT STAKEHOLDERS SHOULD DO

OEMs &

Dealers &

Captive

Finance

• Go from "optimizing silos" to "overall optimizing"

• Develop a customer oriented integrated approach

for selling, financing and service across all units

• Systematically exploit customer lifetime value

OEMs

• Manage business across silos

• Change the incentive system accordingly

Dealers

• Ensure adequate customer care across sales,

service and along the car's lifecycle

• Establish integrated Workplaces

Captive

Finance

• Support the customer across life-time (new car,

used car, leasing …)

• Develop offerings together with sales and services

10-20% sales

increase

through

exploitation

of crossselling

potential

possible

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

44

"We need to teach, train and coach

our dealers. That's the key lever to

improve sales and that's our priority

# 1 for the next years"

VP sales, volume OEM

"It's a leadership issue. Look at the

managerial quality of the owner or

the MD of the dealer. Improve It. The

rest is easier."

Senior manager network development, Premium OEM

PRINCIPLE 5:

QUALIFY YOUR RETAIL NETWORK

TO THE NEXT HIGHER LEVEL

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

45

PRINCIPLE 5: QUALIFY YOUR RETAIL NETWORK

Qualification programs should be designed around dealer

processes – and with dealer participation

WHAT STAKEHOLDERS SHOULD DO

OEMs &

Dealers

OEMs

Dealers

• Jointly (!) design pragmatic programs with

measurable (!) results and long-term impact (!)

• Reduce the number of programs and focus on sales/

service managers

• Do not "push" one program after another, let dealers

"pull" what they need

• Be dealer specific – because "one size fits all" actually

does not

• Test your programs before roll-out

• Focus on key processes

• Insist on measurable results and track KPI's

• Focus on on-the-job coaching instead of classroom

settings

• Systematic local

market

penetration

ensured

• Order intake up

10%

• Customer

satisfaction up

• Dealer

satisfaction up

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

46

"A good salesperson? 12 good

customer contacts a day produce 12

sold cars a month"

Owner, multibrand dealer group

"Only very few Dealers actually track

the basic KPI's for sales. Volume,

yes – but the quality of the customer

database? Forget it."

Network development Manager, volume brand

PRINCIPLE 6:

KNOW YOUR CUSTOMERS

(current & potential)

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

47

PRINCIPLE 6: KNOW YOUR CUSTOMERS

An integrated, high quality customer database is the key lever to

lift unexplored sales potential

WHAT STAKEHOLDERS SHOULD DO

OEMs &

Dealers

• Collaborate to ensure top customer database quality

• Establish mandatory sales controlling activities on

retail level

• Incentivize data quality

OEMs

• Publish dealer performance internally to establish an

objective and independent benchmark

• Focus on sales managers' leadership capabilities

Dealers

Systematically

increase sales

performance

• Measure the key sales processes and the quality of

your customer database(s)

• Make it known that you are tracking the key indicators

and focus on contact-data and conversion rates in the

sales funnel

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

48

"We have way too many sales

programs – we can't count them, we

can't manage them and they don't

reach our customers"

CEO, Captive Finance Provider

PRINCIPLE 7:

GET TO GRIP WITH INCENTIVES!

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

49

PRINCIPLE 7: GET TO GRIP WITH INCENTIVES!

Create the base for a trustful cooperation to define efficient,

customer oriented incentive programs

WHAT STAKEHOLDERS SHOULD DO

OEMs &

Wholesalers &

Dealers &

Captive Finance

• Collaborate actively in the development and

implementation of incentive programs

• Exchange mandatory data and information on

incentive programs, performance and customer needs

OEMs

• Define and follow a clear incentive strategy across

lifecycle and functions

• Reduce high number of incentive programs and

simplify the administrative implementation

• "Don't just give away money"

Dealers

• Measure the incentive performance on customers and

vehicles

• Align new and used cars, services and aftersales

incentive programs

• Ensure early communication of incentive programs

and their objectives to sales

Effective

and

efficient

incentive

programs

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

50

"Management's example and sales

staff's behavior make the difference

and separate us from the

competition."

MD, Multibrand Group

"Even if you're doing everything

right and customers love you – they

will turn around and buy a car from

another brand – simply because they

like to have something new – and the

choices are there ..."

EVP, Automotive Service Provider

PRINCIPLE 8:

LIVE THE BRAND!

Ensure brand adequate behavior, every day, in every customer interaction

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

51

PRINCIPLE 8: LIVE THE BRAND!

Connect your people with your brand

WHAT STAKEHOLDERS SHOULD DO

OEMs &

Dealers

• Build customer loyalty on the base of your

customers' physical experience with you, your

brand and your sales organization

• Identify and remove those hotspots that inflict

severe brand damage

OEMs

• Practice what you preach

• Define how the brand translates into

on-the-job-behavior

Translate brand

claims into onthe-job-behavior

Feel the difference

Driven by passion

The Power of Dreams

Dealers

• Define the key processes that "make" the brand

along "moments of truth" in customer interaction

• Have a clear value proposition while promoting

the OEM brands and your own business brand

The Future of the

Automobile

The relentless pursuit

of perfection

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

52

"Used cars. We don't know enough

and haven't done anything for years"

Director Sales Strategy, Volume OEM

"Used car business is more or less

not existent with us"

MD Network development OEM

PRINCIPLE 9:

MARKET USED CARS!

Look upon each used car as an attractive business opportunity

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

53

PRINCIPLE 9: MARKET USED CARS!

Look upon each used car as an attractive business opportunity

WHAT STAKEHOLDERS SHOULD DO

OEMs &

Dealers &

Captive

Finance

OEMs

• Establish a customer care program for used car sales

• Develop an integrated approach for used car selling,

financing and service within your sales system

• Use a common used car sales platform

• Align new car sales and re-marketing activities to

support residual values

• Support with active brand management, covering the

whole product life-cycle

Dealers

• Provide more management attention to used cars

• Focus on inventory turn

• Care for used car customers after car sales

Captive

Finance

• Develop specific used car products

• Implement risk adjusted pricing

• Expand

customer

base

• Realize

opportunities

to increase

margins

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

54

" No strategy for B2B new car sales;

Focus so far only on ‚traditional‘

areas"

Director Sales, volume OEM

"Fleet customer care is far more

complex than private customer care.

Overall the professionalism is low and

a clear profile is missing"

Director NSC, Premium OEM

PRINCIPLE 10:

DON’T FORGET THE OTHER HALF! (FLEET)

Expand and professionalize your fleet business

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

55

PRINCIPLE 10: DON’T FORGET THE OTHER HALF (FLEET)!

The impact of fleet management on profitability and image is high

WHAT STAKEHOLDERS SHOULD DO

OEMs &

Wholesale

& Captive

Finance

• Bundle your fleet activities in one organizational unit

with full P/L-responsibility across brands and entities

• Ensure direct user/chooser care

Dealers

• Discover small commercials as your customers

Captive

Finance

• Define appropriate products for different fleet

categories

Increase sales,

profitability and

brand loyalty

through

professional fleet

management

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

56

" Why are automotive sales, marketing

and distribution so expensive?

Because only one dictates what

customers are supposed to buy. And

that’s the production line …"

VP, European Car Group

" Their job description, their bonusscheme and the press keep top

managers in sales from doing what is

necessary in the long-term"

MD, Car Retailing Group

PRINCIPLE 11:

DARE TO FOLLOW YOUR LONG-TERM STRATEGY!

Overcome the pressure of quarterly reports

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

57

PRINCIPLE 11: DARE TO FOLLOW YOUR LONG-TERM STRATEGY!

A (joint) long-term strategy must be built around value

maximization for all stakeholders

WHAT STAKEHOLDERS SHOULD DO

OEMs &

Dealers &

Captive

Finance

• Collaborate to achieve a common target

• Have a long-term strategy and stick to it

OEMs

• Implement wholesale and retail structures with "built-in“

profitability

• Implement the necessary changes – even if they cost

some (small, short-term) volume

• Be reliable for dealers

Dealers

• Ensure systematic local market development and build

strong relationships with actual/potential customers

• Have a strategic plan for growth and ensure

management quality at the POS

Captive

Finance

• Develop a brand supporting business and operations

model

• Act as cross-functional one-stop shop

Long-term

success

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

58

E.

Outlook – The road ahead

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

59

Our study's participants see a trend towards less dense retail

networks with more professional dealers

What is your vision of Automotive Sales in 2015? (Top-5 trends)

Retail networks will be further

consolidated

46%

More multi-brand dealers

17%

Franchise of aftersales

Increasing importance of the

internet

New approaches/concepts for

metro-areas

9%

• Reduced number of dealers

• Qualification key to survival

• Large multi-brand dealer groups will

cover "parallel markets" (e.g. Bavaria &

Northern Italy; Netherlands/Belgium

and Rhineland etc.)

14%

• OEMs and existing providers battling

for aftermarket share

14%

• After years as information medium the

internet will finally develop into a

selling platform

• Mega cities will see automotive megastores (mostly multi-branded and partly

OEM-financed)

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

60

Limited influence of BER-changes expected

Will changes in the European Block Exemption/BER lead to a complete restructuring of

car distribution?

EXPECTED SCENARIOS

Nearly same BER as today – with minor

evolutionary changes

76%

Revolution ("Wild West")

Evolution: concentration in all networks;

strong increase of large multi-brand

dealers and internet based sales

10%

7%

Minor changes in network structure –

Major changes in after sales

3%

Open/unclear

3%

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

61

Long-term success is based on built-in profitability and

determination to implement the necessary changes

Strategic guideline to maximize value

Ensure outstanding customer

experience at the POS and maximize

your brand’s value

T

O

D

A

Y

Restructure retail networks to ensure a

"built-in" minimum dealer profitability

Align your organization to maximize

your profits along the lifecycle of your

customers and their cars

Brand value up

Implementation

Customer

satisfaction up

Profits up

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

62

Implementation of the necessary changes will restore the

profitability equation for all stakeholders

Focus on dealer revenues and profitability

Intra-brand

Competition

Dealer

Profitability

Restructured

Dealer

Networks

Production

Customer

Retention/

Acquisition

Investment/

Improvement

Ability to hire

& retain Top

Talent

Dealer

Satisfaction

POSPerformance

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

63

F.

Survey team –

Roland Berger Strategy Consultants &

IBM GBS Consultants

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

64

OVERVIEW PROJECT MEMBERS

Roland Berger Strategy Consultants & IBM GBS Consultants teams

Ralf Landmann, Partner, Frankfurt

Dr. Alexander Scheidt, Partner

Automotive Competence Center

Phone: +49 (69) 29924-6300

Ralf_Landmann@de.rolandberger.com

Automotive Leader North East Europe, Frankfurt

Phone: +49 (171) 566-2281

Alexander.Scheidt@de.ibm.com

Susanne Tebartz, Senior Project Manager, Munich

Claudia Schmitt-Lühmann, Associate Partner

Automotive Competence Center

Phone: +49 (89) 9230-8457

Susanne_Tebartz@de.rolandberger.com

Strategy & Change Leader Automotive, Stuttgart

Phone: +49 (170) 785-9617

Claudia.Schmitt-Luehmann@de.ibm.com

Nicole Steffen, Consultant, Frankfurt

Jens Diehlmann, Partner

Automotive Competence Center

Phone: +49 (69) 29924-6304

Nicole_Steffen@de.rolandberger.com

Automotive Captive Finance, Frankfurt

Phone: +49 (170) 786-1115

Jens.Diehlmann@de.ibm.com

Ralf Kalmbach, Partner, Munich

Carsten Eickhoff, Associate Partner

Automotive Competence Center

Phone: +49 (89) 9230-8669

Ralf_Kalmbach@de.rolandberger.com

Marketing & Sales Automotive, Munich

Phone: +49 (170) 785-5813

Carsten.Eickhoff@de.ibm.com

Max Blanchet, Partner, Paris

Marco Zurru, Partner, Milan

Tom Wendt, Project Manager, Munich

Jörg Richartz, Senior Consultant, Düsseldorf

Erich Nickel, Director Automotive MSS, Stuttgart

Anja Kremer, Managing Consultant, Frankfurt

Philippe Guillaume, Partner, Luxembourg

James Daulton, Managing Consultant, London

Sergio Strata, Partner, Torino

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

65

Roland Berger Strategy Consultants

Roland Berger Strategy Consultants

The Automotive Competence Center (ACC)

• We are a worldwide leading consulting

firm, serving our clients with more than

1,700 employees located in 33 offices

across Europe, Asia and the Americas.

• Since the firm's establishment in 1967, we

have enjoyed dynamic and sustainable

growth and excellent business results.

• An average growth rate of over 17% p.a.

since 1970 clearly shows our outstanding

development

• We support the world‘s leading companies of the

automotive industry.

• In close cooperation with our clients, we solve a wide

range of strategic issues and operational problems at

every stage of the automotive industry value chain.

• The ACC is one of the largest Industry Competence

Centers of Roland Berger. Our teams’ industry and

consulting experience guarantees that we can generate

tangible value for our clients.

• Over 700 successful projects in the past decade have

made us a leading player in the automotive consulting

arena

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

66

IBM Global Business Services Consultants

IBM Global Business Services

IBM GBS

SERVICE AREAS

Customer Relationship Mgt

Supply Chain Management

Financial Management

Human Capital Management

End-to-end consulting

Strategy and Change

Public

Industrial

- Automotive-

Financial

Services

Distribution

Communications

SECTORS

• Is with more than 60,000 consultants in

160 countries the world's largest consulting

services organization.

• Serves clients with business transformation

and industry expertise, and the ability to

translate that expertise into integrated,

responsive, innovative business solutions

and services that deliver bottom-line end-toend business value.

• Offers end-to-end consulting services from

strategy to implementation with:

– 43 partners and 400 consultants in the

European automotive community

– 30 dedicated Automotive Captive

Finance experts in Europe

Application Innovation

Pan-European Automotive Sales Excellence Study 2007 © Roland Berger Strategy Consultants & IBM GBS Consultants. All rights reserved.

67

© Copyright 2025