Foreign Exchange Forecasts â FOMC Less Patient

4

1

Please click on the following links to view our Current Issuance

CitiFirst MINIs and GSL MINIs (PDF)

CitiFirst MINIs and GSL MINIs (excel)

CitiFirst Instalment MINIs (PDF)

and visit our new website au.citifirst.com to view all other CitiFirst Warrants

Remember: All CitiFirst Warrants have 'O' as the fifth letter. All MINIs have 'K', 'M' or 'Q' as the fourth letter. GSL MINIs have 'L' and Instalment MINIs have 'J'.

The Overview 24 March 2015

Foreign Exchange Forecasts – FOMC Less Patient, More Cautious?

(Jeremy Hale 20 March 2015)

A much more dovish than expected Fed post the March FOMC has created doubt about the USD bull market

medium term. However, Fed concern about a strong USD will delay but not cancel Fed normalisation while more

than twenty non-US Central Banks easing monetary policy this year so far keep policy divergence alive while we

wait for the Fed. More generally, we think there is still another 10% or so to go in USD gains versus G10

currencies medium term.

Stronger EA data near term and positioning unwinds may extend EUR upside for a while but a trend reversal is

unlikely since the currency is critical to ECB plans for higher inflation/ inflation expectations. We still see sub-parity

over 6-12m.

USD/JPY continues to consolidate in similar fashion following previous QE announcements aftermaths. We still

target 130+ medium term but this may need anticipation of news from either the Fed or any additional QE from the

BoJ.

The upcoming UK election will be a GBP flashpoint, but post-election policy risks are receding. We see sterling inbetween EUR weakness and USD strength.

The story remains the same in the $Bloc. Weaker commodities and terms of trade will weigh on AUD, NZD and

CAD and may force local central banks to ease further.

In EM we have further cut our FX forecasts. We now expect EM FX vs. USD to weaken by 6% over 6-12m, versus

4% in February. CEEMEA remains the biggest drag (-11% vs. USD) compared to Asia (-3%) and Latam (-4%).

Link to full article :

https://ir.citi.com/m5k1MOEBm45u6EdA9Y0V4StcN5aXJP6rI89aU3T3YKt2DU0ld1OPEA%3D%3D

Top Warrants & Stopped Out Warrants

Warrant Code

XJOQOA

WBCJOK

RHCKOE

WPLKOR

SIRKOE

Previous day’s top warrants by value and volume

Value

Citi

Warrant Code

$1,014,440

Citi Sells

XJOQOA

$216,020

Citi Sells

FMGQOB

$178,598

Citi Sells

SIRKOE

$148,131

Citi Buys

XJOKOY

$133,049

Citi Buys

KARKOF

Volume

361,800

200,000

100,000

55,500

49,000

Citi

Citi Sells

Intraday

Citi Buys

Citi Buys

Citi Sells

Stopped Out Warrants

Warrant Code

Strike

Stop Loss

Remaining Value

Stop Loss Date

Final Listing Date

WPLKOU

NCMKOV

39.9638

14.9073

35.99

13.42

$3.92

$1.455

23/03/2015

23/03/2015

25/03/2015

25/03/2015

Headlines & Highlights

Key data: US Existing Home Sales MoM (Feb) (1.2%, 1.7% exp, -4.9% prev). Eurozone Consumer Confidence

(Mar A) (-3.7, -6 exp, -6.7 prev). Canada Bloomberg Nanos Confidence (Mar 20) (55, 54.6 prev). US Chicago Fed

Nat Activity Index (Feb) (-11.0%, 10.0% exp, -10.0% prev).

Federal Reserve Vice Chairman Stanley Fischer said raising interest rates from near zero “likely will be

warranted before the end of the year” and subsequent increases probably won’t be uniform or predictable. “A

smooth path upward in the federal funds rate will almost certainly not be realized” as the economy encounters

shocks such as the surprise plunge in oil prices, Fischer, said on Monday in remarks to the Economic Club of New

York.

German Chancellor Angela Merkel encouraged Prime Minister Alexis Tsipras to follow the path set out by

Greece’s creditors, saying his country belongs in Europe and she wants its economy to succeed. “We want Greece

to be economically strong, we want Greece to have growth,” Merkel said. “And I think we share the view that this

requires structural reforms, solid finances and a functioning administration.”

Overnight

Equities | S&P 2109 (0.0%) | Stoxx600 401 (-0.7%) | FTSE 7038 (0.2%)

U.S stocks rose slightly on Monday, with the S&P 500 closing up by +0.1% following last Friday’s strong

performance as data released showed that sales of existing homes rose +1.2% in February.

Fed Vice Chairman Stanley Fisher said on Monday that raising interest rates “likely will be warranted before the

end of the year” and that subsequent increases will not be uniform or predictable.

Seven of the S&P 500’s ten main sector groups rose, led by gains in the Consumer Staples space. The worst

performer of the S&P 500 was railroad operator Kansas City Southern, which fell -7.8% as they cut their full year

revenue forecast.

In Europe, market performance was mixed as most national benchmarks pulled back slightly from record highs

achieved last week.

The Stoxx 600 lost -0.7% as ECB President Mario Draghi spoke at the European Parliamentary committee during

afternoon trade, saying that there has been increased momentum in Eurozone growth as a result of lower oil prices

and declines in the euro.

London’s FTSE 100 index touched a record peak early in the session, before pulling back slightly and closing up

+0.2% to a new record close of 7,037.67 points.

Greek stocks continued to be the largest outperformer in the region, with the Athex Composite index surging

+2.97% in anticipation of an upcoming meeting with Greek Prime Minister Alexis Tsipras and German Chancellor

Angela Merkel in Berlin.

Germany’s DAX 30 index lost -1.2% and the CAC 40 fell -0.7%.

Foreign exchange | AUDUSD 0.7890 (1.03%) | DXY 96.8720 (-1.01%) | EURUSD 1.0957 (1.33%)

The US dollar fell for a second straight session against a basket of major currencies on Monday after traders

unwound bullish dollar positions on the likelihood that the Fed policy will be accommodative over the near term.

EURUSD traded higher ahead of key European data today. EURUSD traded from 1.0620 to 1.1040 in the space of

two hours during its overnight trading. The pound however, traded lower weighed by worries over the outcome of

the national election in early May and doubts over whether British interest rates will rise any time soon. GBPUSD

traded in the range of 1.4839-1.4989 overnight.

The softening greenback has pushed the AUDUSD pair higher overnight. AUDUSD is currently trading at 0.7890,

up 1.01% overnight. NZDUSD spiked higher late in yesterday’s trading session with rumours of a large exporter

buy order.

The Canadian dollar continued to strengthen against the greenback on Monday as last week’s US dollar selloff

against major currencies was given another push by comments from the US Fed official. The Russian rouble was

weaker in early trade on Monday, with a drop in crude prices outweighing higher demand for the currency due to

monthly tax payments.

Commodities | Gold 1190 (0.48%) | Oil (WTI) 47.41 (1.80%) | Copper 291.50 (5.05%)

Gold continued to climb on speculation that the Federal Reserve will delay raising US interest rates.

Crude advanced as the USD dropped against all but one of its 16 major counterparts, extending last week’s fall.

The International Copper Study Group estimated Copper’s output deficit in 2014 was 475,000 metric tonnes..

Trading Calendar

ECONOMICS

-

Aus ANZ Roy Morgan Weekly Consumer Conf. Index(110.8 prev)

-

Aus Conf. Board Leading Index MoM (Jan) (0.004 prev)

-

US Feb CPI

China March Prelim Manuf. PMI

UK Feb CPI

Overnight Summary

(Source: Reuters)

Last

5,956

5,955

Change

-19

-2

%

Change

-0.32%

-0.03%

Past

Month

0.49%

1.29%

Major World Indices

Dow

S&P500

Nasdaq

-- Europe -UK

Last

18,116

2,104

5,011

Change

-12

-4

-15

%

Change

-0.06%

-0.17%

-0.31%

Past

Month

0.00%

-0.25%

1.01%

7,038

15

0.22%

1.82%

Germany

11,896

-144

-1.19%

6.87%

Nikkei

Hong Kong

Korea

19,754

24,495

2,037

194

119

-1

0.99%

0.49%

-0.03%

6.19%

-1.03%

3.06%

Currencies

$A / $US

$A / Stg

$A / Euro

Last

0.7887

0.52735

0.7202

Change

0.0238

0.0089

0.0027

%

Change

3.11%

1.72%

0.38%

Past

Month

1.09%

4.49%

4.63%

96.983

-0.935

-0.95%

2.54%

Australian Indices

ASX 200

SPI

-- Asia / Pacific --

DXY (USD Basket)

A$ TWI

$US / Yen

Metals (LME) / Energy

Gold - spot

Oil - WTI

64.7

0.9

1.41%

1.25%

119.74

-0.29

-0.24%

-0.79%

Last

Change

%

Change

Past

Month

1,191.00

46.85

8.36

1.13

0.71%

2.47%

-0.89

-3.50

Metals (LME-3mth official, $USc / lb)

Aluminium

81.56

0.09

0.11%

0.39%

Copper

277.60

3.40

1.24%

7.90%

Nickel

648.64

2.49

0.39%

1.24%

62.40

-1.65

-2.58%

-11.93%

2475.00

31.00

1.27%

-1.59%

53.71

54.81

1.71

0.15

3.29%

0.27%

-13.55%

-13.60%

Last

%

Change

A$ equiv

Spread

Thml Coal (Newcastle)

SHFE Steel Rebar

Iron Ore 3M Future usd

Iron Ore

Dual Listed Co's

BHP Billiton plc

Rio plc

NWS A

BHP ADR

Cash Rates

Australia

US

Euro

1,591

2,943

16.88

49.41

3.38%

0.96%

0.24%

2.81%

30.17

55.80

21.40

31.32

Futures

2.25

0.25

0.05

Next

2.11

0.13

0.00

Next + 1

2.00

0.22

0.03

2.75%

4.32%

0.81%

1.04%

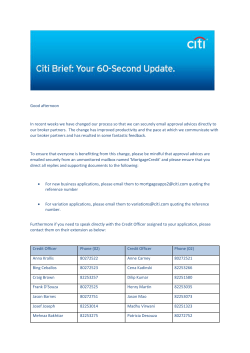

Contacts

Elizabeth Tian

02 8225 6154

elizabeth.tian@citi.com

Carsten Jensen

02 8225 6184

carsten.jensen@citi.com

web: www.citifirst.com.au

ph: 1300 30 70 70

For further information please contact the CitiFirst Sales desk on 1300 30 70 70. To unsubscribe, please email citifirst.warrants@citi.com.

DISCLAIMER

The CitiFirst Warrant ‘The Overview’ should not be viewed as independent information. Sales and Trading personnel are not research analysts. Any market commentary in this

communication is not intended to constitute "research" as that term is defined by applicable regulations. This communication is provided for information and discussion

purposes only. It does not constitute advice nor an offer or solicitation to purchase or sell any financial instruments. The views expressed herein may change without notice and

may differ from those views expressed by other Firm personnel.

Investors should read the relevant Product Disclosure Statement which details all of the risks of investing in Warrants and seek their own independent financial, legal and

taxation advice based on their own circumstances before making any investment decision. To obtain a copy of the Product Disclosure Document or the Research report

referenced please contact the Citi Warrants Sales Desk on 1300 30 70 70 or go to www.citifirst.com.au.

This material is made available by Citigroup Global Markets Australia Pty Limited ("Citigroup Global Markets") ABN 64 003 114 832 and AFSL 240992, Participant of the ASX

Group. This information does not take into account the investment objectives or financial situation of any particular person. Investors should be aware that there are risks of

investing and that prices both rise and fall. Investors should seek their own independent financial advice based on their own circumstances before making a decision.

Although the information contained herein is based upon generally available information and has been obtained from sources believed to be reliable, we do not guarantee its

accuracy, and such information may be incomplete or condensed. Any prices used herein are historic and may not be available when any order is entered. All opinions and

estimates included in this document constitute our judgment as of this date and are subject to change without notice.

This material does not purport to identify the nature of the specific or other risks associated with a particular transaction. The ultimate decision to proceed with any transaction

rests solely with you. We are not acting as your advisor or agent. Therefore prior to entering into the proposed transaction you should determine, without reliance upon us or our

affiliates, the economic risks and merits, as well as the legal, tax and accounting characterizations and consequences of the transaction, and independently determine that you

are able to assume these risks. In this regard, by acceptance of these materials, you acknowledge that you have been advised that (a) we are not in the business of providing

legal, tax or accounting advice, (b) you understand that there may be legal, tax or accounting risks associated with the transaction, (c) you should receive legal tax and

accounting advice from advisors with appropriate expertise to assess relevant risks, and (d) you should apprise senior management in your organization as to the legal, tax and

accounting advice (and, if acceptable, risks) associated with this transaction and our disclaimers as to these maters. If you are acting as a financial adviser or agent, you should

evaluate these considerations in light of the circumstances applicable to your principal and the scope of your authority. If you believe you need assistance in evaluating and

understanding the terms or risks of a particular transaction, you should consult appropriate advisers before entering into the transaction.

We and/or our affiliates (together, the "Firm") may from time to time take proprietary positions and/or make a market in instruments identical or economically related to derivative

transactions entered into with you, or may have an investment banking or other commercial relationship with and access to information from the issuer(s) of financial products

underlying derivative transactions entered into with you. We may also undertake proprietary activities, including hedging transactions related to the initiation or termination of a

derivative transaction with you, that may adversely affect the market price, rate, index or other market factors(s) underlying a derivative transaction entered into with you and

consequently the value of the transaction. This document and its contents are proprietary information and products of our firm and may not be reproduced or otherwise

disseminated in whole or in part without our written consent unless required to by judicial or administrative proceeding.

© Citigroup 2014. All Rights Reserved. Citi and the Red Arc Device are trademarks and service marks of Citigroup Inc. or its affiliates and are used and registered throughout

the world. Any unauthorized use, duplication, redistribution or disclosure is prohibited by law and will result in prosecution

© Copyright 2025